- South Korea

- /

- Life Sciences

- /

- KOSDAQ:A039860

NanoEntek (KOSDAQ:039860 shareholders incur further losses as stock declines 13% this week, taking three-year losses to 55%

If you love investing in stocks you're bound to buy some losers. Long term NanoEntek, Inc. (KOSDAQ:039860) shareholders know that all too well, since the share price is down considerably over three years. Unfortunately, they have held through a 55% decline in the share price in that time. Unfortunately the share price momentum is still quite negative, with prices down 32% in thirty days.

If the past week is anything to go by, investor sentiment for NanoEntek isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for NanoEntek

NanoEntek wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, NanoEntek's revenue dropped 11% per year. That is not a good result. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

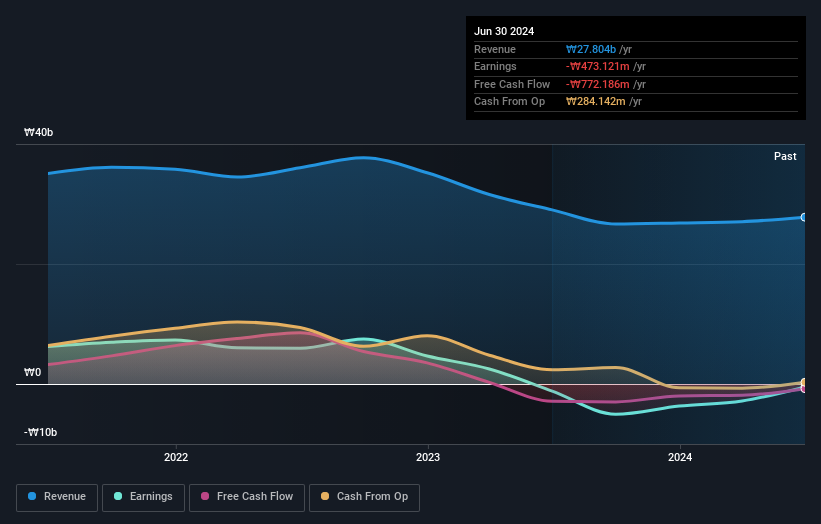

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling NanoEntek stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 3.7% in the twelve months, NanoEntek shareholders did even worse, losing 8.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 4 warning signs we've spotted with NanoEntek (including 2 which are significant) .

We will like NanoEntek better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if NanoEntek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A039860

NanoEntek

Engages in the research and development, production, and sale of life-science lab equipment, in vitro diagnostic medical devices, point of care diagnostic devices, and related consumables and solutions in Korea and internationally.

Flawless balance sheet slight.