In a week marked by busy earnings reports and fluctuating economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before experiencing sharp declines, with small-cap stocks demonstrating relative resilience compared to their larger counterparts. As investors navigate these dynamic conditions, identifying high-growth tech stocks that emphasize innovation and expansion can be crucial for capitalizing on potential opportunities within the evolving market landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| TG Therapeutics | 35.01% | 56.18% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1291 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bittium Oyj offers solutions in communications and connectivity, healthcare technology products and services, as well as biosignal measuring and monitoring across Finland, Germany, and the United States, with a market cap of €250.53 million.

Operations: The company generates revenue through its offerings in communications and connectivity solutions, healthcare technology products, and biosignal measuring and monitoring services. Operations are focused in Finland, Germany, and the United States. The market capitalization stands at €250.53 million.

Amidst a transformative year, Bittium Oyj has pivoted from a net loss to profitability, showcasing a robust turnaround with net income reaching EUR 1.7 million from a previous EUR 6 million loss. This resurgence is underscored by an anticipated revenue growth of 12.5% annually, outpacing the Finnish market's 2.1%. Further bolstering its financial health, Bittium's earnings are expected to surge by 40.9% yearly, reflecting not just recovery but significant potential for expansion in the tech sector. The firm’s commitment to innovation is evident from its R&D investments which remain crucial in sustaining long-term growth amidst rapidly evolving technological landscapes.

- Click here and access our complete health analysis report to understand the dynamics of Bittium Oyj.

Explore historical data to track Bittium Oyj's performance over time in our Past section.

CJ CGV (KOSE:A079160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea and has a market capitalization of approximately ₩932.22 billion.

Operations: The company generates revenue primarily through its Multiplex Operation segment, which accounts for ₩1.50 trillion. Another source of income is the Technology Special Format and Equipment segment, contributing ₩93.11 billion.

CJ CGV, despite recent challenges, exhibits potential with its projected revenue growth at 15.2% annually, outpacing the South Korean market's average of 9.9%. This growth is particularly notable given the company's transition towards profitability within the next three years. The firm's commitment to innovation and development is underscored by a significant increase in earnings forecasted at 112.1% per year, signaling robust future prospects despite current unprofitability. Moreover, CJ CGV has maintained a positive free cash flow status which supports its strategic investments and operational enhancements moving forward.

- Take a closer look at CJ CGV's potential here in our health report.

Examine CJ CGV's past performance report to understand how it has performed in the past.

Bonesupport Holding (OM:BONEX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bonesupport Holding AB (publ) is an orthobiologics company that specializes in developing and commercializing injectable bio-ceramic bone graft substitutes across Europe, North America, and other international markets, with a market cap of SEK21.69 billion.

Operations: Bonesupport Holding AB focuses on the orthobiologics sector, generating revenue primarily from its pharmaceutical segment, which accounts for SEK814.46 million.

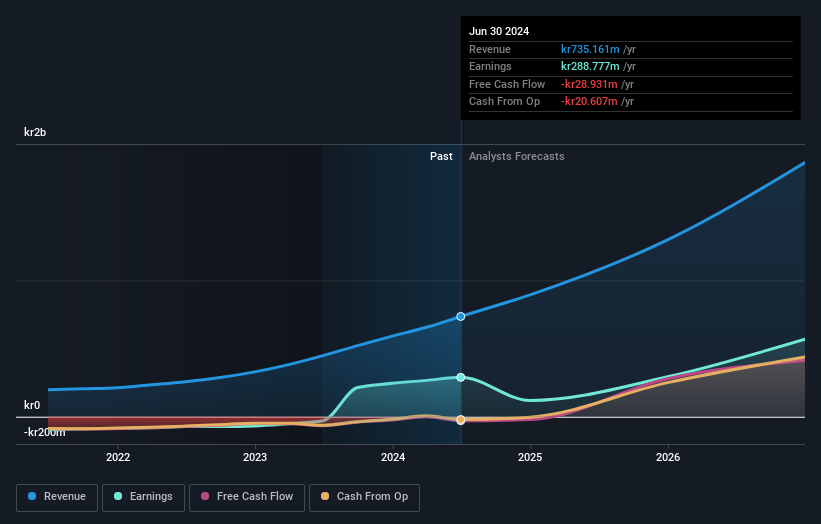

Bonesupport Holding, navigating a transformative phase, reported a robust 36.3% year-over-year revenue growth, signaling strong market acceptance. This growth is underpinned by a forecasted annual earnings increase of 76.7%, reflecting potential operational efficiencies and market expansion. Notably, R&D investments remain pivotal, with significant allocations aimed at enhancing its biotech solutions, evident from recent advancements in the SOLARIO study which underscored the efficacy of its innovative antibiotic-eluting products in orthopedic treatments. These strategic initiatives may well position Bonesupport to capitalize on emerging opportunities within the biotechnology sector while addressing critical healthcare challenges effectively.

Next Steps

- Delve into our full catalog of 1291 High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives