- South Korea

- /

- Entertainment

- /

- KOSE:A079160

3 KRX Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has remained flat, yet it is up 7.8% over the past year with earnings expected to grow by 29% per annum in the coming years. In this context, identifying stocks that might be trading below their estimated value can offer potential opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PharmaResearch (KOSDAQ:A214450) | ₩229500.00 | ₩422696.80 | 45.7% |

| T'Way Air (KOSE:A091810) | ₩3085.00 | ₩5518.32 | 44.1% |

| Sejin Heavy Industries (KOSE:A075580) | ₩7440.00 | ₩14866.86 | 50% |

| TSE (KOSDAQ:A131290) | ₩55100.00 | ₩99592.33 | 44.7% |

| Wonik Ips (KOSDAQ:A240810) | ₩28750.00 | ₩48636.53 | 40.9% |

| Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩49950.00 | ₩90475.93 | 44.8% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1486.00 | ₩2868.36 | 48.2% |

| ADTechnologyLtd (KOSDAQ:A200710) | ₩14640.00 | ₩24729.34 | 40.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩43700.00 | ₩81123.11 | 46.1% |

Here we highlight a subset of our preferred stocks from the screener.

Hanall Biopharma (KOSE:A009420)

Overview: Hanall Biopharma Co., Ltd. is a pharmaceutical company that manufactures and sells pharmaceutical products both in South Korea and internationally, with a market cap of ₩2.41 trillion.

Operations: The company generates revenue of ₩130.37 billion from its pharmaceutical manufacturing and sales operations in South Korea and abroad.

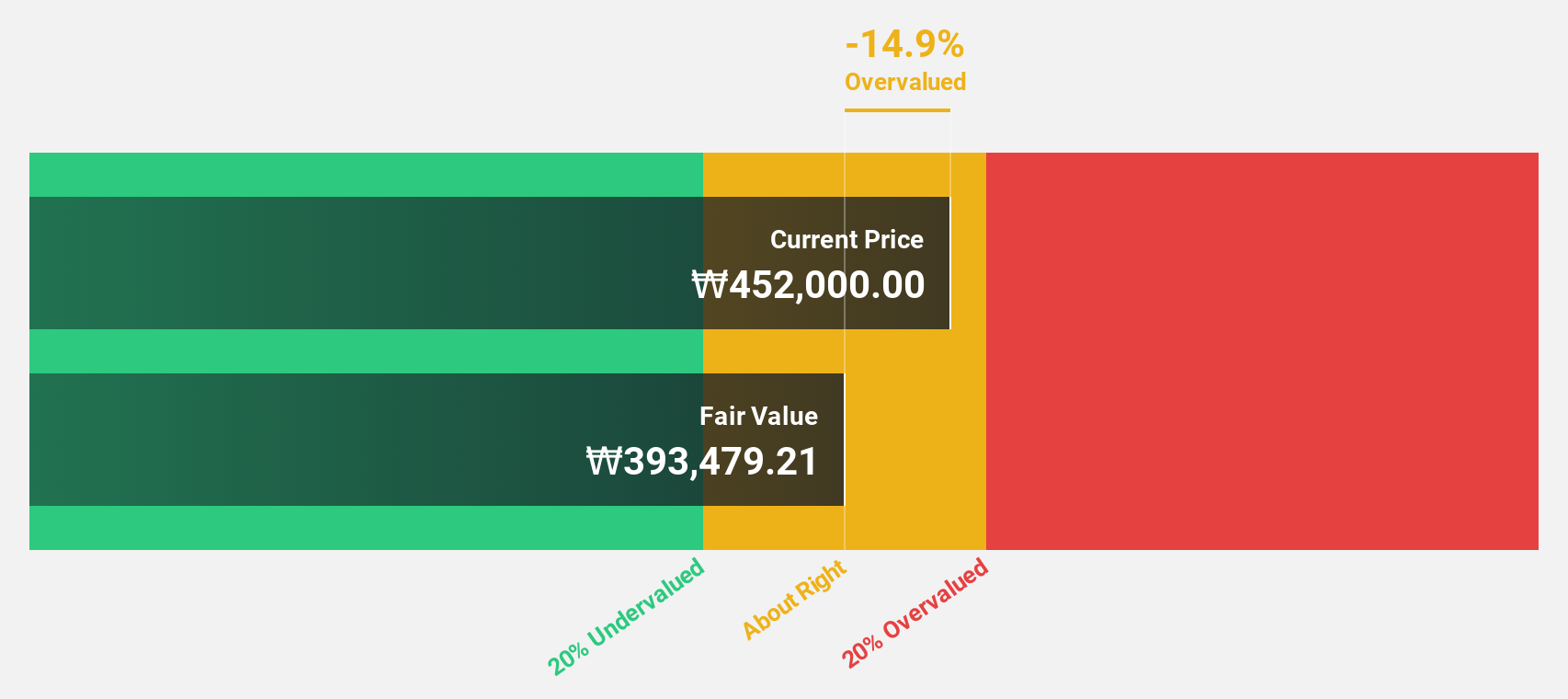

Estimated Discount To Fair Value: 12.2%

Hanall Biopharma is currently trading at ₩47,600, which is 12.2% below its estimated fair value of ₩54,198.01, suggesting some undervaluation based on cash flows. Despite recent volatility and a significant drop in sales and net income compared to the previous year, the company is forecast to become profitable over the next three years with earnings expected to grow at 93.89% annually, outpacing market growth expectations.

- According our earnings growth report, there's an indication that Hanall Biopharma might be ready to expand.

- Dive into the specifics of Hanall Biopharma here with our thorough financial health report.

CJ CGV (KOSE:A079160)

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand in South Korea and has a market cap of approximately ₩933.87 billion.

Operations: The company's revenue is primarily derived from Multiplex Operation at ₩1.50 billion and Technology Special Format and Equipment at ₩93.11 million.

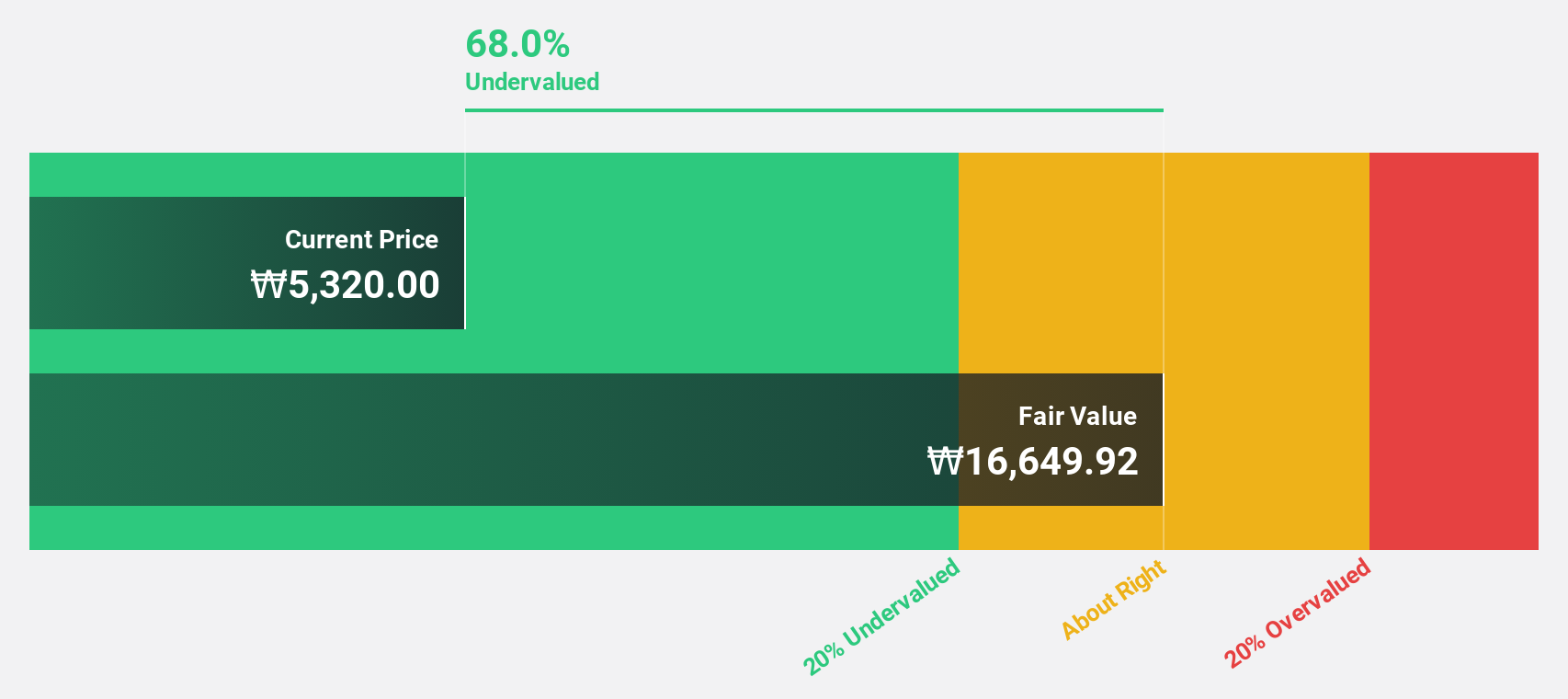

Estimated Discount To Fair Value: 34.6%

CJ CGV is trading at ₩5,640, significantly below its estimated fair value of ₩8,625.91, highlighting potential undervaluation based on cash flows. Despite a decrease in sales to ₩244.85 billion for Q2 2024 from the previous year and a reduced net loss of ₩3.70 billion, the company is expected to become profitable within three years with earnings growth surpassing market averages while maintaining competitive revenue growth projections.

- In light of our recent growth report, it seems possible that CJ CGV's financial performance will exceed current levels.

- Navigate through the intricacies of CJ CGV with our comprehensive financial health report here.

HD Hyundai Electric (KOSE:A267260)

Overview: HD Hyundai Electric Co., Ltd. manufactures and sells electrical equipment in South Korea, with a market cap of approximately ₩12.31 billion.

Operations: The company's revenue is primarily derived from its Electric Equipment segment, totaling approximately ₩3.21 billion.

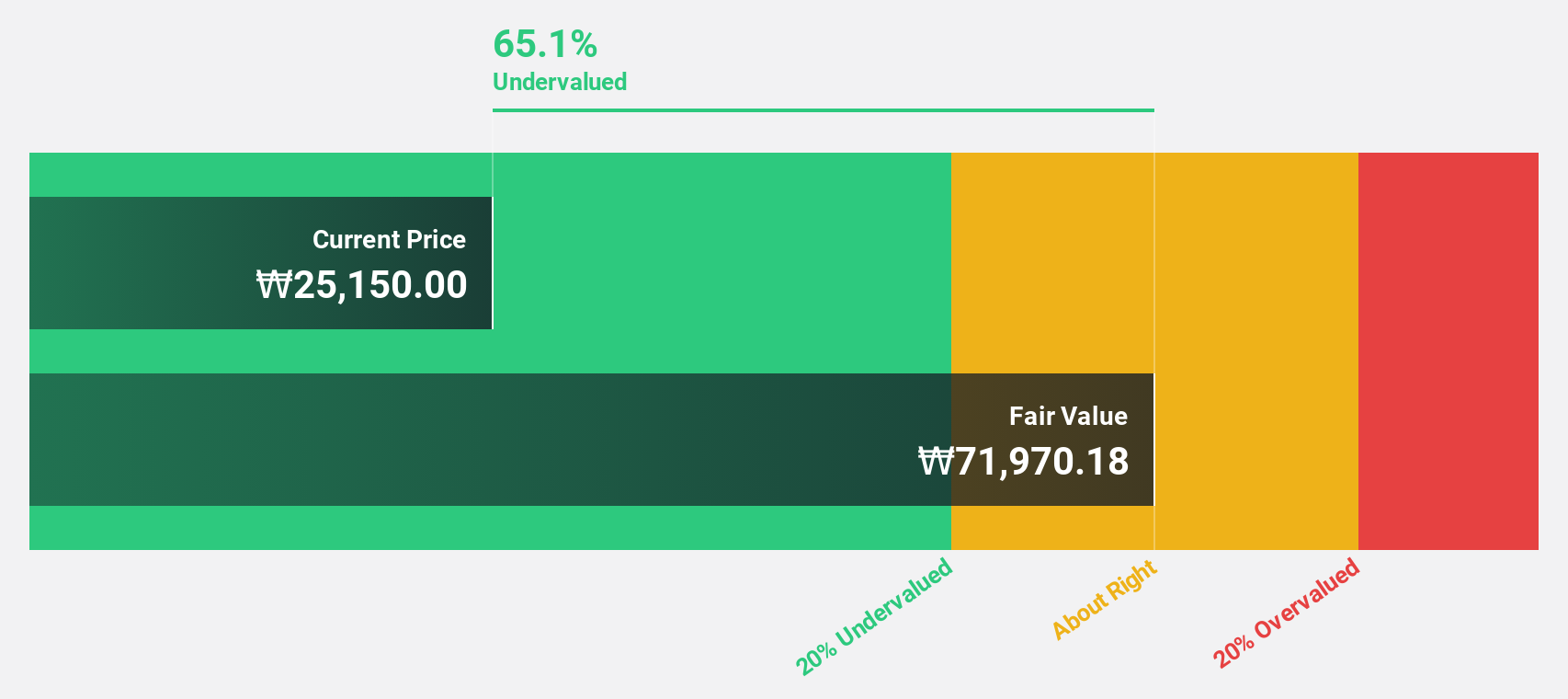

Estimated Discount To Fair Value: 24.8%

HD Hyundai Electric is trading at ₩342,000, approximately 24.8% below its estimated fair value of ₩454,543.38, suggesting potential undervaluation based on cash flows. Despite recent share price volatility and earnings growth forecasted to lag behind the broader Korean market, the company's revenue is expected to outpace market averages. Additionally, its inclusion in the FTSE All-World Index may enhance investor visibility and interest moving forward.

- Insights from our recent growth report point to a promising forecast for HD Hyundai Electric's business outlook.

- Delve into the full analysis health report here for a deeper understanding of HD Hyundai Electric.

Seize The Opportunity

- Discover the full array of 32 Undervalued KRX Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A079160

CJ CGV

Engages in the operation of theaters under CJ CGV brand name in South Korea.

Undervalued with reasonable growth potential.