- South Korea

- /

- Pharma

- /

- KOSDAQ:A039200

3 KRX Stocks Estimated To Be Up To 48.3% Below Intrinsic Value

Reviewed by Simply Wall St

The South Korea stock market has experienced a downturn, finishing lower in three consecutive sessions and shedding more than 105 points or 4 percent. Despite the recent volatility, this presents an opportunity to identify undervalued stocks that may be trading below their intrinsic value. In this article, we will explore three KRX stocks estimated to be up to 48.3% below their intrinsic value, offering potential for investors seeking value in a fluctuating market.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| HD Hyundai Electric (KOSE:A267260) | ₩239000.00 | ₩460637.27 | 48.1% |

| APR (KOSE:A278470) | ₩284500.00 | ₩520255.97 | 45.3% |

| Cosmecca Korea (KOSDAQ:A241710) | ₩81800.00 | ₩151912.94 | 46.2% |

| Oscotec (KOSDAQ:A039200) | ₩33900.00 | ₩65583.14 | 48.3% |

| Intellian Technologies (KOSDAQ:A189300) | ₩48500.00 | ₩91198.10 | 46.8% |

| Global Tax Free (KOSDAQ:A204620) | ₩3260.00 | ₩6413.84 | 49.2% |

| Hanall Biopharma (KOSE:A009420) | ₩36900.00 | ₩70271.91 | 47.5% |

| Shinsung E&GLtd (KOSE:A011930) | ₩1562.00 | ₩2947.00 | 47% |

| Hotel ShillaLtd (KOSE:A008770) | ₩45350.00 | ₩82954.13 | 45.3% |

| Hd Hyundai MipoLtd (KOSE:A010620) | ₩94600.00 | ₩171449.47 | 44.8% |

We're going to check out a few of the best picks from our screener tool.

Oscotec (KOSDAQ:A039200)

Overview: Oscotec Inc. is a biotechnology company involved in drug development, functional materials, dental bone graft materials, and has a market cap of ₩1.29 trillion.

Operations: Oscotec's revenue segments include the Food Business Division (₩1.69 billion), Medical Business Sector (₩1.63 billion), New Drug Business Division (₩990.90 million), and Functional Materials Division (₩310.71 million).

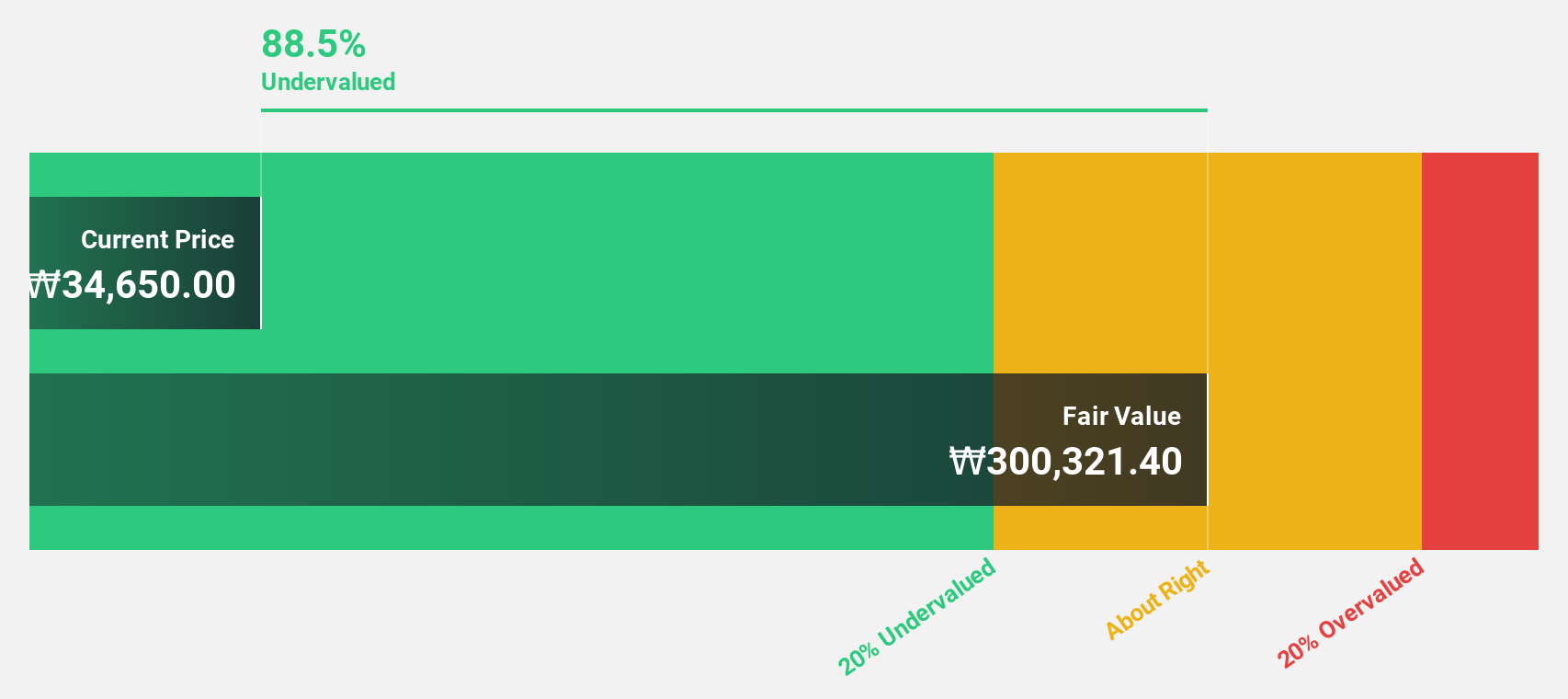

Estimated Discount To Fair Value: 48.3%

Oscotec is trading at ₩33,900, significantly below its estimated fair value of ₩65,583.14, making it highly undervalued based on discounted cash flow analysis. Despite a volatile share price over the past three months and current minimal revenue (₩5B), the company is expected to see substantial revenue growth of 68.9% per year and become profitable within three years with an anticipated high return on equity of 27.5%.

- Our earnings growth report unveils the potential for significant increases in Oscotec's future results.

- Unlock comprehensive insights into our analysis of Oscotec stock in this financial health report.

Kakao Games (KOSDAQ:A293490)

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide, with a market cap of ₩1.38 trillion.

Operations: Kakao Games Corporation generates revenue primarily from its computer graphics segment, amounting to ₩986.72 million.

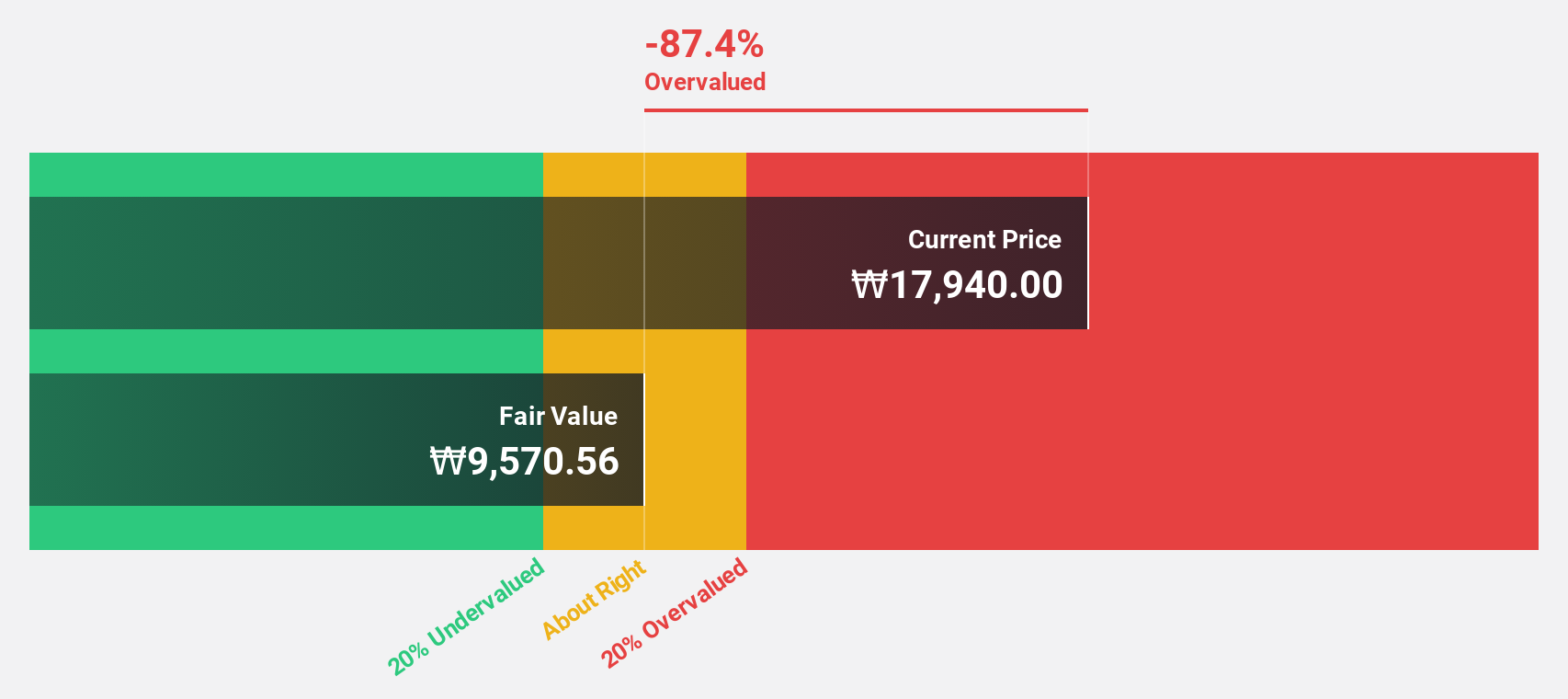

Estimated Discount To Fair Value: 43.2%

Kakao Games is trading at ₩16,900, significantly below its estimated fair value of ₩29,779.55, indicating it may be undervalued based on discounted cash flow analysis. Recent private placements raised KRW 270 billion through convertible bonds due in 2029. Despite a low forecasted return on equity (6.7%), earnings are expected to grow substantially at 110.85% per year and the company is projected to become profitable within three years with revenue growth outpacing the market average.

- Insights from our recent growth report point to a promising forecast for Kakao Games' business outlook.

- Take a closer look at Kakao Games' balance sheet health here in our report.

CJ CGV (KOSE:A079160)

Overview: CJ CGV Co., Ltd. operates theaters under the CJ CGV brand name in South Korea and has a market cap of ₩1.11 trillion.

Operations: CJ CGV Co., Ltd. generates revenue primarily from its theater operations in South Korea, with a market cap of ₩1.11 trillion.

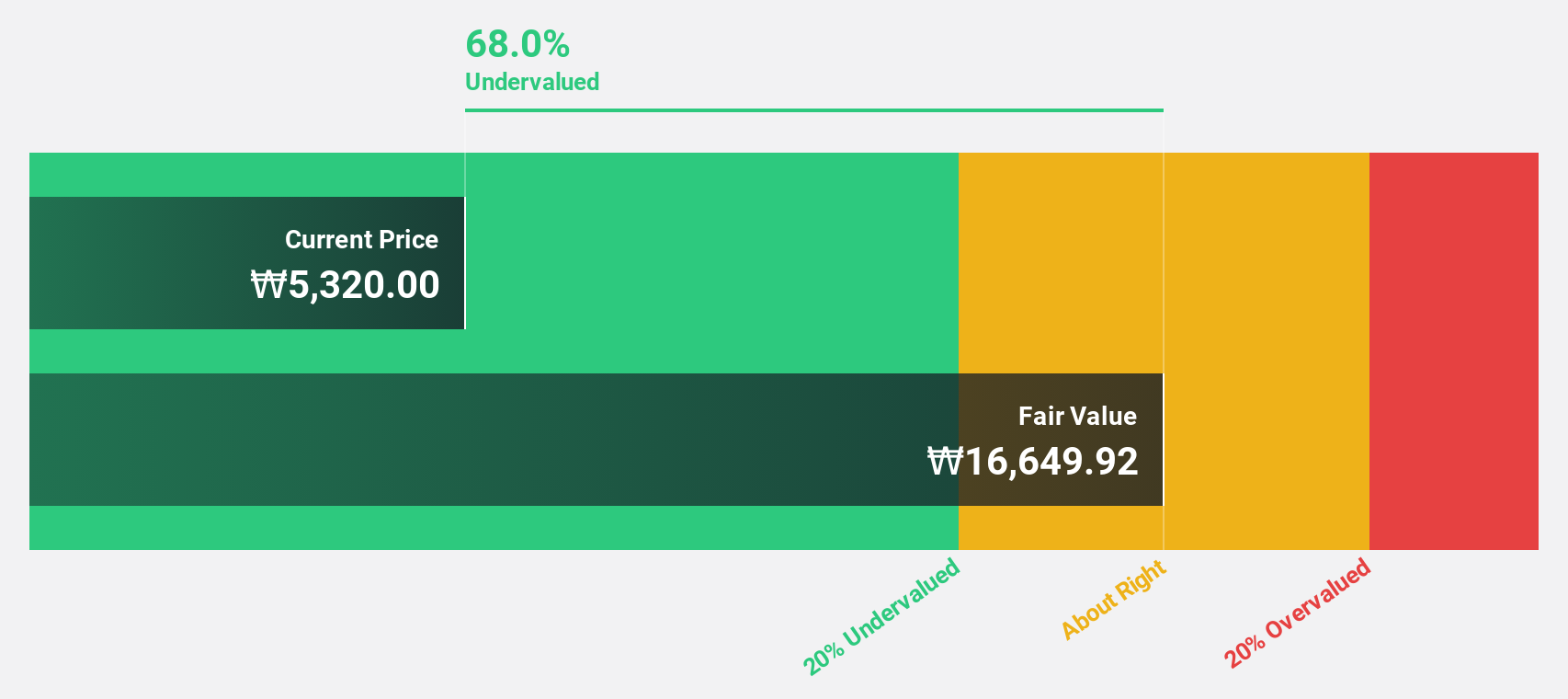

Estimated Discount To Fair Value: 22.7%

CJ CGV is trading at ₩6,730, well below its estimated fair value of ₩8,709.45, suggesting significant undervaluation based on discounted cash flow analysis. Despite recent earnings showing a net loss of KRW 3.70 billion for Q2 2024 and declining sales year-over-year, the company is expected to become profitable within three years with an annual profit growth forecast above the market average and revenue growth outpacing the South Korean market at 13.6% per year.

- Upon reviewing our latest growth report, CJ CGV's projected financial performance appears quite optimistic.

- Click here to discover the nuances of CJ CGV with our detailed financial health report.

Next Steps

- Navigate through the entire inventory of 34 Undervalued KRX Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A039200

Oscotec

Operates as a biotechnology company, engages in the drug development, functional materials and related products, and dental bone graft material businesses.

Exceptional growth potential with adequate balance sheet.