- South Korea

- /

- Food

- /

- KOSE:A003230

3 Global Growth Stocks With Up To 13% Insider Ownership

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a mixed economic environment characterized by fluctuating interest rate expectations and varied regional performances. With U.S. equity indexes experiencing slight gains amid hopes for Federal Reserve rate cuts, and European markets facing growth concerns, identifying stocks with strong growth potential and significant insider ownership can be a strategic approach to harnessing potential returns. Companies with high insider ownership often indicate confidence from those closest to the business, which can be particularly appealing in times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's explore several standout options from the results in the screener.

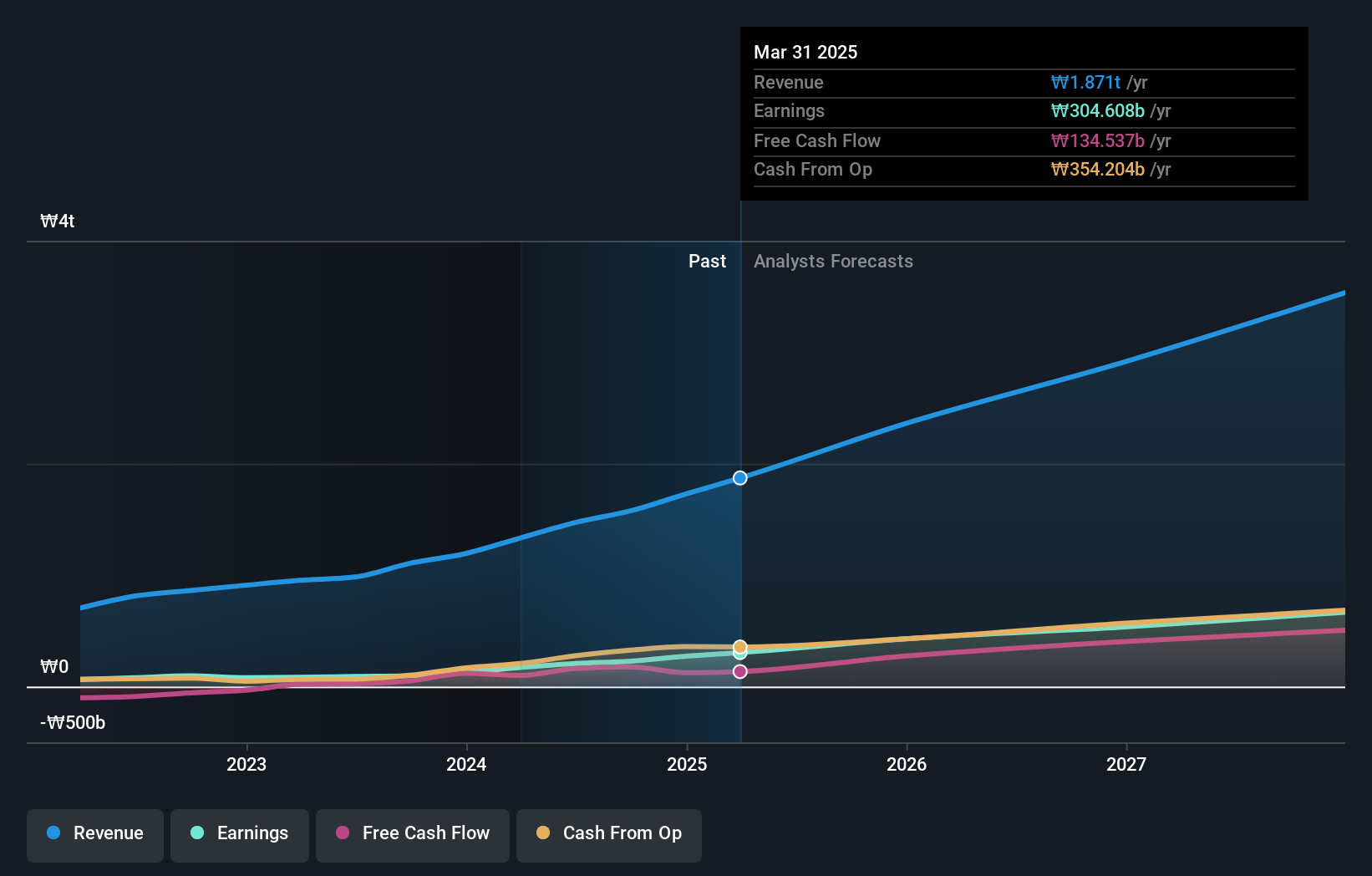

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★★★

Overview: Samyang Foods Co., Ltd., along with its subsidiaries, operates in the food industry both in South Korea and internationally, with a market cap of ₩12.16 billion.

Operations: Samyang Foods generates revenue primarily through its operations in the food sector, serving both domestic and international markets.

Insider Ownership: 11.7%

Samyang Foods shows strong growth potential, with earnings having grown by 54.6% in the past year and forecasted to grow at 28.56% annually, surpassing the Korean market's average. Revenue is also expected to rise significantly at 22.9% per year. Despite trading below estimated fair value, recent product launches like MEP in the U.S., which targets a younger demographic craving unique flavors, highlight strategic expansion efforts without substantial insider trading activity recently noted.

- Click here and access our complete growth analysis report to understand the dynamics of Samyang Foods.

- Our expertly prepared valuation report Samyang Foods implies its share price may be too high.

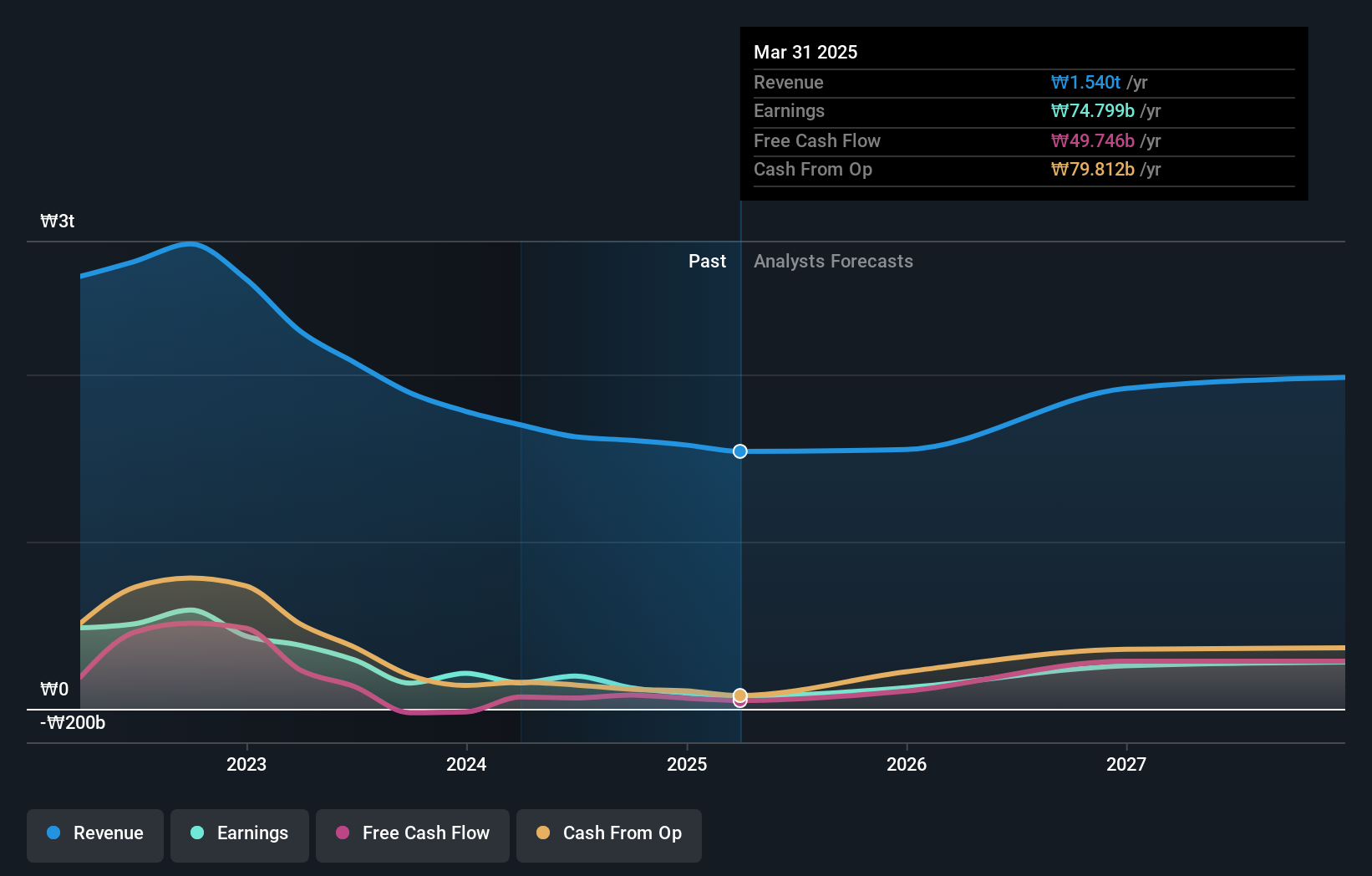

NCSOFT (KOSE:A036570)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩3.92 trillion.

Operations: The company generates revenue of ₩1.55 trillion from its online games and game services segment.

Insider Ownership: 13.7%

NCSOFT is positioned for growth with revenue expected to expand at 13.4% annually, outpacing the Korean market average. Despite a recent net loss of KRW 35.41 million in Q2 2025, the company is forecast to become profitable within three years, indicating strong long-term potential. Trading below its estimated fair value by 19.1%, NCSOFT's insider ownership remains stable without significant trading activity over the past three months.

- Get an in-depth perspective on NCSOFT's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, NCSOFT's share price might be too pessimistic.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases in Taiwan and internationally, with a market cap of NT$184.18 billion.

Operations: The company generates revenue primarily from the research and development of new drugs, amounting to NT$12.63 billion.

Insider Ownership: 9.7%

PharmaEssentia's earnings are forecast to grow significantly, with a 65.34% annual increase expected over the next three years, surpassing the TW market average. Revenue growth is also robust at 31.5% per year. The company recently reported strong financial results for Q2 2025, with sales reaching TWD 3.60 billion and net income of TWD 832.25 million. Trading well below its estimated fair value, PharmaEssentia continues expanding its global footprint with recent product approvals in Latin America.

- Dive into the specifics of PharmaEssentia here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that PharmaEssentia is priced lower than what may be justified by its financials.

Key Takeaways

- Unlock our comprehensive list of 854 Fast Growing Global Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003230

Samyang Foods

Engages in the food business in South Korea and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives