- South Korea

- /

- Entertainment

- /

- KOSE:A036420

How Much Did Jcontentree's(KRX:036420) Shareholders Earn From Share Price Movements Over The Last Three Years?

It is doubtless a positive to see that the Jcontentree corp. (KRX:036420) share price has gained some 70% in the last three months. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 37% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Jcontentree

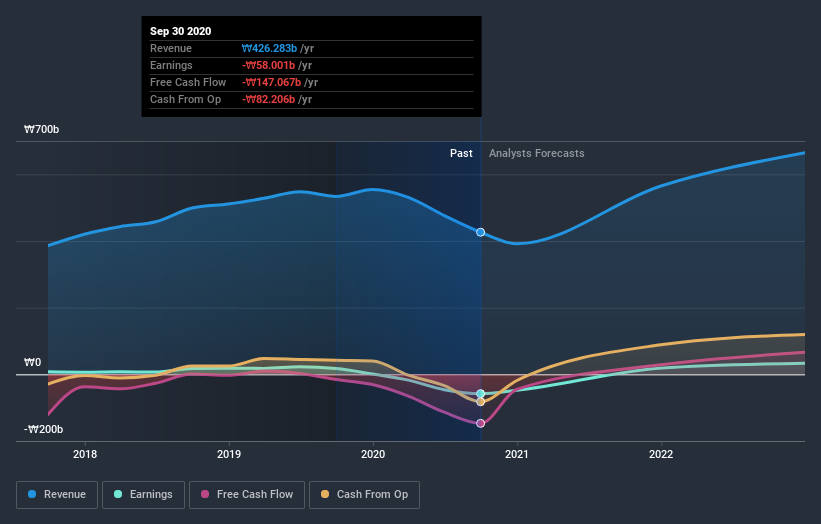

Because Jcontentree made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, Jcontentree saw its revenue grow by 5.7% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. The stock dropped 11% during that time. If revenue growth accelerates, we might see the share price bounce. But the real upside for shareholders will be if the company can start generating profits.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Jcontentree is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Jcontentree's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Jcontentree hasn't been paying dividends, but its TSR of -34% exceeds its share price return of -37%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Jcontentree provided a TSR of 3.8% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 3% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Jcontentree better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Jcontentree (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade Jcontentree, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A036420

ContentreeJoongAng

Operates as an entertainment and media company in South Korea and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives