- China

- /

- Medical Equipment

- /

- SHSE:688617

Global Growth Companies With High Insider Ownership June 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed economic signals and geopolitical tensions, investors are keenly observing the Federal Reserve's steady interest rate policy and its implications for growth forecasts. Amidst this backdrop, growth companies with high insider ownership offer an intriguing proposition, as their alignment of interests between management and shareholders can be particularly appealing during uncertain times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Kakao (KOSE:A035720)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakao Corp. operates mobile and online platforms in South Korea with a market cap of approximately ₩30.77 trillion.

Operations: The company's revenue segments include Kakao Co., Ltd. with ₩2.62 billion, Kakao piccoma corp. with ₩573.36 million, Kakao Games Co., Ltd. with ₩780.83 million, Kakao Mobility Co., Ltd. with ₩678.57 million, SM Entertainment Co., Ltd. with ₩997.56 million, Kakao Entertainment Co., Ltd. with ₩1.73 billion, and Kakao Pay Co., Ltd. at ₩801.79 million.

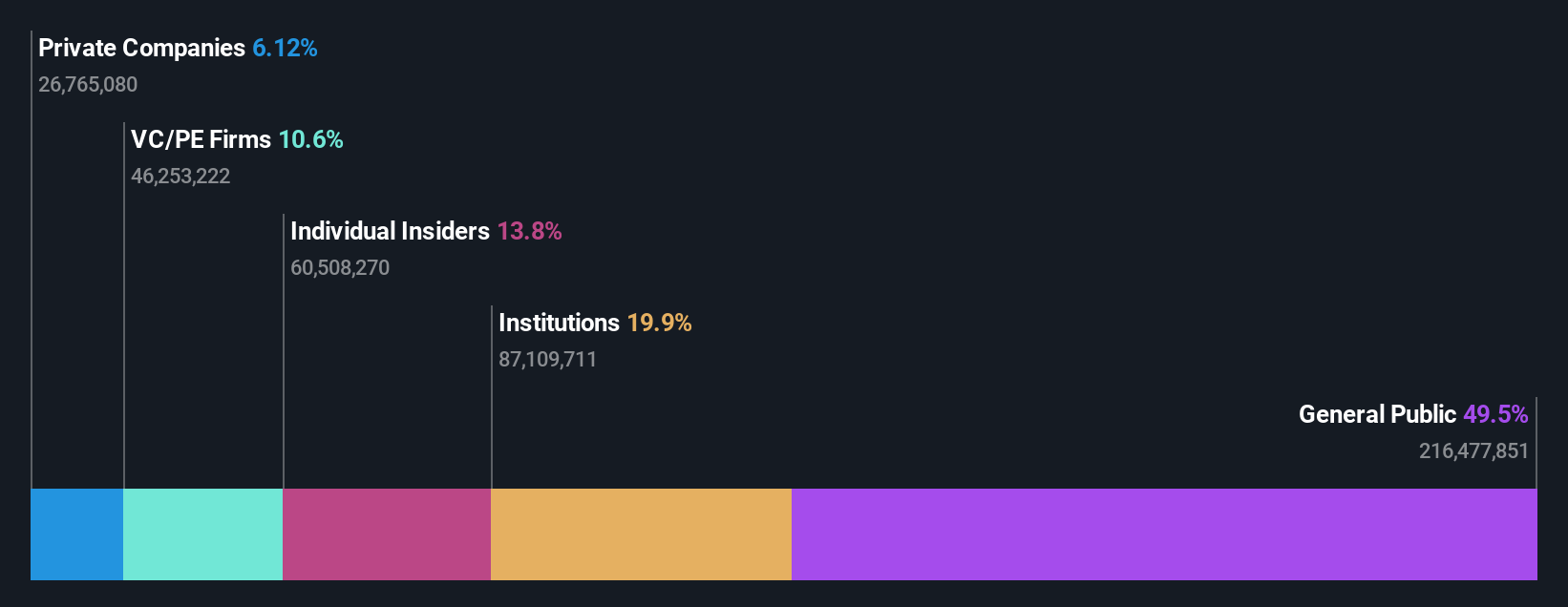

Insider Ownership: 13.8%

Kakao Corp. demonstrates strong growth potential with earnings expected to grow significantly, at 36.34% annually, outpacing the Korean market's 20.2%. Despite a slower revenue growth forecast of 6%, it surpasses the market average of 4.9%. Recent financial maneuvers include a private placement raising KRW 50 billion and an acquisition of a stake by an undisclosed buyer for KRW 410 billion, suggesting strategic moves to bolster its growth trajectory amidst high insider ownership dynamics.

- Dive into the specifics of Kakao here with our thorough growth forecast report.

- Our valuation report here indicates Kakao may be overvalued.

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

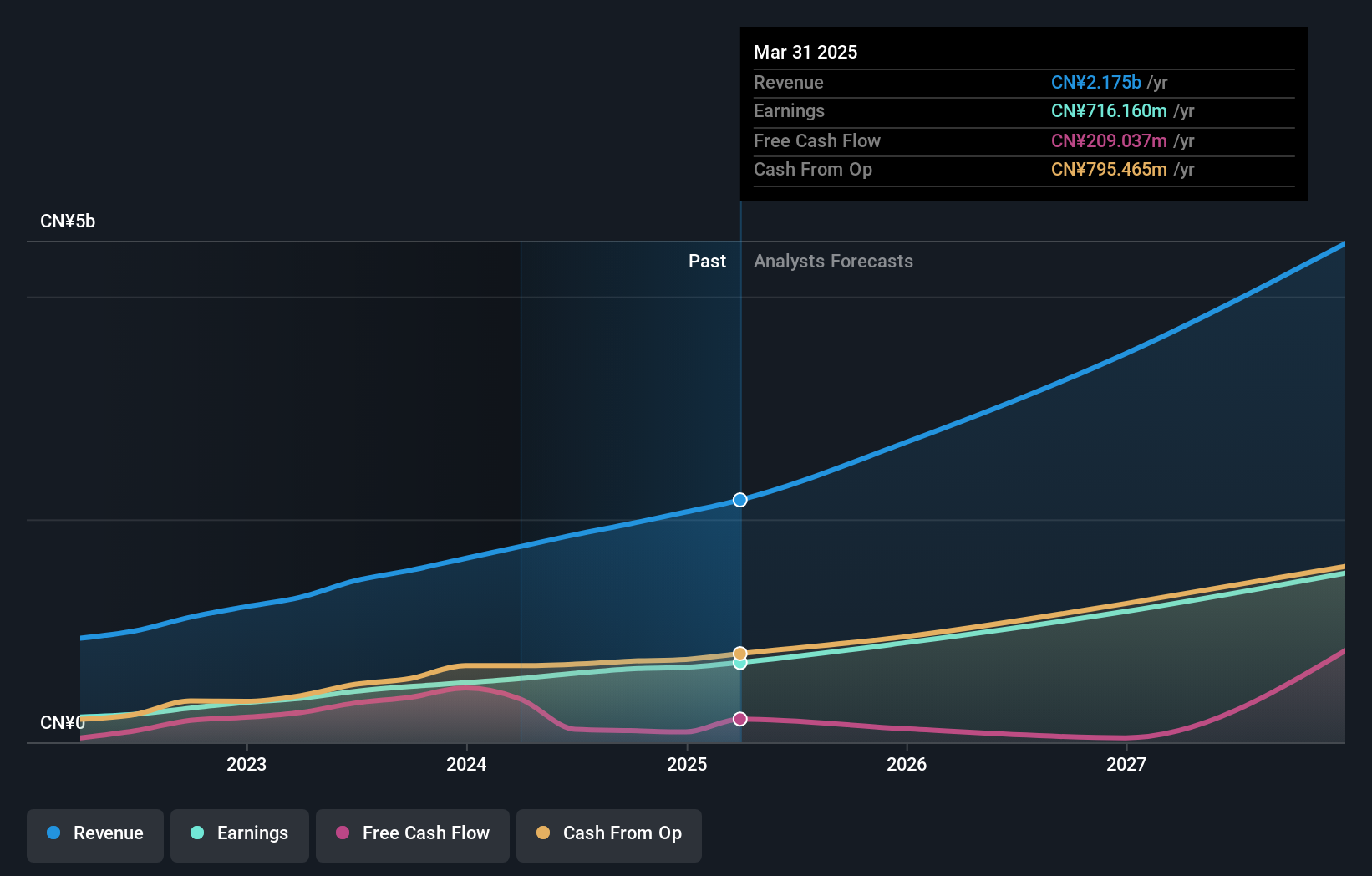

Overview: APT Medical Inc. focuses on the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China, with a market cap of CN¥38.78 billion.

Operations: The company generates revenue of CN¥2.17 billion from its medical products segment.

Insider Ownership: 22%

APT Medical's earnings are forecast to grow at 26.78% annually, surpassing the Chinese market's 23.2% rate, with revenue growth projected at 25.8%, well above the market average of 12.3%. The company reported Q1 sales of CNY 564.28 million and net income of CNY 183.15 million, reflecting robust performance despite a recent dividend decrease to CNY 1.75 per share and an upcoming stock split set for June 2025, indicating strategic financial adjustments amidst strong growth prospects.

- Delve into the full analysis future growth report here for a deeper understanding of APT Medical.

- Our expertly prepared valuation report APT Medical implies its share price may be too high.

Hubei Feilihua Quartz Glass (SZSE:300395)

Simply Wall St Growth Rating: ★★★★★☆

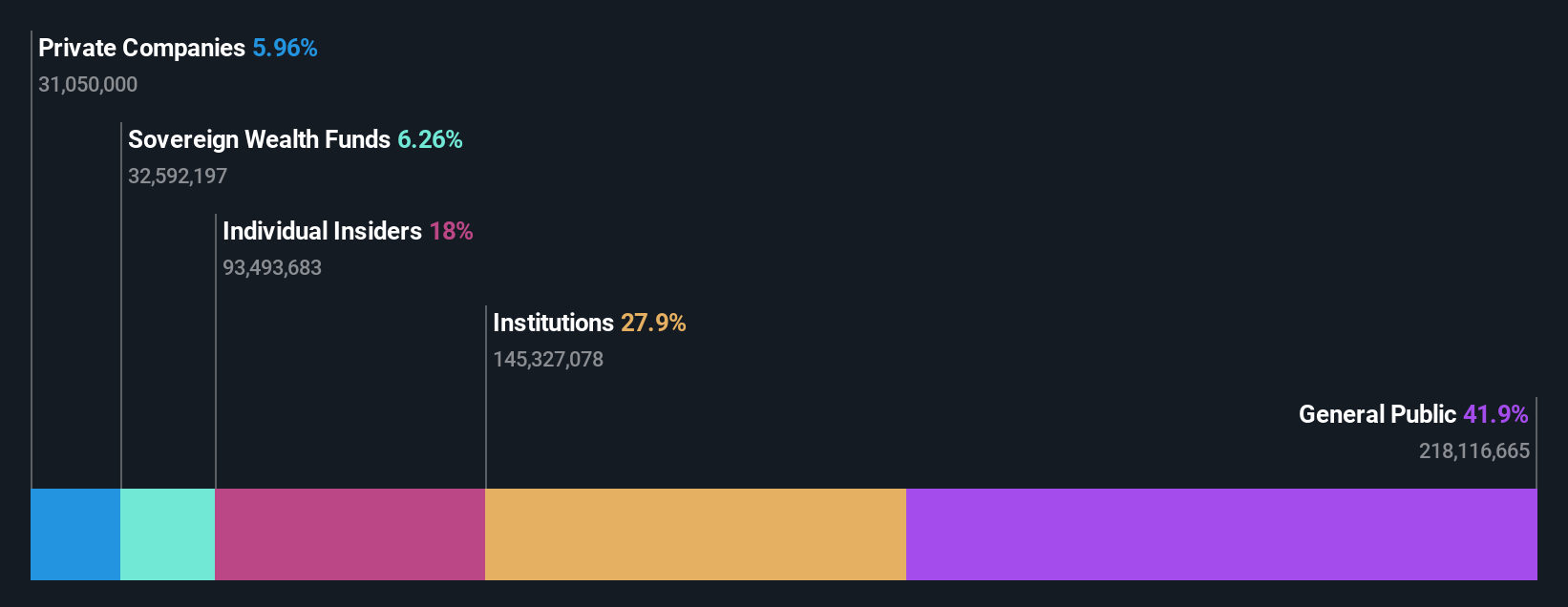

Overview: Hubei Feilihua Quartz Glass Co., Ltd. is involved in the research, development, and production of quartz materials and quartz fiber products globally, with a market capitalization of CN¥23.67 billion.

Operations: The company's revenue primarily comes from the Non-Metallic Mineral Products Industry, amounting to CN¥1.70 billion.

Insider Ownership: 18%

Hubei Feilihua Quartz Glass is poised for substantial growth, with earnings forecasted to increase by 38.3% annually, outpacing the Chinese market's 23.2%. Revenue is expected to grow at 25.9% per year, significantly above the market average of 12.3%. Despite a recent dividend decrease to CNY 1.30 per share and amendments to company bylaws, Q1 results showed strong net income growth from CNY 77.43 million to CNY 105.09 million year-over-year, reflecting solid financial performance amidst strategic changes.

- Click here to discover the nuances of Hubei Feilihua Quartz Glass with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Hubei Feilihua Quartz Glass' share price might be too optimistic.

Summing It All Up

- Click this link to deep-dive into the 830 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688617

APT Medical

Engages in the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives