- South Korea

- /

- Interactive Media and Services

- /

- KOSE:A035420

Is Now The Time To Put NAVER (KRX:035420) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like NAVER (KRX:035420). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

NAVER's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years NAVER grew its EPS by 8.6% per year. That's a pretty good rate, if the company can sustain it.

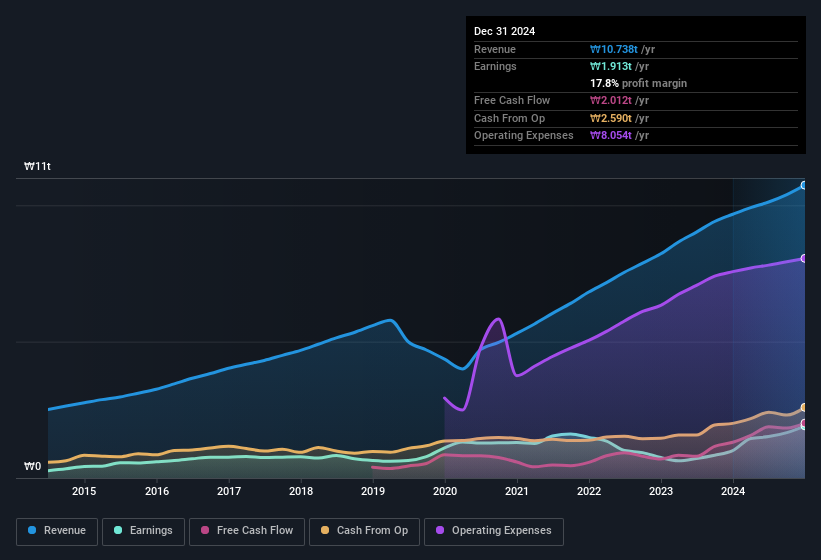

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that NAVER is growing revenues, and EBIT margins improved by 3.0 percentage points to 18%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

See our latest analysis for NAVER

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for NAVER's future EPS 100% free.

Are NAVER Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₩29t company like NAVER. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth ₩1.2t. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations over ₩12t, like NAVER, the median CEO pay is around ₩2.0b.

The NAVER CEO received ₩1.3b in compensation for the year ending December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is NAVER Worth Keeping An Eye On?

As previously touched on, NAVER is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for NAVER, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Now, you could try to make up your mind on NAVER by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry .

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in KR with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NAVER might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A035420

NAVER

Provides online search portal and information services in South Korea and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success