- China

- /

- Electronic Equipment and Components

- /

- SZSE:002609

High Growth Tech Stocks In Asia For September 2025

Reviewed by Simply Wall St

As global markets navigate a landscape shaped by fluctuating interest rates and economic indicators, the Asian tech sector stands out with its potential for high growth, driven by innovation and strategic positioning in an evolving digital economy. In this context, identifying promising stocks involves looking at companies that not only leverage technological advancements but also demonstrate resilience amid broader market shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.79% | 22.79% | ★★★★★★ |

| Giant Network Group | 31.77% | 35.00% | ★★★★★★ |

| PharmaEssentia | 31.53% | 65.34% | ★★★★★★ |

| Fositek | 33.62% | 43.82% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Zhongji Innolight | 26.47% | 27.39% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 55.36% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

DEAR U (KOSDAQ:A376300)

Simply Wall St Growth Rating: ★★★★★★

Overview: Dear U Co., Ltd. is an information technology company with a market capitalization of approximately ₩1.15 billion.

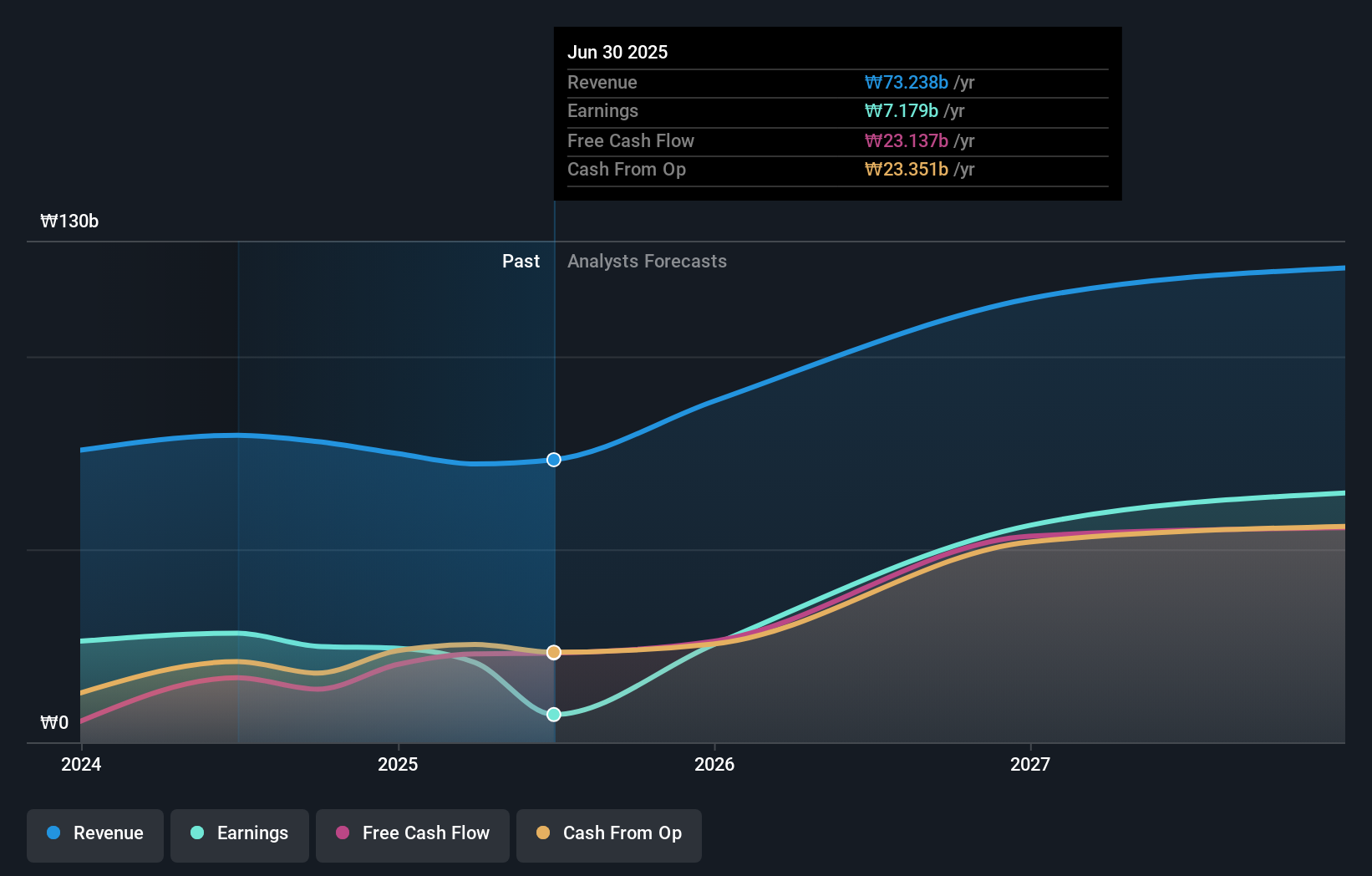

Operations: The company generates revenue primarily from its Bubble segment, which contributes ₩73.24 billion.

DEAR U, a player in the Interactive Media and Services sector, demonstrates a mixed financial landscape amid Asia's competitive tech arena. Despite experiencing a significant earnings drop of 74.6% last year, forecasts are notably optimistic with expected annual revenue and earnings growth rates at 21% and 62.3%, respectively—outpacing the broader Korean market projections of 7.1% for revenue and 23.4% for earnings growth. This rebound is supported by DEAR U's robust R&D focus which aligns with industry shifts towards more integrated digital solutions, suggesting potential for future market share gains despite current volatility in its share price and a recent dip in net profit margins to 9.8% from last year’s 35.5%.

- Delve into the full analysis health report here for a deeper understanding of DEAR U.

Assess DEAR U's past performance with our detailed historical performance reports.

NanJing GOVA Technology (SHSE:688539)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NanJing GOVA Technology Co., Ltd. specializes in the research, design, development, production, and sale of sensors and sensor network systems in China with a market cap of CN¥5.99 billion.

Operations: GOVA Technology focuses on sensors and sensor network systems, operating primarily in China. The company engages in research, design, development, production, and sales activities within this sector.

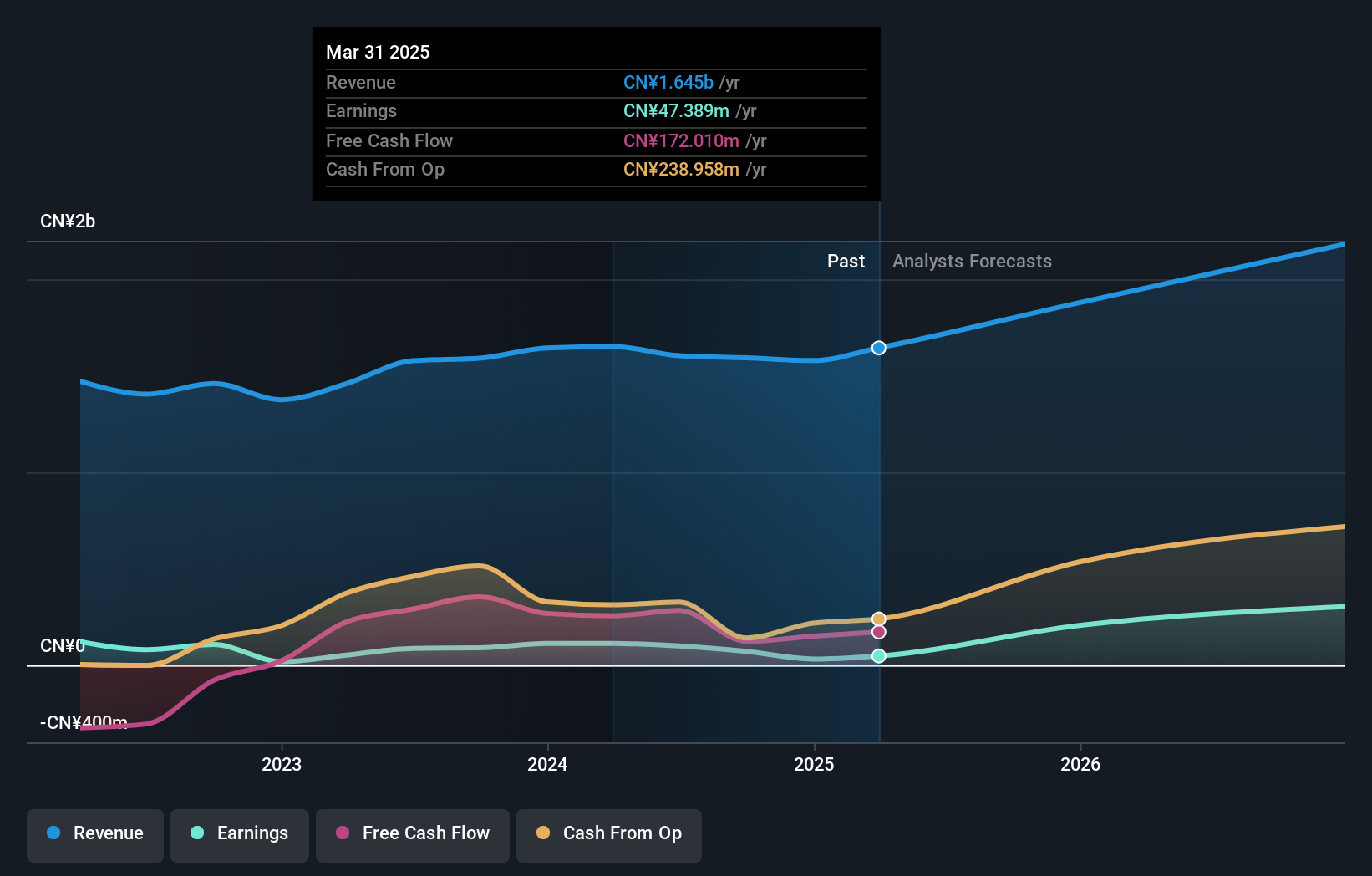

NanJing GOVA Technology, amidst a competitive tech landscape in Asia, posted a revenue increase to CNY 184.32 million from CNY 158.08 million year-over-year, reflecting a growth of 16.6%. This performance is bolstered by an earnings forecast predicting an annual growth rate of 28.4%, notably outpacing the Chinese market's average of 26%. Despite challenges like its negative earnings growth last year and lower profit margins—15% compared to the previous year’s 24.4%—the company's strategic R&D investments are aligning with broader industry trends that could enhance its market position in the long term.

- Navigate through the intricacies of NanJing GOVA Technology with our comprehensive health report here.

Gain insights into NanJing GOVA Technology's past trends and performance with our Past report.

Shenzhen Jieshun Science and Technology IndustryLtd (SZSE:002609)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Jieshun Science and Technology Industry Co., Ltd. specializes in providing intelligent management systems for car parks and related services, with a market capitalization of CN¥6.56 billion.

Operations: The company's primary revenue stream is the Intelligent Management System for Car Parks, generating CN¥684.18 million, followed by Parking Time and Parking Fee Business at CN¥373.35 million. Software and Cloud Services contribute CN¥246.63 million, while Smart Parking Operation adds CN¥167.81 million to the revenue mix.

Shenzhen Jieshun Science and Technology Industry Co., Ltd. has demonstrated robust growth, with a revenue jump to CNY 743.65 million from CNY 612.35 million year-over-year, marking a significant increase of 21.5%. This growth is complemented by an impressive leap in net income from CNY 17.02 million to CNY 41.48 million within the same period, reflecting a surge of over 143%. Despite challenges in the tech sector, the company's commitment to innovation is evident in its R&D investments which align well with industry trends towards enhanced security solutions, potentially positioning it favorably against competitors in Asia's high-growth tech landscape.

Summing It All Up

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 183 more companies for you to explore.Click here to unveil our expertly curated list of 186 Asian High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002609

Shenzhen Jieshun Science and Technology IndustryLtd

Shenzhen Jieshun Science and Technology Industry Co.,Ltd.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives