- South Korea

- /

- Entertainment

- /

- KOSDAQ:A293490

Kakao Games Corp.'s (KOSDAQ:293490) Shares Climb 34% But Its Business Is Yet to Catch Up

Kakao Games Corp. (KOSDAQ:293490) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

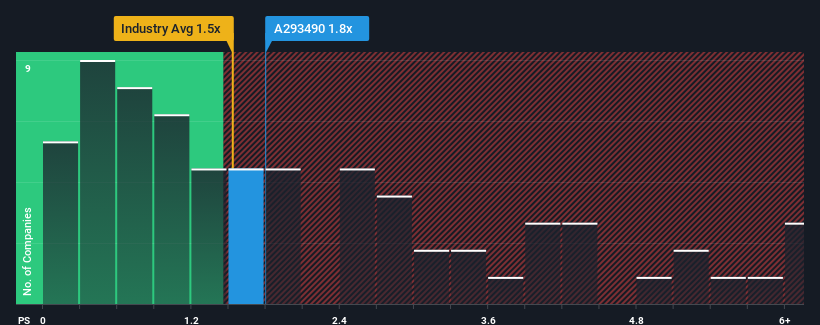

Even after such a large jump in price, there still wouldn't be many who think Kakao Games' price-to-sales (or "P/S") ratio of 1.8x is worth a mention when the median P/S in Korea's Entertainment industry is similar at about 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Kakao Games

How Kakao Games Has Been Performing

Recent times haven't been great for Kakao Games as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Kakao Games' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Kakao Games?

Kakao Games' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 7.2% gain to the company's revenues. Revenue has also lifted 9.7% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.8% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

With this information, we find it interesting that Kakao Games is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Kakao Games' P/S Mean For Investors?

Its shares have lifted substantially and now Kakao Games' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Kakao Games' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Kakao Games with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Kakao Games, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Kakao Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A293490

Kakao Games

Operates a mobile and PC online game service platform for gamers worldwide.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives