- South Korea

- /

- Entertainment

- /

- KOSDAQ:A289220

GIANTSTEP Inc.'s (KOSDAQ:289220) P/S Is Still On The Mark Following 26% Share Price Bounce

GIANTSTEP Inc. (KOSDAQ:289220) shareholders have had their patience rewarded with a 26% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

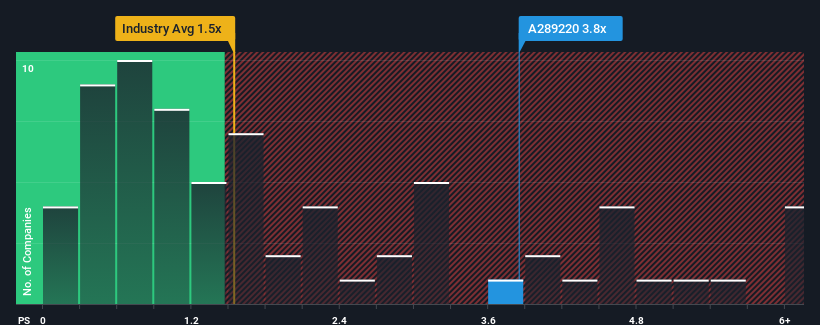

After such a large jump in price, given around half the companies in Korea's Entertainment industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider GIANTSTEP as a stock to avoid entirely with its 3.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for GIANTSTEP

How GIANTSTEP Has Been Performing

GIANTSTEP has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for GIANTSTEP, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is GIANTSTEP's Revenue Growth Trending?

GIANTSTEP's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. Pleasingly, revenue has also lifted 93% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 17%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why GIANTSTEP's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does GIANTSTEP's P/S Mean For Investors?

GIANTSTEP's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of GIANTSTEP revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for GIANTSTEP (1 makes us a bit uncomfortable!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A289220

GIANTSTEP

Produces digital media for various clients related to visual image production in feature films, commercials, music video, and television industries.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026