The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Pearl Abyss Corp. (KOSDAQ:263750) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Pearl Abyss

What Is Pearl Abyss's Net Debt?

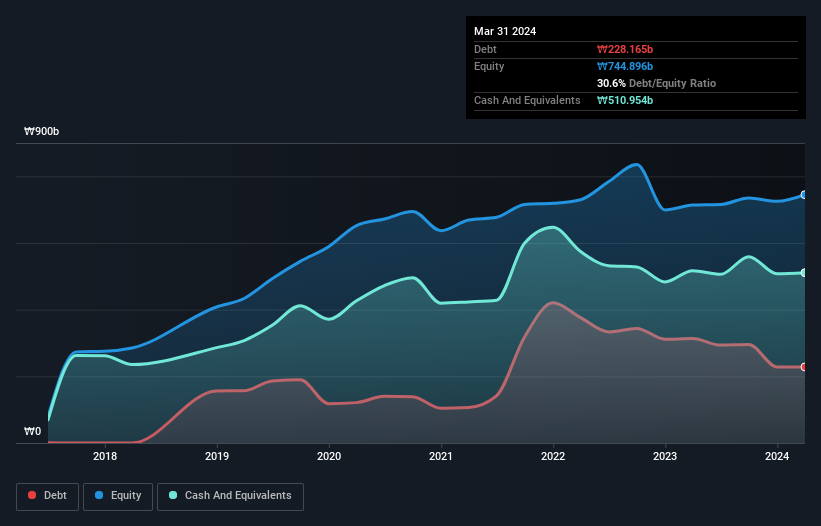

The image below, which you can click on for greater detail, shows that Pearl Abyss had debt of ₩228.2b at the end of March 2024, a reduction from ₩313.2b over a year. But it also has ₩511.0b in cash to offset that, meaning it has ₩282.8b net cash.

A Look At Pearl Abyss' Liabilities

According to the last reported balance sheet, Pearl Abyss had liabilities of ₩303.4b due within 12 months, and liabilities of ₩176.0b due beyond 12 months. On the other hand, it had cash of ₩511.0b and ₩60.1b worth of receivables due within a year. So it actually has ₩91.7b more liquid assets than total liabilities.

This short term liquidity is a sign that Pearl Abyss could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Pearl Abyss has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Pearl Abyss's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Pearl Abyss had a loss before interest and tax, and actually shrunk its revenue by 12%, to ₩333b. We would much prefer see growth.

So How Risky Is Pearl Abyss?

While Pearl Abyss lost money on an earnings before interest and tax (EBIT) level, it actually booked a paper profit of ₩19b. So taking that on face value, and considering the cash, we don't think its very risky in the near term. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with Pearl Abyss .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A263750

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives