- South Korea

- /

- Media

- /

- KOSDAQ:A263720

The D&C MediaLtd (KOSDAQ:263720) Share Price Is Up 183% And Shareholders Are Boasting About It

D&C Media Co.,Ltd. (KOSDAQ:263720) shareholders might be concerned after seeing the share price drop 13% in the last month. In contrast, the return over three years has been impressive. In fact, the share price is up a full 183% compared to three years ago. After a run like that some may not be surprised to see prices moderate. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Check out our latest analysis for D&C MediaLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

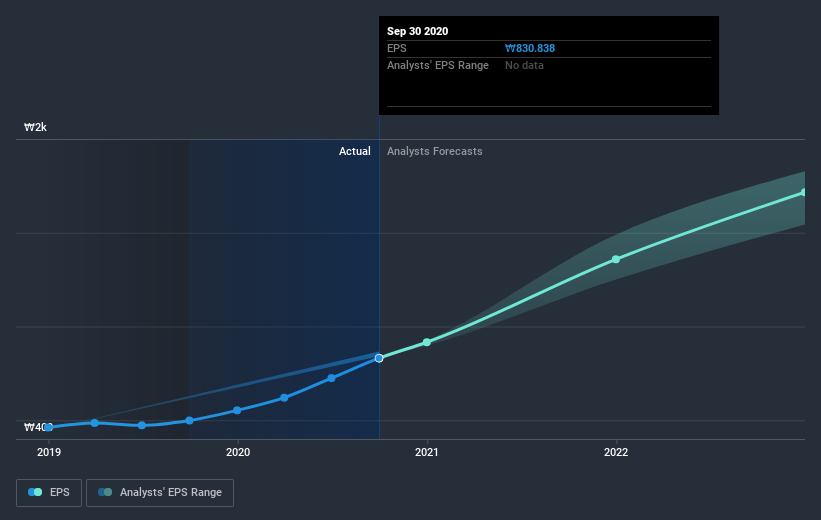

D&C MediaLtd was able to grow its EPS at 28% per year over three years, sending the share price higher. This EPS growth is lower than the 41% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that D&C MediaLtd has improved its bottom line lately, but is it going to grow revenue? Check if analysts think D&C MediaLtd will grow revenue in the future.

A Different Perspective

Pleasingly, D&C MediaLtd's total shareholder return last year was 102%. That's better than the annualized TSR of 41% over the last three years. The improving returns to shareholders suggests the stock is becoming more popular with time. Is D&C MediaLtd cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade D&C MediaLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A263720

D&C MediaLtd

D&C Media Co.,Ltd. publishes and distributes books and novels.

Flawless balance sheet and good value.

Market Insights

Community Narratives