- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSDAQ:A230360

Shareholders of Echomarketing (KOSDAQ:230360) Must Be Delighted With Their 500% Total Return

It hasn't been the best quarter for Echomarketing Co., Ltd. (KOSDAQ:230360) shareholders, since the share price has fallen 11% in that time. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 446%. So you might argue that the recent reduction in the share price is unremarkable in light of the longer term performance. The thing to consider is whether there is still too much elation around the company's prospects.

View our latest analysis for Echomarketing

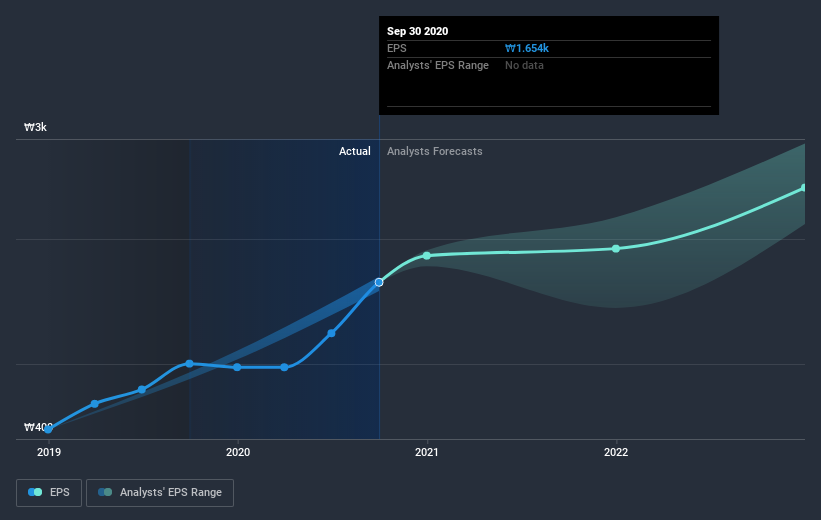

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Echomarketing was able to grow its EPS at 93% per year over three years, sending the share price higher. The average annual share price increase of 76% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Echomarketing has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Echomarketing's TSR for the last 3 years was 500%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Pleasingly, Echomarketing's total shareholder return last year was 70%. And yes, that does include the dividend. The TSR has been even better over three years, coming in at 82% per year. It's always interesting to track share price performance over the longer term. But to understand Echomarketing better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Echomarketing (including 1 which is is significant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade Echomarketing, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EchomarketingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A230360

EchomarketingLtd

Designs and performs data-driven and full-funnel marketing services in worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026