- South Korea

- /

- General Merchandise and Department Stores

- /

- KOSDAQ:A230360

Many Would Be Jealous Of Echomarketing's (KOSDAQ:230360) Returns On Capital

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So, when we ran our eye over Echomarketing's (KOSDAQ:230360) trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Echomarketing, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.36 = ₩55b ÷ (₩196b - ₩45b) (Based on the trailing twelve months to September 2020).

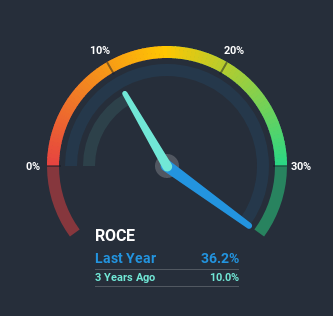

Therefore, Echomarketing has an ROCE of 36%. In absolute terms that's a great return and it's even better than the Media industry average of 9.3%.

Check out our latest analysis for Echomarketing

Above you can see how the current ROCE for Echomarketing compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Echomarketing here for free.

The Trend Of ROCE

We'd be pretty happy with returns on capital like Echomarketing. Over the past five years, ROCE has remained relatively flat at around 36% and the business has deployed 548% more capital into its operations. Now considering ROCE is an attractive 36%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. If Echomarketing can keep this up, we'd be very optimistic about its future.

On a side note, Echomarketing has done well to reduce current liabilities to 23% of total assets over the last five years. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously.In Conclusion...

In summary, we're delighted to see that Echomarketing has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. On top of that, the stock has rewarded shareholders with a remarkable 605% return to those who've held over the last three years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

Echomarketing does have some risks, we noticed 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Echomarketing is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

If you decide to trade Echomarketing, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if EchomarketingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A230360

EchomarketingLtd

Designs and performs data-driven and full-funnel marketing services in worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026