As global markets experience fluctuations with tech stocks facing scrutiny over elevated valuations, the Asian market presents a dynamic landscape for high-growth opportunities, particularly in the technology sector. Amid these conditions, identifying promising tech stocks involves evaluating factors such as innovation potential, market adaptability, and financial resilience to navigate the evolving economic environment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 21.66% | 24.66% | ★★★★★★ |

| ASROCK Incorporation | 29.29% | 31.73% | ★★★★★★ |

| PharmaEssentia | 34.39% | 51.51% | ★★★★★★ |

| Taiwan Union Technology | 22.06% | 34.17% | ★★★★★★ |

| Fositek | 36.92% | 48.42% | ★★★★★★ |

| Gold Circuit Electronics | 27.50% | 35.18% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We'll examine a selection from our screener results.

NEXON Games (KOSDAQ:A225570)

Simply Wall St Growth Rating: ★★★★☆☆

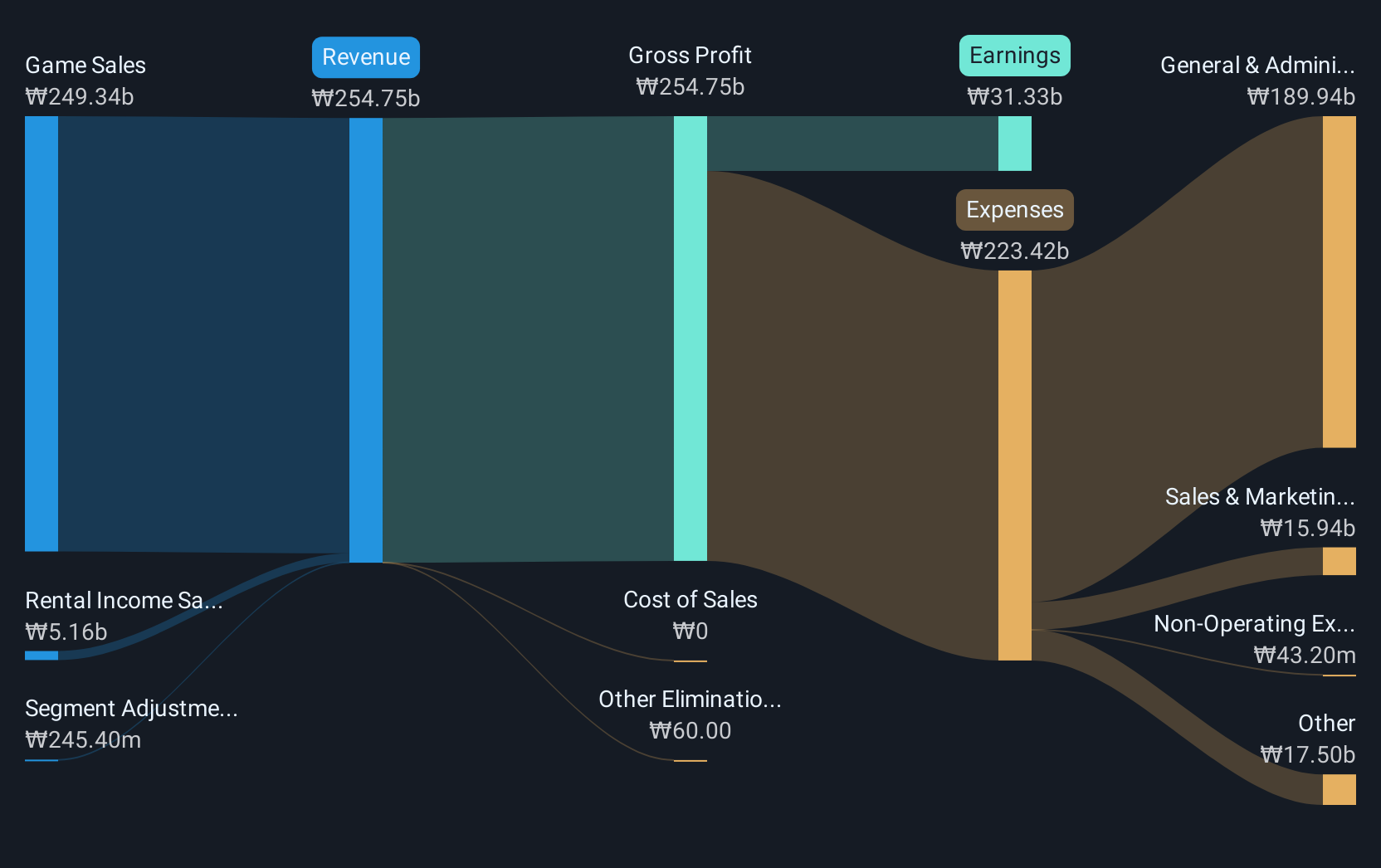

Overview: NEXON Games Co., Ltd. is a South Korean company that develops games for both domestic and international markets, with a market cap of ₩874.82 billion.

Operations: The company generates revenue primarily from its Game Development Division, which accounts for ₩244.87 billion. Additionally, it has a smaller contribution from the Rental Sector at ₩4.86 billion.

NEXON Games, amidst a challenging financial period with a reported net loss of KRW 23.2 billion for the second quarter of 2025 and sales declining to KRW 38.6 billion from KRW 43.6 billion year-over-year, has actively engaged in share repurchases, buying back 1.08% of its shares for KRW 9.8 billion recently. Despite these setbacks, the company's earnings are expected to surge by an impressive annual rate of 70.3%. This growth is underscored by its commitment to innovation and market adaptation, as evidenced by significant investments in R&D aimed at revitalizing its product offerings and enhancing user engagement across global markets.

NanJi E-Commerce (SZSE:002127)

Simply Wall St Growth Rating: ★★★★★☆

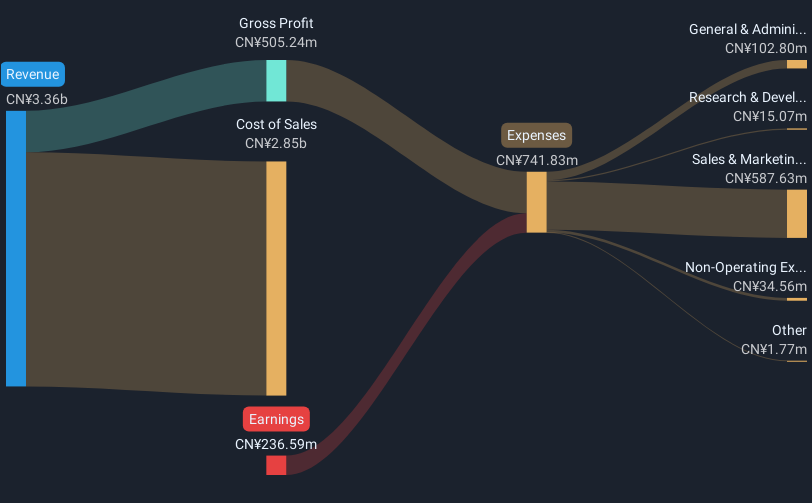

Overview: NanJi E-Commerce Co., LTD is a company that offers brand licensing and comprehensive mobile Internet marketing services in China, with a market capitalization of CN¥8.46 billion.

Operations: NanJi E-Commerce generates revenue primarily through brand licensing and mobile Internet marketing services within China. The company's market capitalization stands at CN¥8.46 billion, reflecting its position in the industry.

In the rapidly evolving e-commerce sector in Asia, NanJi E-Commerce has demonstrated notable agility. Despite a downturn in sales to CNY 1.99 billion from CNY 2.41 billion year-over-year as of September 2025, the company's strategic amendments to its bylaws and proactive governance adjustments signal a robust framework for future operations. With an impressive forecast of earnings growth at nearly 79.6% annually and revenue acceleration expected at 24.3% per year—surpassing the broader Chinese market's growth—NanJi is positioning itself effectively within this competitive landscape. These figures underscore its potential resilience and adaptability amid shifting market dynamics, although it currently operates at a loss with no positive free cash flow yet reported.

- Navigate through the intricacies of NanJi E-Commerce with our comprehensive health report here.

Explore historical data to track NanJi E-Commerce's performance over time in our Past section.

Sercomm (TWSE:5388)

Simply Wall St Growth Rating: ★★★★☆☆

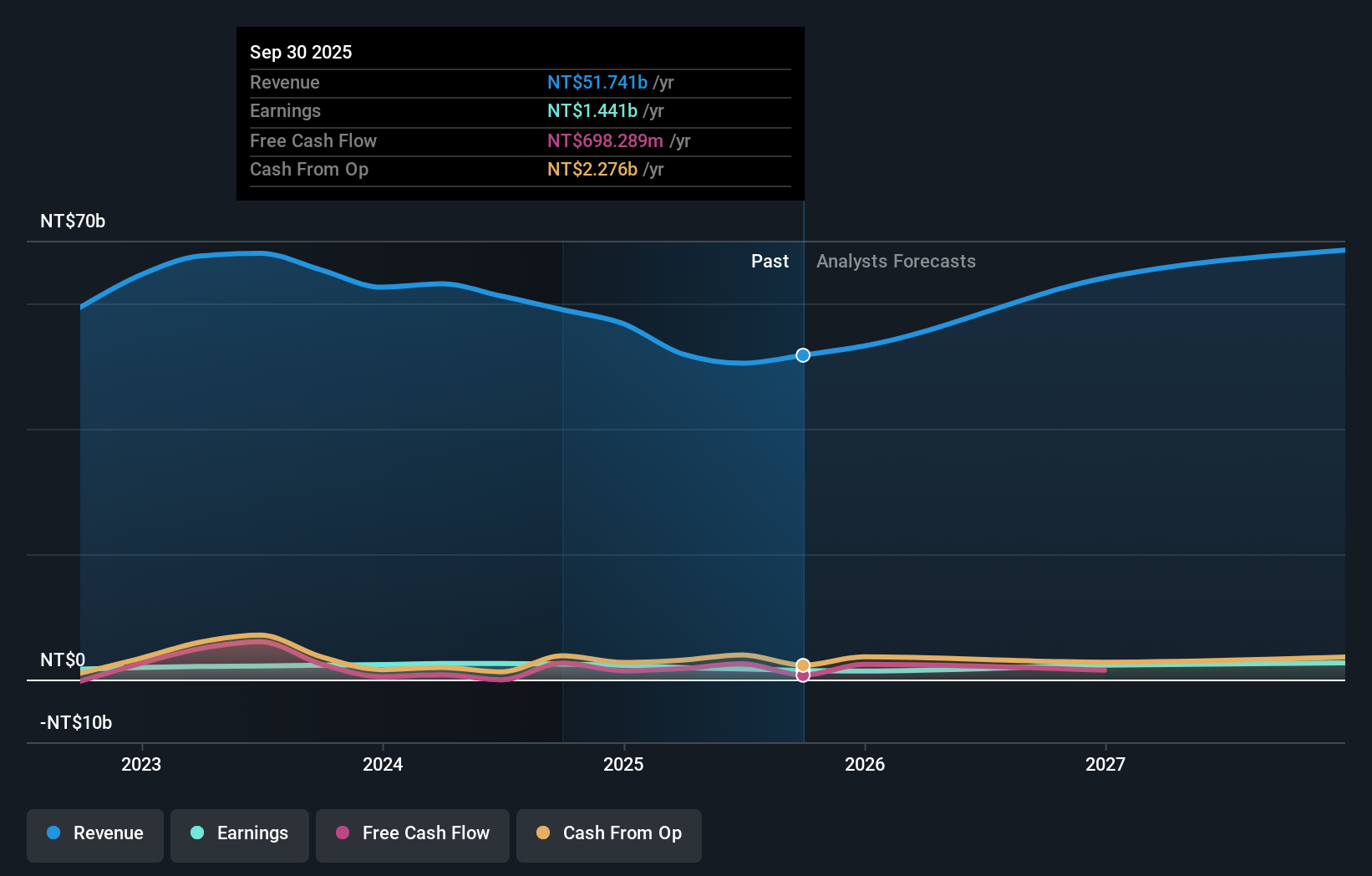

Overview: Sercomm Corporation is engaged in researching, developing, manufacturing, and selling networking communication software and equipment across North America, Europe, and the Asia Pacific with a market cap of NT$24.70 billion.

Operations: The company generates revenue primarily from the computer networks segment, amounting to NT$51.74 billion.

Sercomm, a player in the tech sector, recently unveiled its Denver Test House, enhancing its R&D capabilities significantly. This facility not only supports advanced product testing across WiFi and IoT but also reflects an investment in creating adaptable environments for future technologies. With R&D expenses climbing to 5% of their total revenue last year, Sercomm is positioning itself as a leader in innovation within the industry. Additionally, at the RDK Global Summit, they launched a new STB platform using Broadcom’s latest SoC and RDK7 software, signaling their commitment to evolving with market demands and accelerating product development cycles. These strategic moves underline Sercomm's focus on sustaining high annual earnings growth forecasted at 32.8%, outpacing Taiwan's market average by over 13%.

- Click here and access our complete health analysis report to understand the dynamics of Sercomm.

Assess Sercomm's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Access the full spectrum of 176 Asian High Growth Tech and AI Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanJi E-Commerce might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002127

NanJi E-Commerce

Provides brand licensing and comprehensive and mobile Internet marketing services in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives