David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Wemade Co.,Ltd. (KOSDAQ:112040) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for WemadeLtd

What Is WemadeLtd's Debt?

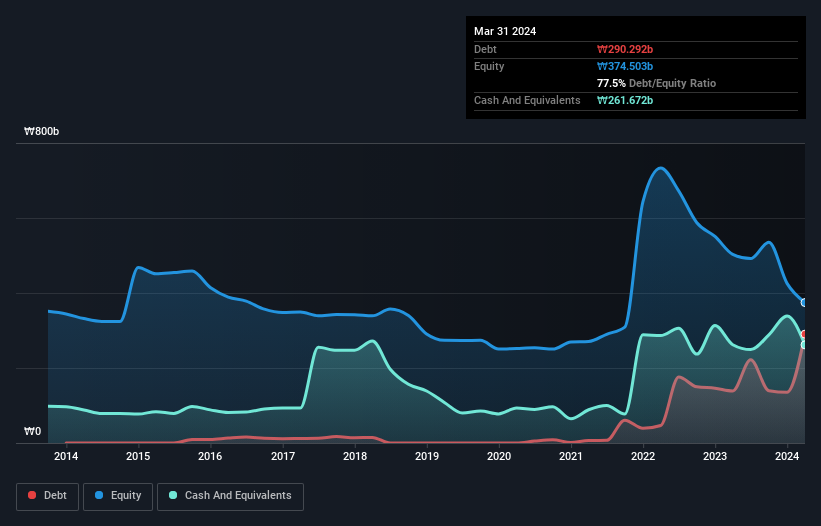

As you can see below, at the end of March 2024, WemadeLtd had ₩290.3b of debt, up from ₩138.9b a year ago. Click the image for more detail. On the flip side, it has ₩261.7b in cash leading to net debt of about ₩28.6b.

A Look At WemadeLtd's Liabilities

The latest balance sheet data shows that WemadeLtd had liabilities of ₩992.9b due within a year, and liabilities of ₩39.8b falling due after that. On the other hand, it had cash of ₩261.7b and ₩87.8b worth of receivables due within a year. So its liabilities total ₩683.3b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since WemadeLtd has a market capitalization of ₩1.46t, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if WemadeLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year WemadeLtd wasn't profitable at an EBIT level, but managed to grow its revenue by 58%, to ₩673b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, WemadeLtd still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost ₩101b at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled ₩48b in negative free cash flow over the last twelve months. So suffice it to say we do consider the stock to be risky. For riskier companies like WemadeLtd I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if WemadeLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A112040

WemadeLtd

Develops and publishes games in South Korea and internationally.

Very undervalued with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success