- South Korea

- /

- Entertainment

- /

- KOSDAQ:A112040

Revenues Not Telling The Story For Wemade Co.,Ltd. (KOSDAQ:112040) After Shares Rise 25%

Despite an already strong run, Wemade Co.,Ltd. (KOSDAQ:112040) shares have been powering on, with a gain of 25% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

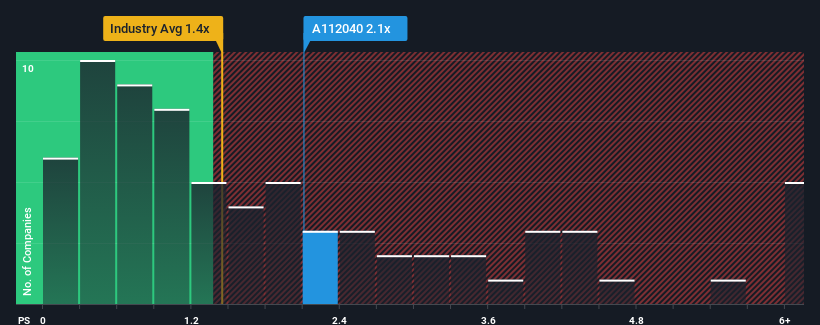

After such a large jump in price, given close to half the companies operating in Korea's Entertainment industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider WemadeLtd as a stock to potentially avoid with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for WemadeLtd

How WemadeLtd Has Been Performing

WemadeLtd's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on WemadeLtd will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For WemadeLtd?

The only time you'd be truly comfortable seeing a P/S as high as WemadeLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen an excellent 161% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 15% over the next year. That's shaping up to be similar to the 16% growth forecast for the broader industry.

With this information, we find it interesting that WemadeLtd is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On WemadeLtd's P/S

The large bounce in WemadeLtd's shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given WemadeLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

You always need to take note of risks, for example - WemadeLtd has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on WemadeLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if WemadeLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A112040

WemadeLtd

Develops and publishes games in South Korea and internationally.

Very undervalued with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.