As we enter January 2025, global markets have shown mixed performances with the U.S. stock indices closing out a strong year despite recent fluctuations, while economic indicators such as the Chicago PMI and GDP forecasts suggest caution amid contracting manufacturing activity and revised growth expectations. In this context of varied market sentiment, identifying promising high-growth tech stocks involves focusing on companies that demonstrate resilience and adaptability in navigating economic challenges, as well as those poised to capitalize on technological advancements and innovation.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

WemadeLtd (KOSDAQ:A112040)

Simply Wall St Growth Rating: ★★★★★☆

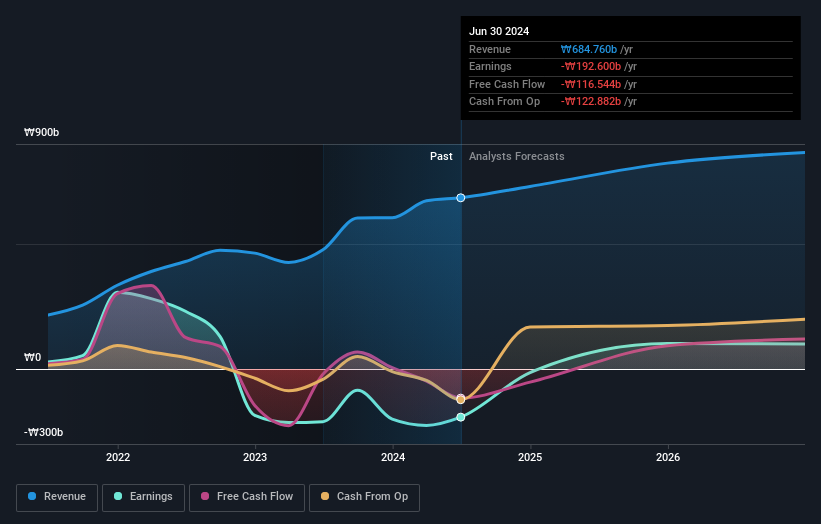

Overview: Wemade Co., Ltd. is a company that develops and publishes games both in South Korea and internationally, with a market cap of ₩1.30 trillion.

Operations: Wemade Co., Ltd. primarily generates revenue through its gaming business, which accounts for ₩663.58 billion. The company focuses on developing and publishing games across South Korea and international markets.

WemadeLtd, despite its current unprofitability, is navigating a promising trajectory with expected revenue growth outpacing the South Korean market at 12.2% annually compared to the broader market's 9.2%. The company's commitment to innovation is evident from its substantial R&D investments, crucial for staying competitive in the tech-driven entertainment sector. Recent financials reveal mixed results; while third-quarter sales dipped to KRW 214.36 billion from KRW 235.54 billion year-over-year, net income slightly increased, highlighting resilience amidst challenges. Moreover, WemadeLtd is poised for profitability within three years with an anticipated robust return on equity of 31.5%, signaling potential upside as operational efficiencies improve and market conditions evolve.

- Click to explore a detailed breakdown of our findings in WemadeLtd's health report.

Evaluate WemadeLtd's historical performance by accessing our past performance report.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

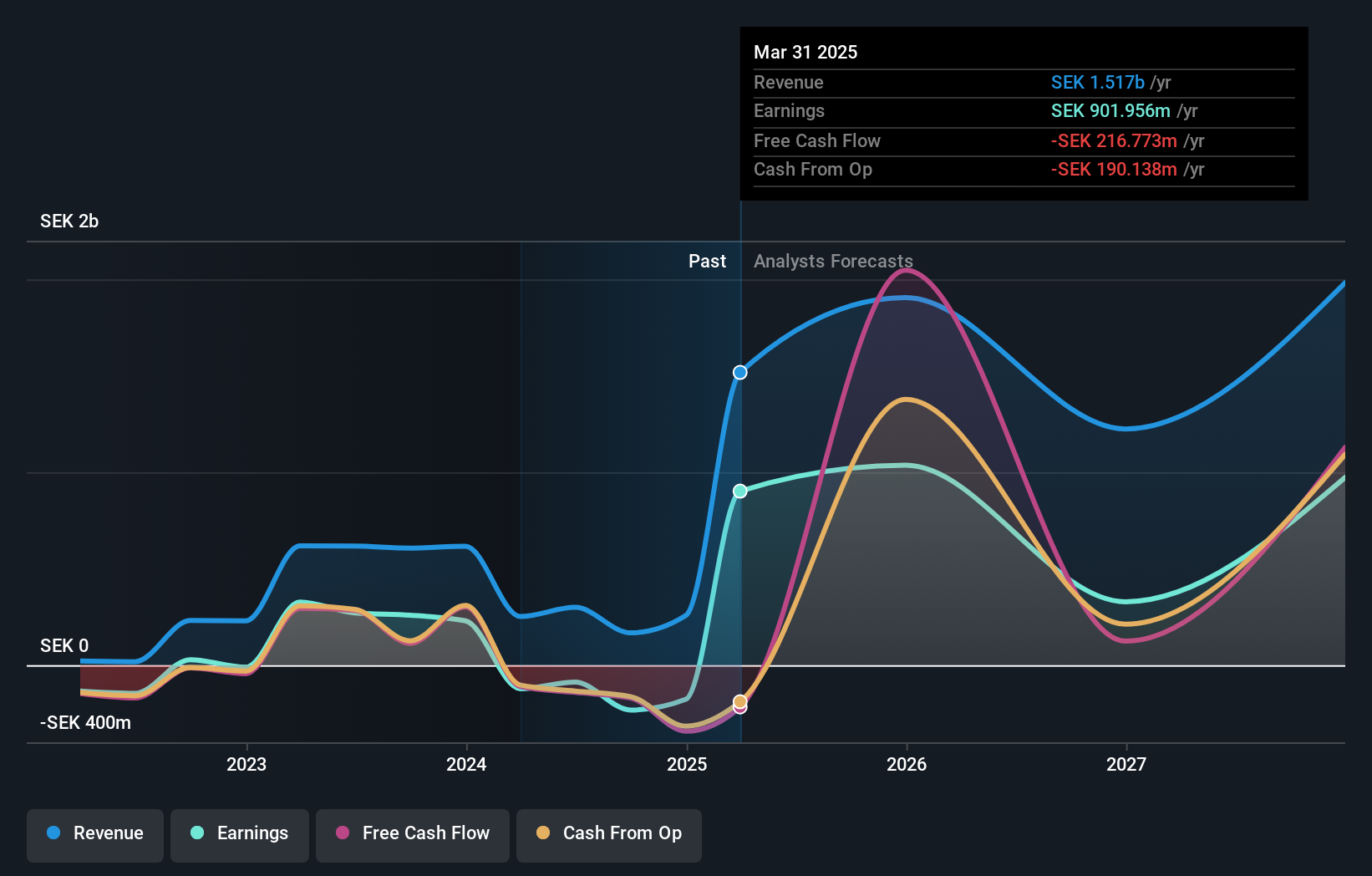

Overview: BioArctic AB (publ) is a Swedish company focused on developing biological drugs for central nervous system disorders, with a market cap of SEK18.21 billion.

Operations: BioArctic AB focuses on developing biological drugs for central nervous system disorders, generating revenue primarily from its biotechnology segment, which contributed SEK167.14 million. The company's gross profit margin is a key financial metric to consider when evaluating its operational efficiency and profitability.

BioArctic stands out in the high-growth biotechnology sector, driven by a robust 41.9% annual revenue growth and an anticipated earnings surge of 51.3%. The company's strategic focus on neurodegenerative diseases has led to significant R&D investments, vital for pioneering treatments like the recently approved Leqembi for Alzheimer's, which is projected to slow disease progression notably. This focus is complemented by innovative technologies such as the BrainTransporter platform, enhancing drug delivery across the blood-brain barrier and opening avenues for substantial future partnerships and market expansion.

- Click here and access our complete health analysis report to understand the dynamics of BioArctic.

Understand BioArctic's track record by examining our Past report.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

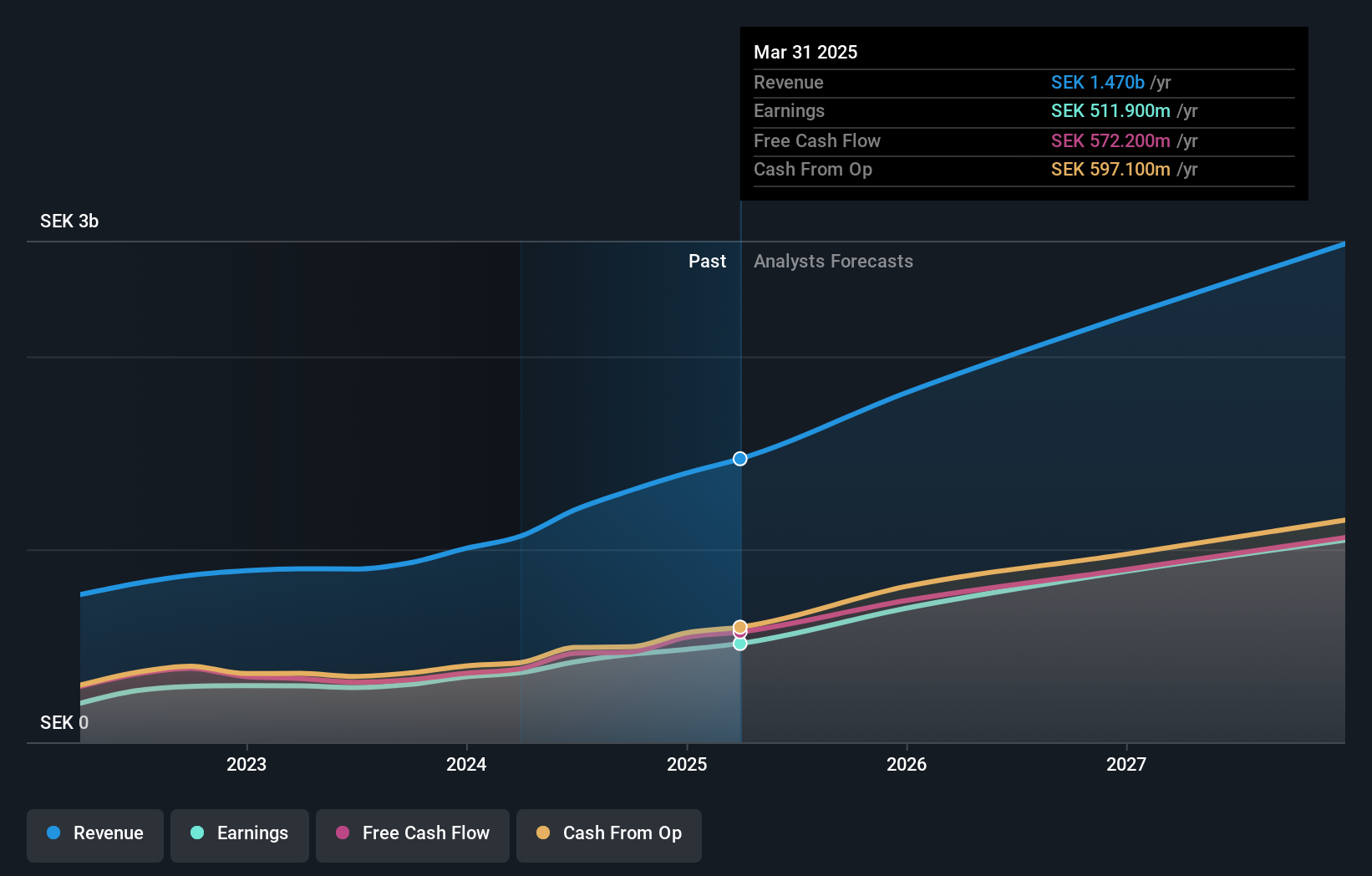

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market capitalization of SEK33.66 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to SEK1.31 billion. Its business model focuses on offering a digital platform for residential property listings in Sweden.

Hemnet Group's recent appointment of Jonas Gustafsson as CEO heralds a strategic pivot, potentially enhancing its digital transformation credentials in the competitive Interactive Media and Services sector. With a robust 52% earnings growth over the past year surpassing industry averages, Hemnet is not just riding the high-growth wave; it's making significant strides with a 19.6% annual revenue increase and an expected profit surge of 24.7% per annum. These figures underscore its operational efficiency and market adaptiveness, further evidenced by strong free cash flow generation and an impressive forecast Return on Equity of 85.5%. This performance, coupled with high-quality earnings, positions Hemnet to leverage its leadership changes effectively amidst evolving market dynamics.

- Take a closer look at Hemnet Group's potential here in our health report.

Explore historical data to track Hemnet Group's performance over time in our Past section.

Next Steps

- Take a closer look at our High Growth Tech and AI Stocks list of 1253 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioArctic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOA B

BioArctic

Develops biological drugs for patients with central nervous system disorders in Sweden.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives