- South Korea

- /

- Entertainment

- /

- KOSDAQ:A035760

CJ ENM (KOSDAQ:035760 investor three-year losses grow to 54% as the stock sheds ₩108b this past week

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But the long term shareholders of CJ ENM CO., Ltd. (KOSDAQ:035760) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 54% drop in the share price over that period. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 6.7% in the same timeframe.

If the past week is anything to go by, investor sentiment for CJ ENM isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for CJ ENM

Because CJ ENM made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over three years, CJ ENM grew revenue at 12% per year. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 16% per year. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

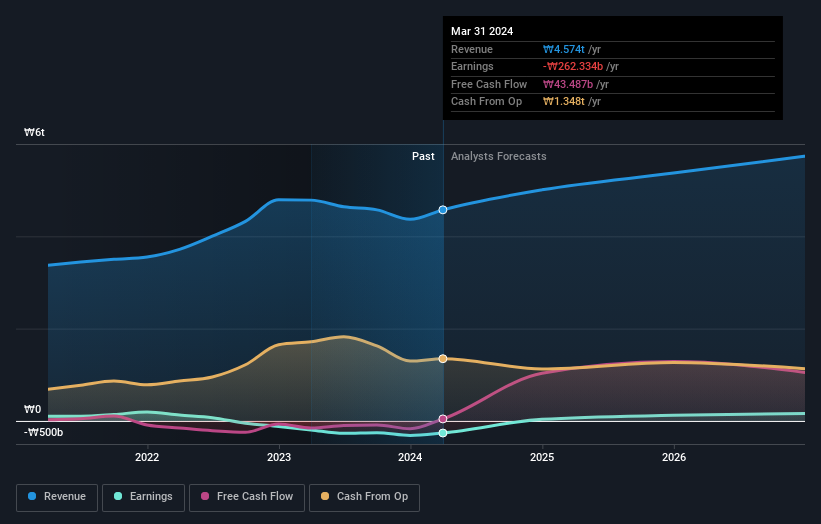

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

CJ ENM is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that CJ ENM shareholders have received a total shareholder return of 10% over one year. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand CJ ENM better, we need to consider many other factors. For instance, we've identified 1 warning sign for CJ ENM that you should be aware of.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A035760

CJ ENM

Engages in media, film, music, convention, performing arts, and commerce businesses in South Korea.

Fair value with moderate growth potential.