- South Korea

- /

- Entertainment

- /

- KOSDAQ:A018700

Potential Upside For Barunson Co., Ltd. (KOSDAQ:018700) Not Without Risk

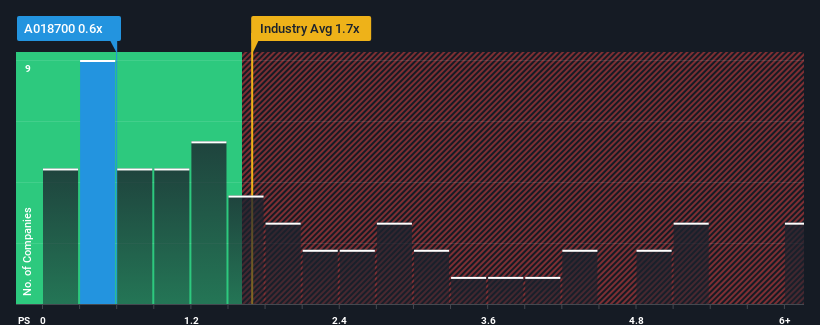

You may think that with a price-to-sales (or "P/S") ratio of 0.6x Barunson Co., Ltd. (KOSDAQ:018700) is a stock worth checking out, seeing as almost half of all the Entertainment companies in Korea have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Barunson

What Does Barunson's Recent Performance Look Like?

Revenue has risen firmly for Barunson recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Barunson's earnings, revenue and cash flow.How Is Barunson's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Barunson's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen an excellent 85% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 15% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Barunson's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Barunson's P/S

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Barunson revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Barunson (including 1 which shouldn't be ignored).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Barunson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A018700

Barunson

Produces, distributes, and invests in cultural contents in South Korea.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives