- Japan

- /

- Specialty Stores

- /

- TSE:2730

3 Undiscovered Gems In Global Markets To Consider

Reviewed by Simply Wall St

In the midst of a mixed performance across global markets, with smaller-cap indexes showing relative strength amid geopolitical tensions and economic uncertainties, investors are seeking opportunities that may have been overlooked. As central banks maintain steady interest rates and market sentiment fluctuates, identifying stocks with strong fundamentals and growth potential becomes crucial for navigating these dynamic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★★ |

| Changjiu Holdings | NA | 11.55% | 10.44% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| Baazeem Trading | 8.48% | -2.02% | -2.70% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Lee's Pharmaceutical Holdings | 13.81% | -0.34% | -27.47% | ★★★★★☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

We'll examine a selection from our screener results.

SK ChemicalsLtd (KOSE:A285130)

Simply Wall St Value Rating: ★★★★☆☆

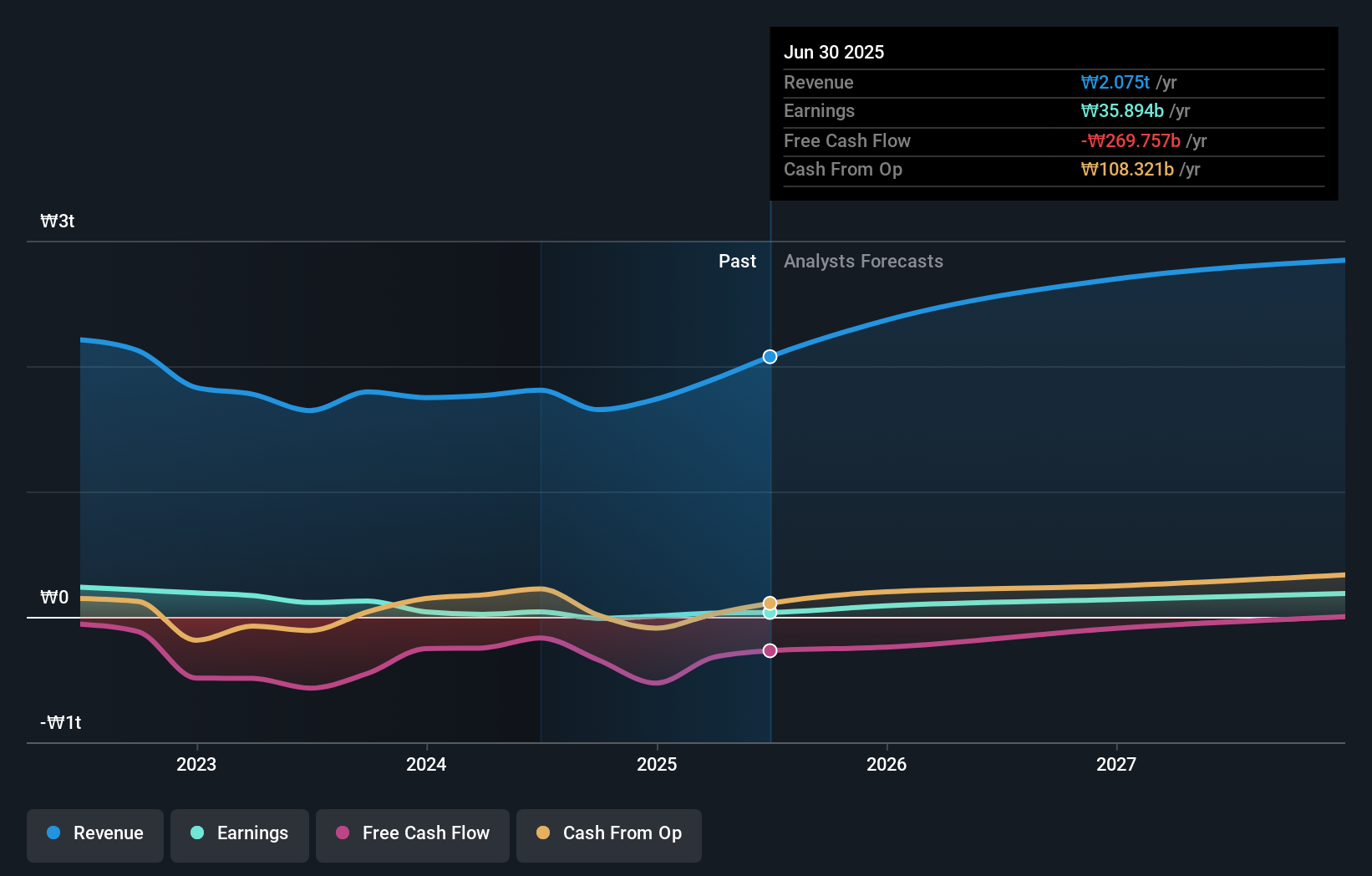

Overview: SK Chemicals Co., Ltd operates in the chemicals and life sciences sectors, offering products and solutions across various regions including South Korea, China, Japan, Asia, the United States, and Europe with a market cap of ₩1.15 trillion.

Operations: SK Chemicals Co., Ltd generates revenue primarily from its Green Chemicals Business, which contributes ₩1.51 trillion, and its Life Science Business, adding ₩767.99 billion.

SK Chemicals, a notable player in the chemicals sector, has seen its debt to equity ratio improve significantly from 140.7% to 59.7% over five years, indicating better financial health. Despite not being free cash flow positive, the company achieved an impressive earnings growth of 52% last year, outpacing the industry average of -0.01%. A recent partnership with Malaysia's LH Plus aims to expand SK's presence in kitchenware materials using ECOZEN and SKYPET CR—innovative materials known for their sustainability and safety features. With sales reaching ₩7 billion in Q1 2025 compared to ₩3.28 billion a year ago, SK Chemicals is positioned for potential growth through strategic collaborations and product innovations.

- Dive into the specifics of SK ChemicalsLtd here with our thorough health report.

Examine SK ChemicalsLtd's past performance report to understand how it has performed in the past.

Acter Group (TPEX:5536)

Simply Wall St Value Rating: ★★★★★☆

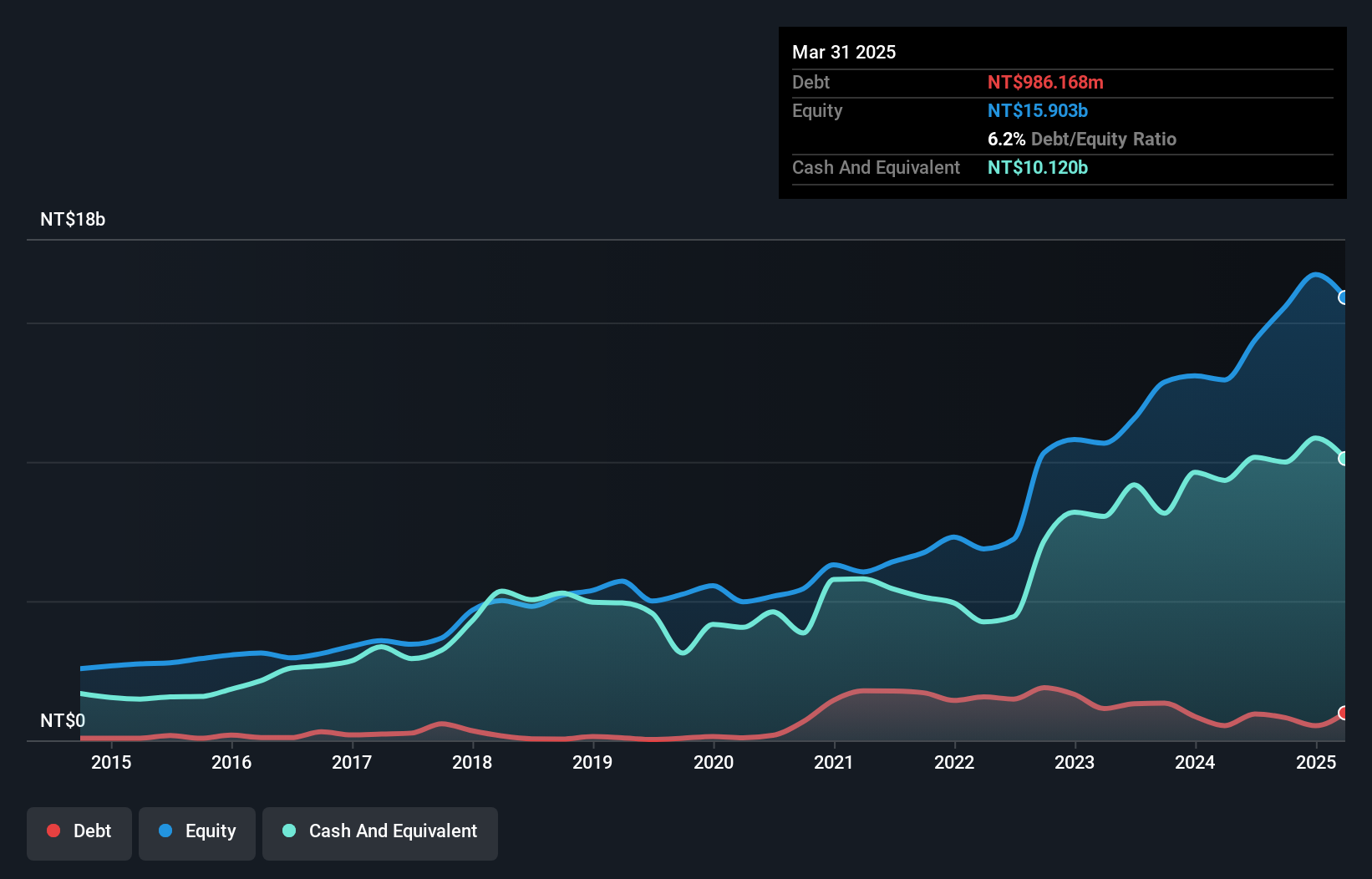

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market capitalization of NT$47.34 billion.

Operations: Acter Group generates revenue primarily from engineering services in Taiwan, Mainland China, and other Asian regions. The company has a market capitalization of NT$47.34 billion.

Acter Group, a dynamic player in the construction sector, has shown remarkable growth with its earnings surging 55.7% last year, outpacing the industry's -0.1%. The company's debt-to-equity ratio climbed from 1.8% to 6.2% over five years, indicating increased leverage but also a robust cash position exceeding total debt. With a price-to-earnings ratio of 17.9x below the TW market average of 18.3x, Acter appears undervalued relative to peers. Recent contract wins like the TWD 1,980 million deal for building facilities highlight its strong order book and potential for continued revenue expansion at an impressive forecasted rate of 22.56% annually.

- Get an in-depth perspective on Acter Group's performance by reading our health report here.

Explore historical data to track Acter Group's performance over time in our Past section.

EDION (TSE:2730)

Simply Wall St Value Rating: ★★★★★☆

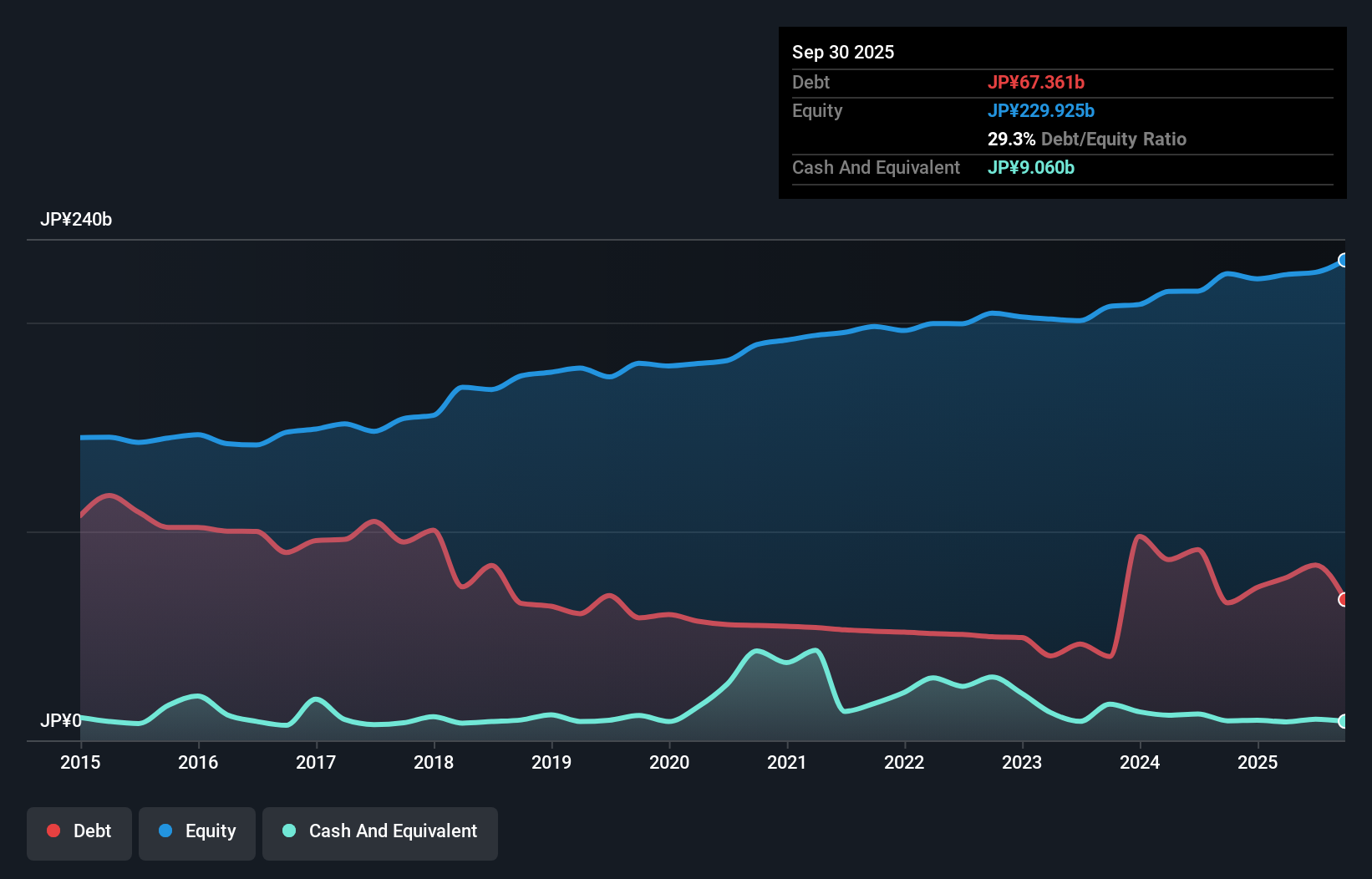

Overview: EDION Corporation, with a market cap of ¥214.25 billion, operates as a home appliance retailer in Japan through its subsidiaries.

Operations: The company generates revenue primarily from the sale of home appliances and other products, totaling ¥768.13 billion.

Edion, a player in the specialty retail sector, has demonstrated significant earnings growth of 56.5% over the past year, outpacing the industry average of 5.8%. The company's net debt to equity ratio stands at a satisfactory 31%, indicating sound financial health with interest payments well covered by EBIT at 76.7 times. Recent activities include a share buyback program where Edion repurchased approximately 3.77% of its shares for ¥7.14 billion and announced dividends totaling ¥2,515 million for fiscal year-end March 2025, reflecting stable shareholder returns amidst robust operating performance expectations for the upcoming period.

- Take a closer look at EDION's potential here in our health report.

Understand EDION's track record by examining our Past report.

Turning Ideas Into Actions

- Delve into our full catalog of 3177 Global Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EDION might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2730

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives