- South Korea

- /

- Metals and Mining

- /

- KOSE:A058730

These 4 Measures Indicate That Development Advance SolutionLtd (KRX:058730) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Development Advance Solution Co.,Ltd. (KRX:058730) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Development Advance SolutionLtd

How Much Debt Does Development Advance SolutionLtd Carry?

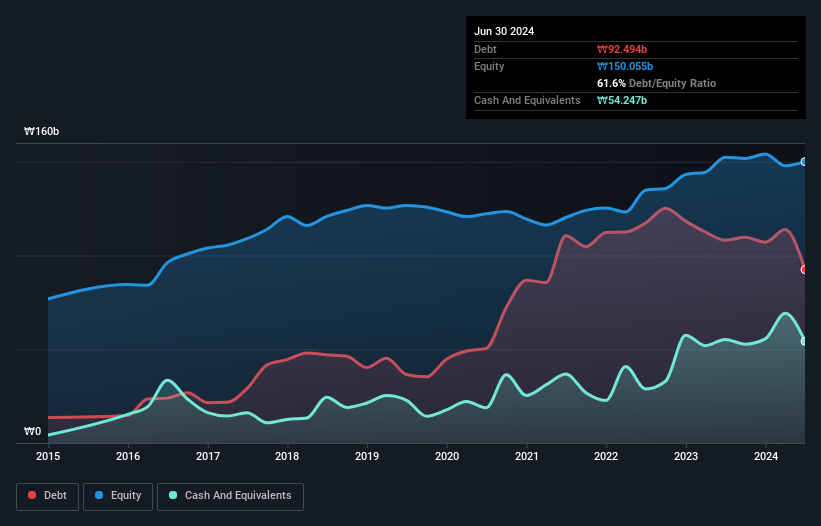

You can click the graphic below for the historical numbers, but it shows that Development Advance SolutionLtd had ₩92.5b of debt in June 2024, down from ₩108.2b, one year before. However, because it has a cash reserve of ₩54.2b, its net debt is less, at about ₩38.2b.

How Healthy Is Development Advance SolutionLtd's Balance Sheet?

We can see from the most recent balance sheet that Development Advance SolutionLtd had liabilities of ₩130.2b falling due within a year, and liabilities of ₩30.6b due beyond that. Offsetting these obligations, it had cash of ₩54.2b as well as receivables valued at ₩107.3b due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Development Advance SolutionLtd's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the ₩66.5b company is short on cash, but still worth keeping an eye on the balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Development Advance SolutionLtd's net debt to EBITDA ratio of 2.7, we think its super-low interest cover of 1.7 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, Development Advance SolutionLtd saw its EBIT tank 64% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Development Advance SolutionLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Development Advance SolutionLtd recorded free cash flow worth 76% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

We weren't impressed with Development Advance SolutionLtd's interest cover, and its EBIT growth rate made us cautious. But its conversion of EBIT to free cash flow was significantly redeeming. When we consider all the factors mentioned above, we do feel a bit cautious about Development Advance SolutionLtd's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 3 warning signs we've spotted with Development Advance SolutionLtd .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A058730

Development Advance SolutionLtd

Development Advance Solution Co.,Ltd. installs steel frameworks and products in South Korea.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026