- South Korea

- /

- Chemicals

- /

- KOSE:A017960

What Hankuk Carbon Co., Ltd.'s (KRX:017960) 25% Share Price Gain Is Not Telling You

The Hankuk Carbon Co., Ltd. (KRX:017960) share price has done very well over the last month, posting an excellent gain of 25%. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

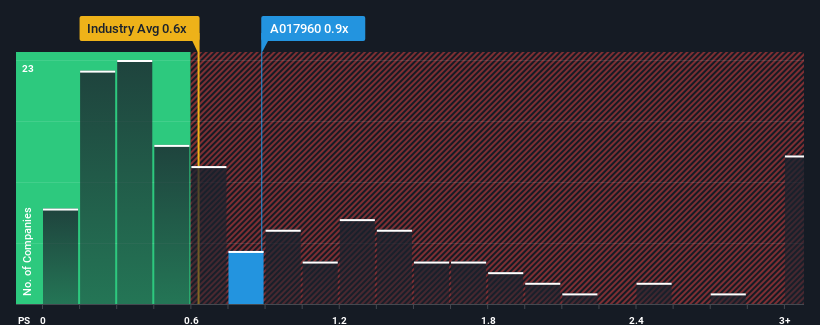

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Hankuk Carbon's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Chemicals industry in Korea is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Hankuk Carbon

How Has Hankuk Carbon Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Hankuk Carbon has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on Hankuk Carbon will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

Keen to find out how analysts think Hankuk Carbon's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Hankuk Carbon?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hankuk Carbon's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. Pleasingly, revenue has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 11% over the next year. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

With this in mind, we find it intriguing that Hankuk Carbon's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Hankuk Carbon's P/S

Hankuk Carbon appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Hankuk Carbon's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 2 warning signs we've spotted with Hankuk Carbon.

If these risks are making you reconsider your opinion on Hankuk Carbon, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hankuk Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A017960

Hankuk Carbon

Produces and sells carbon fiber, synthetic resin, and glass paper related products in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026