Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Hankuk Carbon Co., Ltd. (KRX:017960) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Hankuk Carbon

What Is Hankuk Carbon's Net Debt?

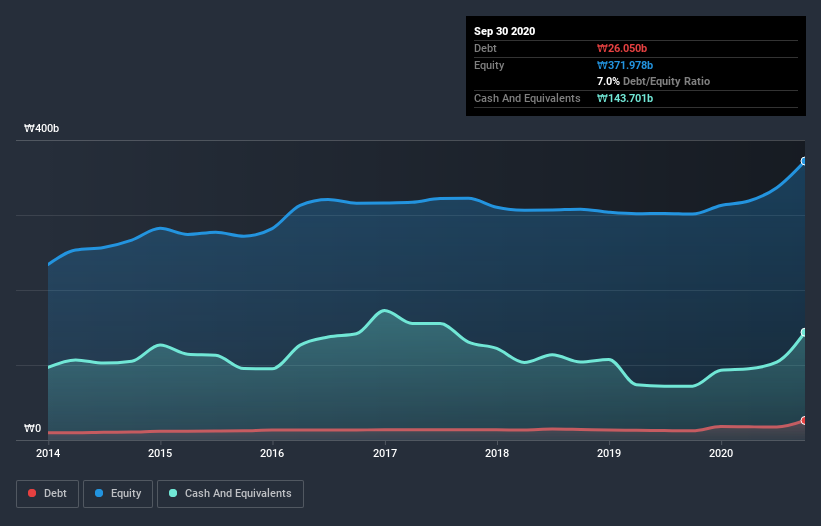

The image below, which you can click on for greater detail, shows that at September 2020 Hankuk Carbon had debt of ₩26.0b, up from ₩12.3b in one year. But it also has ₩143.7b in cash to offset that, meaning it has ₩117.7b net cash.

A Look At Hankuk Carbon's Liabilities

We can see from the most recent balance sheet that Hankuk Carbon had liabilities of ₩75.4b falling due within a year, and liabilities of ₩26.8b due beyond that. Offsetting this, it had ₩143.7b in cash and ₩28.6b in receivables that were due within 12 months. So it can boast ₩70.1b more liquid assets than total liabilities.

This surplus suggests that Hankuk Carbon has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Hankuk Carbon boasts net cash, so it's fair to say it does not have a heavy debt load!

Even more impressive was the fact that Hankuk Carbon grew its EBIT by 533% over twelve months. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Hankuk Carbon can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Hankuk Carbon may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Looking at the most recent two years, Hankuk Carbon recorded free cash flow of 32% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Hankuk Carbon has net cash of ₩117.7b, as well as more liquid assets than liabilities. And it impressed us with its EBIT growth of 533% over the last year. So is Hankuk Carbon's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Hankuk Carbon (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Hankuk Carbon or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hankuk Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A017960

Hankuk Carbon

Produces and sells carbon fiber, synthetic resin, and glass paper related products in South Korea.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026