- South Korea

- /

- Chemicals

- /

- KOSE:A298050

Hankuk Carbon And 2 Other Growth Companies Insiders Are Investing In

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by rate cuts from central banks and mixed performances across major indices, growth stocks continue to capture investor interest with the Nasdaq Composite reaching new heights. In this environment, companies with high insider ownership often stand out as they suggest confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 65.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

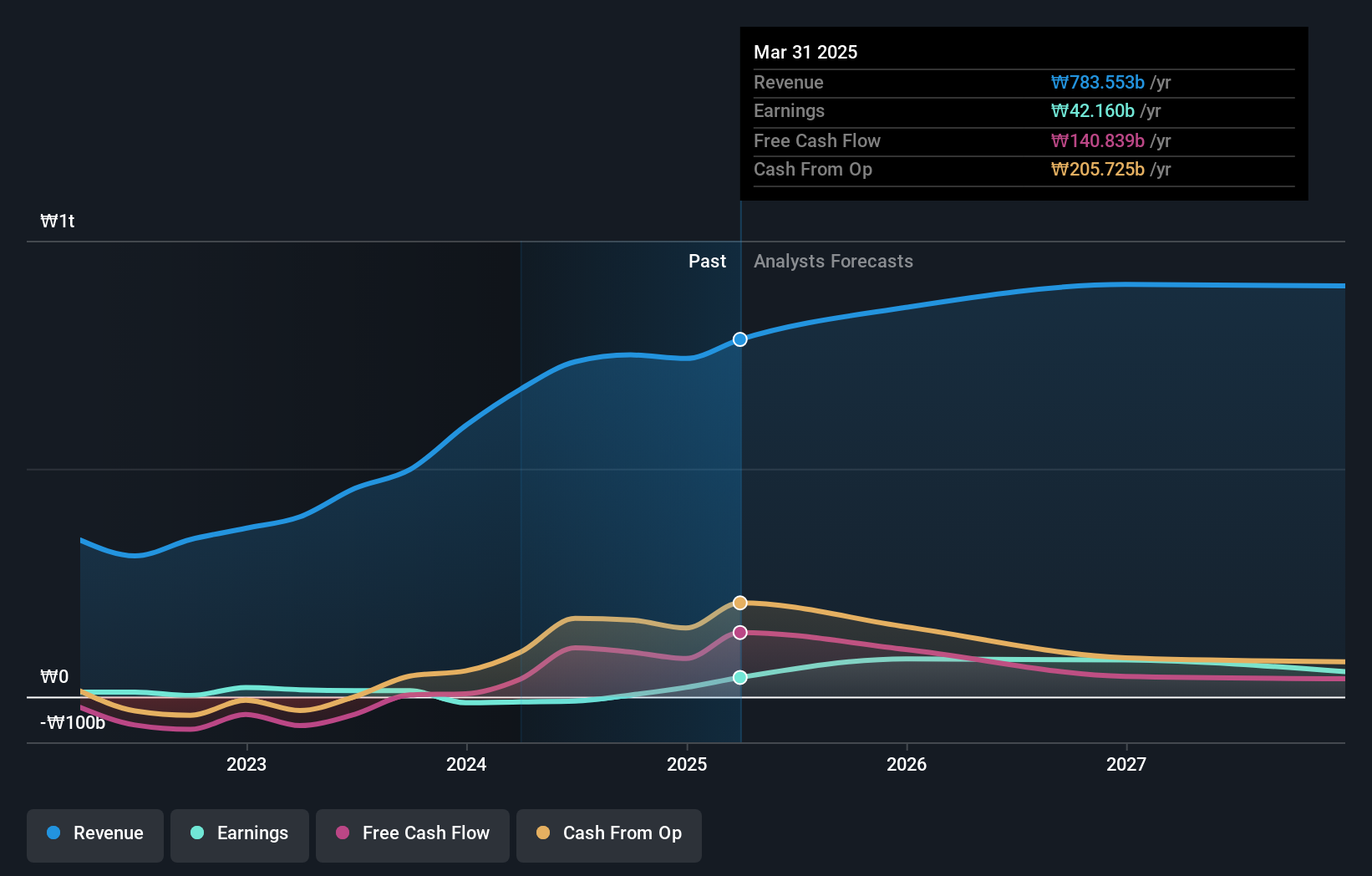

Hankuk Carbon (KOSE:A017960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hankuk Carbon Co., Ltd. is a South Korean company that produces and sells carbon fiber, synthetic resins, and glass paper products with a market cap of ₩510.88 billion.

Operations: The company's revenue is primarily derived from its Industrial Materials Division, contributing ₩703.72 billion, followed by the General Business Division at ₩45.23 billion.

Insider Ownership: 36.2%

Earnings Growth Forecast: 66.9% p.a.

Hankuk Carbon showcases potential as a growth company with high insider ownership, driven by expected annual earnings growth of 66.9%, outpacing the KR market's 12.3%. Despite trading below fair value and analyst price targets, recent earnings announcements reveal improved financial performance, with net income rising to KRW 12.27 billion for Q3 compared to a loss last year. However, profit margins have declined from 2.6% to 0.5%, and return on equity is forecasted at a modest 12%.

- Click to explore a detailed breakdown of our findings in Hankuk Carbon's earnings growth report.

- According our valuation report, there's an indication that Hankuk Carbon's share price might be on the cheaper side.

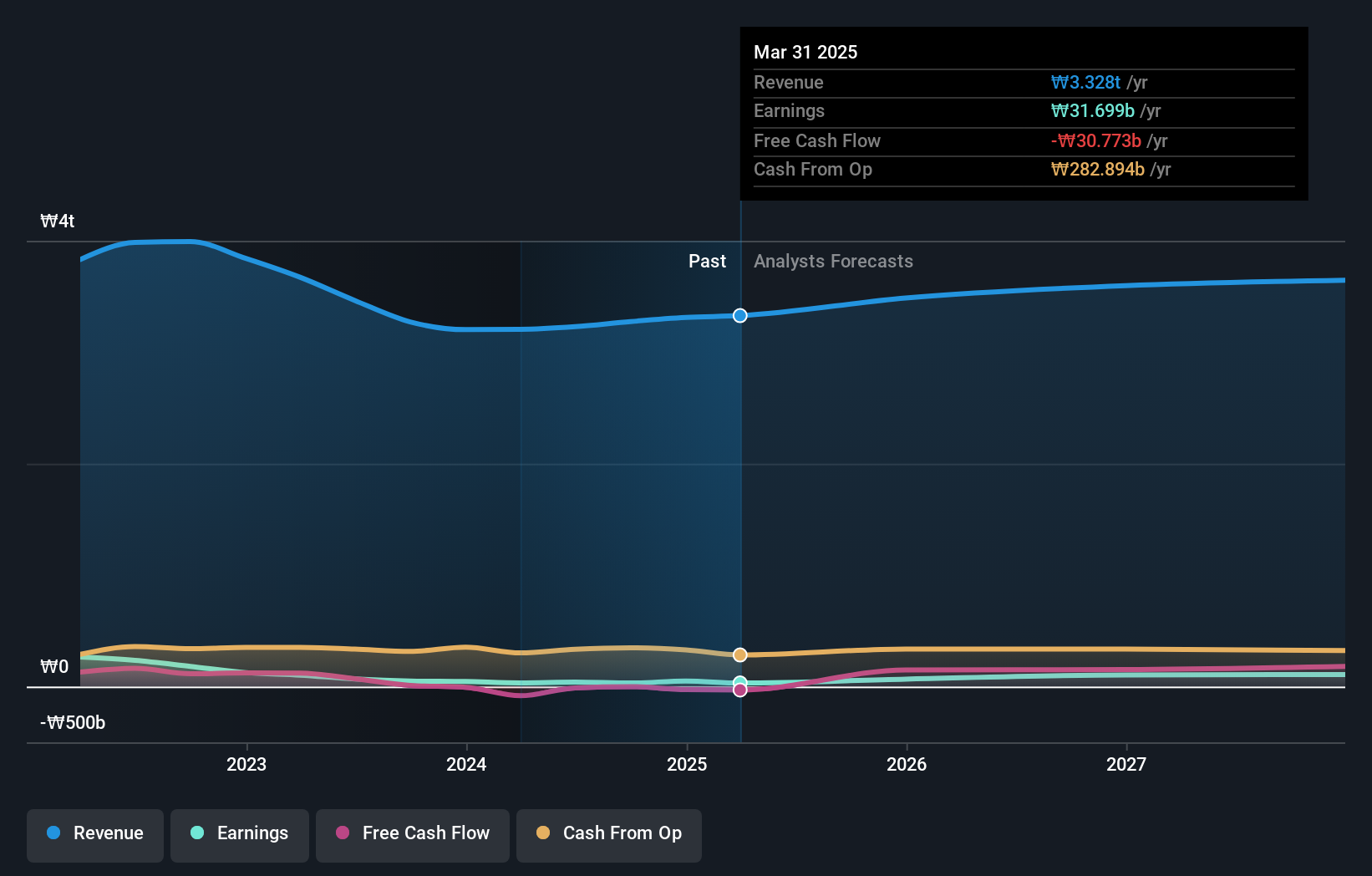

Hs Hyosung Advanced Materials (KOSE:A298050)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hs Hyosung Advanced Materials is a company that manufactures and sells industrial, polyester, nylon, and carpet yarns both in South Korea and internationally, with a market cap of approximately ₩835.52 billion.

Operations: The company's revenue segments consist of the Textile Sector, generating ₩363.59 million, and the Industrial Materials Sector, contributing ₩3.27 billion.

Insider Ownership: 23.5%

Earnings Growth Forecast: 61.9% p.a.

Hs Hyosung Advanced Materials is projected to achieve significant annual earnings growth of 61.9%, surpassing the KR market's 12.3% forecast. Despite trading well below its estimated fair value, recent results show a net loss for Q3, with declining profit margins from 1.5% to 0.7%. The company faces challenges in covering interest payments with earnings, and its return on equity is expected to remain low at 15.1% in three years.

- Delve into the full analysis future growth report here for a deeper understanding of Hs Hyosung Advanced Materials.

- Insights from our recent valuation report point to the potential overvaluation of Hs Hyosung Advanced Materials shares in the market.

Hubei Huitian New Materials (SZSE:300041)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hubei Huitian New Materials Co., Ltd. engages in the research, development, manufacturing, and sale of adhesives and new materials both in China and internationally, with a market cap of CN¥4.80 billion.

Operations: Hubei Huitian New Materials Co., Ltd. generates its revenue through the production and sale of adhesives and new materials across domestic and international markets.

Insider Ownership: 21.1%

Earnings Growth Forecast: 33% p.a.

Hubei Huitian New Materials is forecast to achieve significant annual earnings growth of 33%, outpacing the CN market's 25.8% estimate, though profit margins have declined from 8.4% to 4.3%. The company trades at a large discount to its estimated fair value, but recent results show decreased sales and net income compared to last year. Revenue is expected to grow at a slower pace of 16.8% annually, below the desired high-growth threshold.

- Navigate through the intricacies of Hubei Huitian New Materials with our comprehensive analyst estimates report here.

- The analysis detailed in our Hubei Huitian New Materials valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Dive into all 1539 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hs Hyosung Advanced Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298050

Hs Hyosung Advanced Materials

Manufactures and sells industrial, polyester, nylon, and carpet yarns in South Korea and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives