- South Korea

- /

- Construction

- /

- KOSE:A012630

HDC HOLDINGSLtd (KRX:012630) Has A Somewhat Strained Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that HDC HOLDINGS CO.,Ltd (KRX:012630) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for HDC HOLDINGSLtd

How Much Debt Does HDC HOLDINGSLtd Carry?

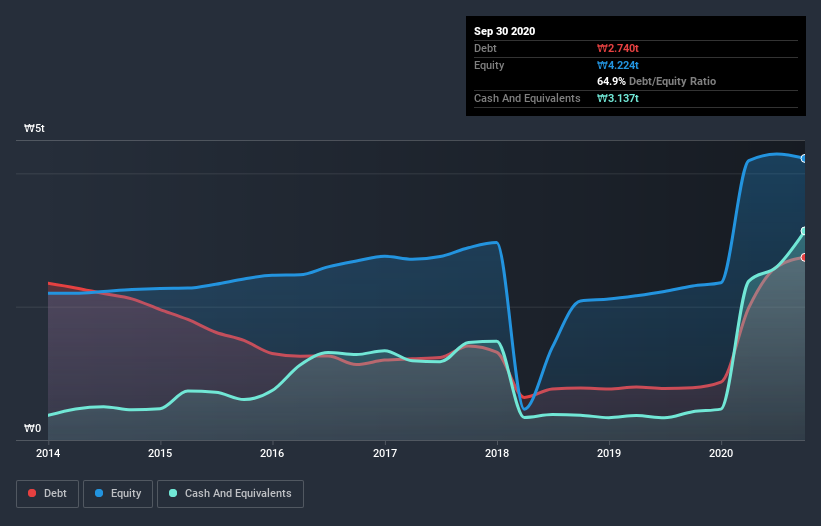

The image below, which you can click on for greater detail, shows that at September 2020 HDC HOLDINGSLtd had debt of ₩2.74t, up from ₩785.4b in one year. However, its balance sheet shows it holds ₩3.14t in cash, so it actually has ₩396.9b net cash.

A Look At HDC HOLDINGSLtd's Liabilities

The latest balance sheet data shows that HDC HOLDINGSLtd had liabilities of ₩2.99t due within a year, and liabilities of ₩2.25t falling due after that. Offsetting these obligations, it had cash of ₩3.14t as well as receivables valued at ₩949.7b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩1.16t.

The deficiency here weighs heavily on the ₩572.9b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, HDC HOLDINGSLtd would likely require a major re-capitalisation if it had to pay its creditors today. HDC HOLDINGSLtd boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

In addition to that, we're happy to report that HDC HOLDINGSLtd has boosted its EBIT by 59%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is HDC HOLDINGSLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While HDC HOLDINGSLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, HDC HOLDINGSLtd recorded free cash flow of 35% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While HDC HOLDINGSLtd does have more liabilities than liquid assets, it also has net cash of ₩396.9b. And we liked the look of last year's 59% year-on-year EBIT growth. So although we see some areas for improvement, we're not too worried about HDC HOLDINGSLtd's balance sheet. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with HDC HOLDINGSLtd (including 2 which is are concerning) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading HDC HOLDINGSLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if HDC HOLDINGSLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A012630

HDC HOLDINGSLtd

Engages in real estate development and construction activities in South Korea.

Undervalued with solid track record.

Market Insights

Community Narratives