- South Korea

- /

- Chemicals

- /

- KOSE:A011790

Revenues Tell The Story For SKC Co., Ltd. (KRX:011790) As Its Stock Soars 26%

Those holding SKC Co., Ltd. (KRX:011790) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 105% following the latest surge, making investors sit up and take notice.

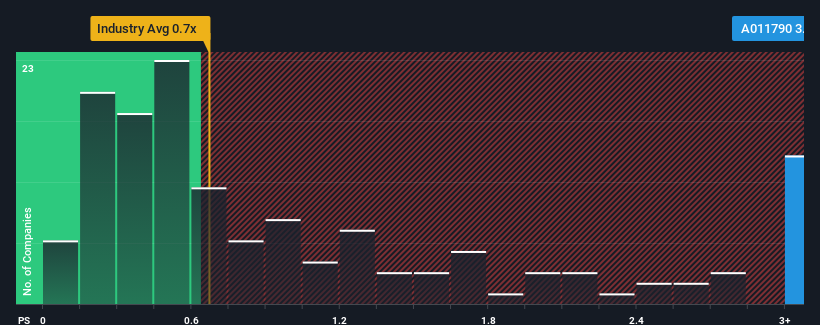

After such a large jump in price, you could be forgiven for thinking SKC is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in Korea's Chemicals industry have P/S ratios below 0.7x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for SKC

What Does SKC's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, SKC has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SKC.What Are Revenue Growth Metrics Telling Us About The High P/S?

SKC's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. This means it has also seen a slide in revenue over the longer-term as revenue is down 35% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 53% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 28%, which is noticeably less attractive.

With this information, we can see why SKC is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On SKC's P/S

The strong share price surge has lead to SKC's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into SKC shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for SKC (1 is potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A011790

SKC

Manufactures and sells basic chemical raw materials and copper foils for batteries.

Limited growth with minimal risk.

Similar Companies

Market Insights

Community Narratives