- South Korea

- /

- Chemicals

- /

- KOSE:A009830

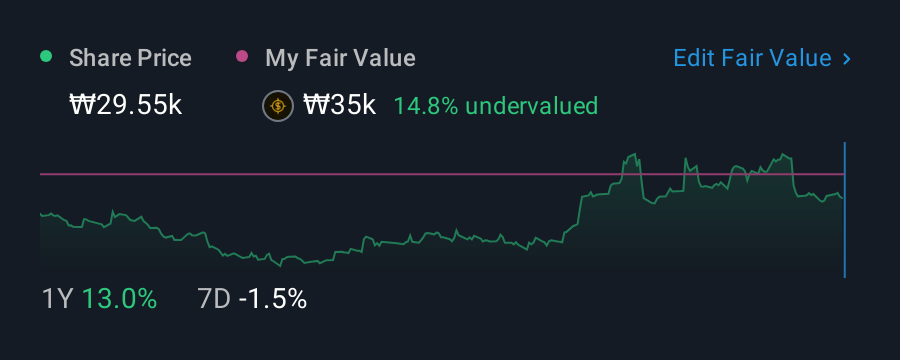

Take Care Before Diving Into The Deep End On Hanwha Solutions Corporation (KRX:009830)

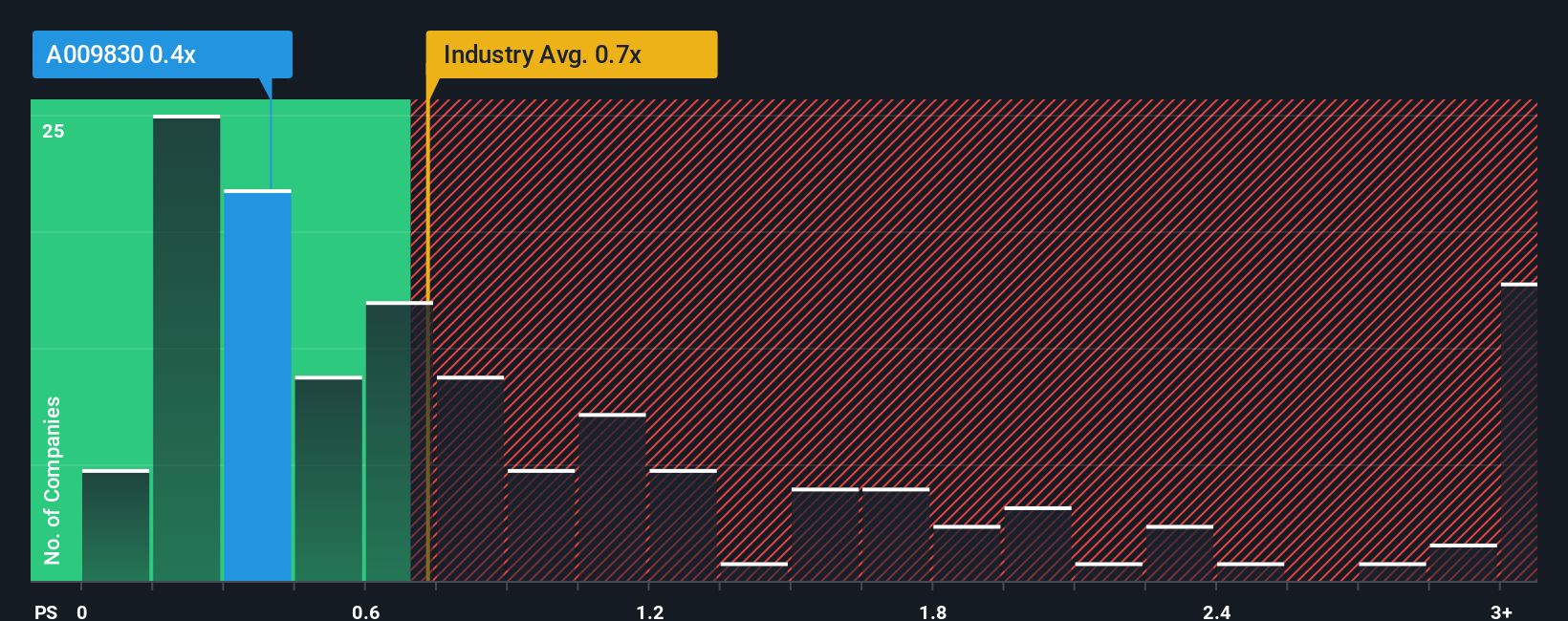

There wouldn't be many who think Hanwha Solutions Corporation's (KRX:009830) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Chemicals industry in Korea is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Hanwha Solutions

How Hanwha Solutions Has Been Performing

There hasn't been much to differentiate Hanwha Solutions' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hanwha Solutions.Is There Some Revenue Growth Forecasted For Hanwha Solutions?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hanwha Solutions' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.4% last year. Revenue has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 14% as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.2%, which is noticeably less attractive.

In light of this, it's curious that Hanwha Solutions' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Hanwha Solutions' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Hanwha Solutions' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Hanwha Solutions you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009830

Hanwha Solutions

Operates in the chemicals, energy solutions, and advanced materials business areas in South Korea and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives