- South Korea

- /

- Chemicals

- /

- KOSE:A009830

Hanwha Solutions Corporation's (KRX:009830) 49% Jump Shows Its Popularity With Investors

Hanwha Solutions Corporation (KRX:009830) shareholders have had their patience rewarded with a 49% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 29%.

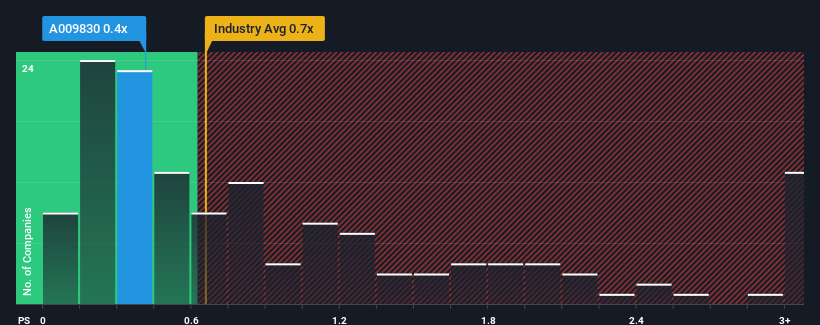

Even after such a large jump in price, there still wouldn't be many who think Hanwha Solutions' price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Korea's Chemicals industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

We've discovered 1 warning sign about Hanwha Solutions. View them for free.See our latest analysis for Hanwha Solutions

What Does Hanwha Solutions' Recent Performance Look Like?

Hanwha Solutions hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Hanwha Solutions' future stacks up against the industry? In that case, our free report is a great place to start.How Is Hanwha Solutions' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Hanwha Solutions' is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.2%. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 9.4% per year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 9.8% each year growth forecast for the broader industry.

With this in mind, it makes sense that Hanwha Solutions' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Hanwha Solutions' P/S?

Its shares have lifted substantially and now Hanwha Solutions' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Hanwha Solutions maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 1 warning sign for Hanwha Solutions that you need to take into consideration.

If you're unsure about the strength of Hanwha Solutions' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Hanwha Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A009830

Hanwha Solutions

Operates in the chemicals, energy solutions, and advanced materials business areas in South Korea and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives