- South Korea

- /

- Metals and Mining

- /

- KOSE:A008350

The Namsun Aluminum (KRX:008350) Share Price Has Soared 399%, Delighting Many Shareholders

For us, stock picking is in large part the hunt for the truly magnificent stocks. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Namsun Aluminum Co., Ltd. (KRX:008350) share price is up a whopping 399% in the last three years, a handsome return for long term holders. It's also up 16% in about a month. But this could be related to good market conditions -- stocks in its market are up 9.7% in the last month.

View our latest analysis for Namsun Aluminum

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years of share price growth, Namsun Aluminum actually saw its earnings per share (EPS) drop 21% per year.

So we doubt that the market is looking to EPS for its main judge of the company's value. Therefore, we think it's worth considering other metrics as well.

The revenue drop of 10% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between Namsun Aluminum's share price and its historic fundamental data. Further research may be required!

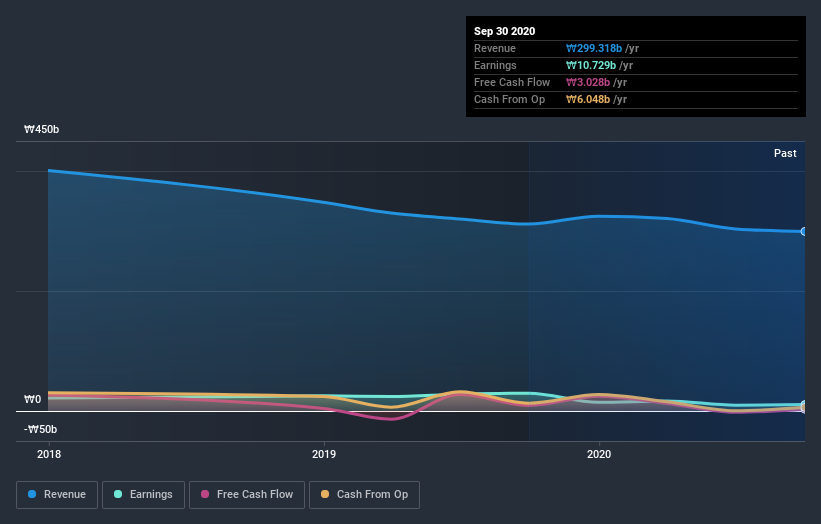

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Namsun Aluminum shareholders have received a total shareholder return of 55% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 35% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Namsun Aluminum has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Namsun Aluminum or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Namsun Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A008350

Namsun Aluminum

Produces and sells aluminum extruded products in South Korea and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives