- South Korea

- /

- Metals and Mining

- /

- KOSE:A008350

Namsun Aluminum Co., Ltd.'s (KRX:008350) Price Is Out Of Tune With Revenues

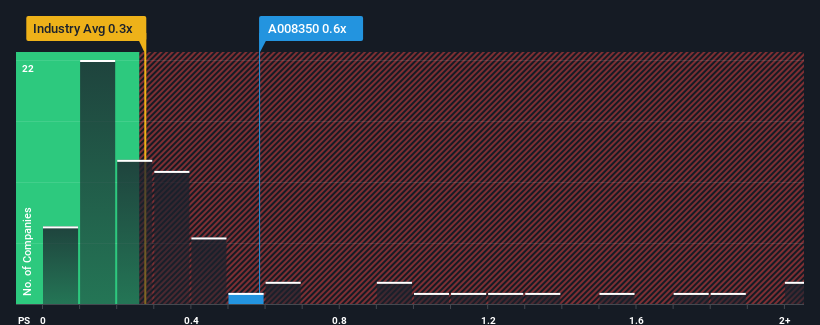

There wouldn't be many who think Namsun Aluminum Co., Ltd.'s (KRX:008350) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Metals and Mining industry in Korea is similar at about 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Namsun Aluminum

How Has Namsun Aluminum Performed Recently?

Namsun Aluminum has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Namsun Aluminum will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Namsun Aluminum will help you shine a light on its historical performance.How Is Namsun Aluminum's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Namsun Aluminum's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen a 20% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's curious that Namsun Aluminum's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Namsun Aluminum revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

You should always think about risks. Case in point, we've spotted 1 warning sign for Namsun Aluminum you should be aware of.

If these risks are making you reconsider your opinion on Namsun Aluminum, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Namsun Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A008350

Namsun Aluminum

Produces and sells aluminum extruded products in South Korea and internationally.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives