- South Korea

- /

- Chemicals

- /

- KOSE:A003720

The Market Doesn't Like What It Sees From Samyoung Co.,Ltd.'s (KRX:003720) Earnings Yet As Shares Tumble 26%

To the annoyance of some shareholders, Samyoung Co.,Ltd. (KRX:003720) shares are down a considerable 26% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

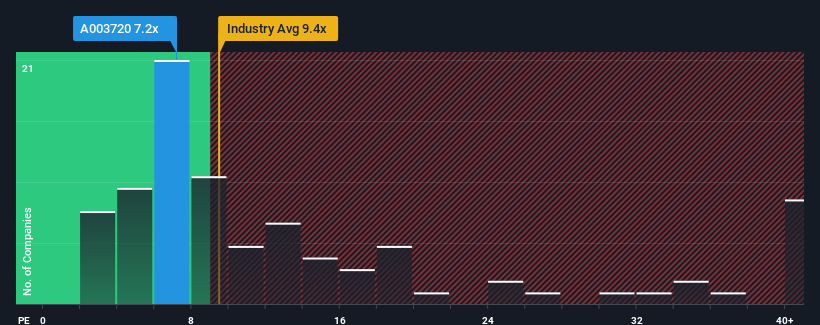

Even after such a large drop in price, SamyoungLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 7.2x, since almost half of all companies in Korea have P/E ratios greater than 11x and even P/E's higher than 22x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for SamyoungLtd as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for SamyoungLtd

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like SamyoungLtd's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 106% last year. The latest three year period has also seen an excellent 1,316% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to slump, contracting by 14% during the coming year according to the two analysts following the company. That's not great when the rest of the market is expected to grow by 33%.

With this information, we are not surprised that SamyoungLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

The softening of SamyoungLtd's shares means its P/E is now sitting at a pretty low level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that SamyoungLtd maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for SamyoungLtd that we have uncovered.

If these risks are making you reconsider your opinion on SamyoungLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A003720

SamyoungLtd

Manufactures and sells electronic and packaging films in South Korea.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives