- South Korea

- /

- Packaging

- /

- KOSE:A002870

Shareholders of Shinpoong Paper Mfg (KRX:002870) Must Be Delighted With Their 356% Total Return

Shinpoong Paper Mfg. Co., Ltd (KRX:002870) shareholders have seen the share price descend 18% over the month. But that doesn't change the fact that the returns over the last half decade have been spectacular. In fact, during that period, the share price climbed 305%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term.

See our latest analysis for Shinpoong Paper Mfg

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

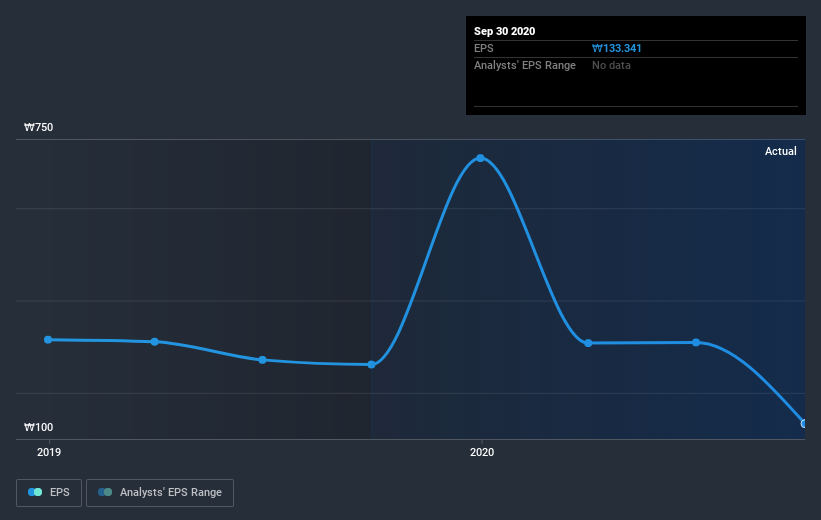

During the five years of share price growth, Shinpoong Paper Mfg moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. We can see that the Shinpoong Paper Mfg share price is up 203% in the last three years. In the same period, EPS is up 34% per year. Notably, the EPS growth has been slower than the annualised share price gain of 45% over three years. So it's fair to assume the market has a higher opinion of the business than it did three years ago.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It might be well worthwhile taking a look at our free report on Shinpoong Paper Mfg's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Shinpoong Paper Mfg, it has a TSR of 356% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's nice to see that Shinpoong Paper Mfg shareholders have received a total shareholder return of 104% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 35% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Shinpoong Paper Mfg (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

We will like Shinpoong Paper Mfg better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading Shinpoong Paper Mfg or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A002870

Adequate balance sheet with very low risk.

Market Insights

Community Narratives