- South Korea

- /

- Metals and Mining

- /

- KOSE:A002710

TCC Steel Corp.'s (KRX:002710) P/E Is Still On The Mark Following 26% Share Price Bounce

TCC Steel Corp. (KRX:002710) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the last month did very little to improve the 57% share price decline over the last year.

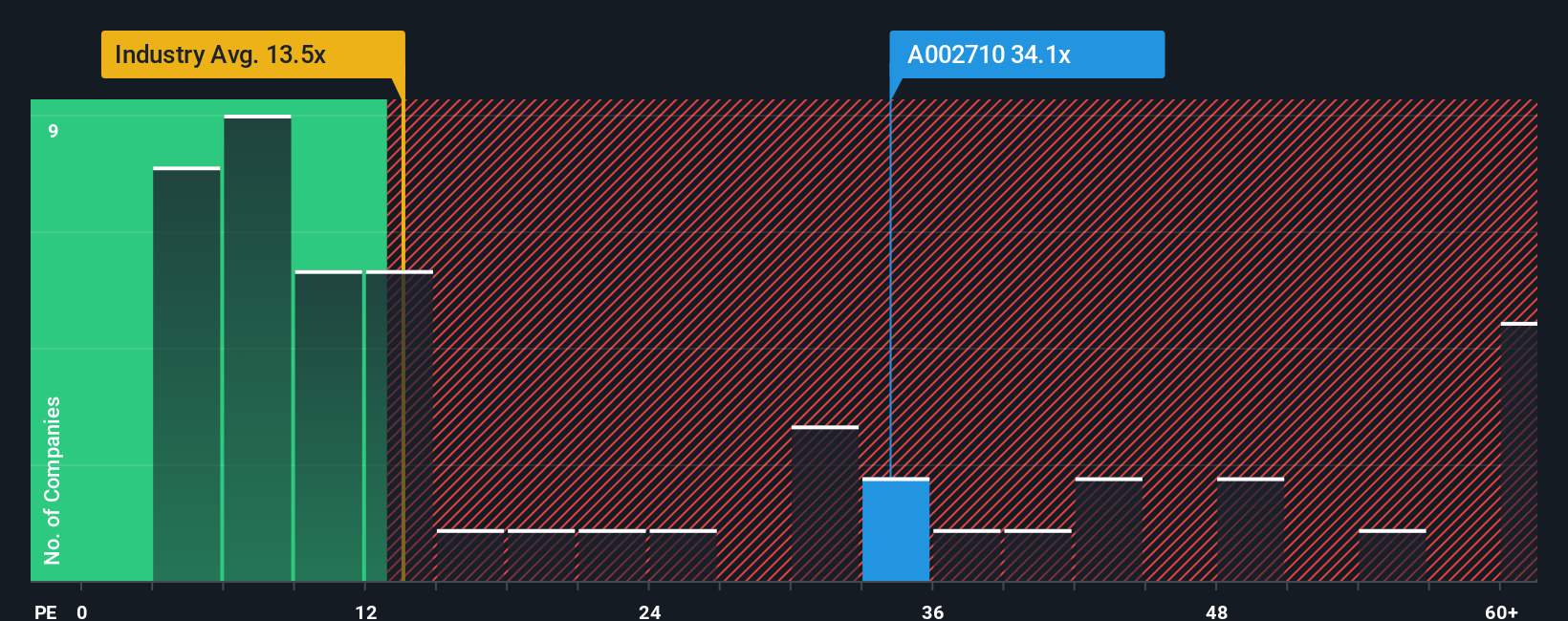

After such a large jump in price, TCC Steel may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 34.1x, since almost half of all companies in Korea have P/E ratios under 14x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, TCC Steel has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for TCC Steel

Is There Enough Growth For TCC Steel?

There's an inherent assumption that a company should far outperform the market for P/E ratios like TCC Steel's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 56% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 48% per annum as estimated by the dual analysts watching the company. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

With this information, we can see why TCC Steel is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From TCC Steel's P/E?

The strong share price surge has got TCC Steel's P/E rushing to great heights as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of TCC Steel's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for TCC Steel (1 is significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on TCC Steel, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TCC Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002710

TCC Steel

Engages in the manufacture and sale of stone coated steel sheets, and other surface-treated steel sheets in South Korea, Asia, Europe, the Middle East, North America, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives