- South Korea

- /

- Hospitality

- /

- KOSE:A035250

3 Top KRX Dividend Stocks With At Least 4.8% Yield

Reviewed by Simply Wall St

Over the last 7 days, the South Korean market has dropped 5.8%, and in the last 12 months, it is down 4.3%. However, with earnings forecasted to grow by 29% annually, investors may find opportunities in dividend stocks that offer stability and attractive yields.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 5.59% | ★★★★★★ |

| Hansae (KOSE:A105630) | 3.42% | ★★★★★☆ |

| KT (KOSE:A030200) | 4.87% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.17% | ★★★★★☆ |

| Samsung Fire & Marine Insurance (KOSE:A000810) | 4.61% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.42% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 7.23% | ★★★★★☆ |

| JW Holdings (KOSE:A096760) | 3.43% | ★★★★★☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.21% | ★★★★☆☆ |

| Samyang (KOSE:A145990) | 3.64% | ★★★★☆☆ |

Click here to see the full list of 74 stocks from our Top KRX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

ORION Holdings (KOSE:A001800)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ORION Holdings Corp. manufactures and sells confectioneries in South Korea, China, and internationally with a market cap of ₩936.64 billion.

Operations: ORION Holdings Corp. generates revenue primarily from its confectionery segment, which brought in ₩3.72 billion, followed by video at ₩107.12 million and landlord services at ₩38.70 million.

Dividend Yield: 4.8%

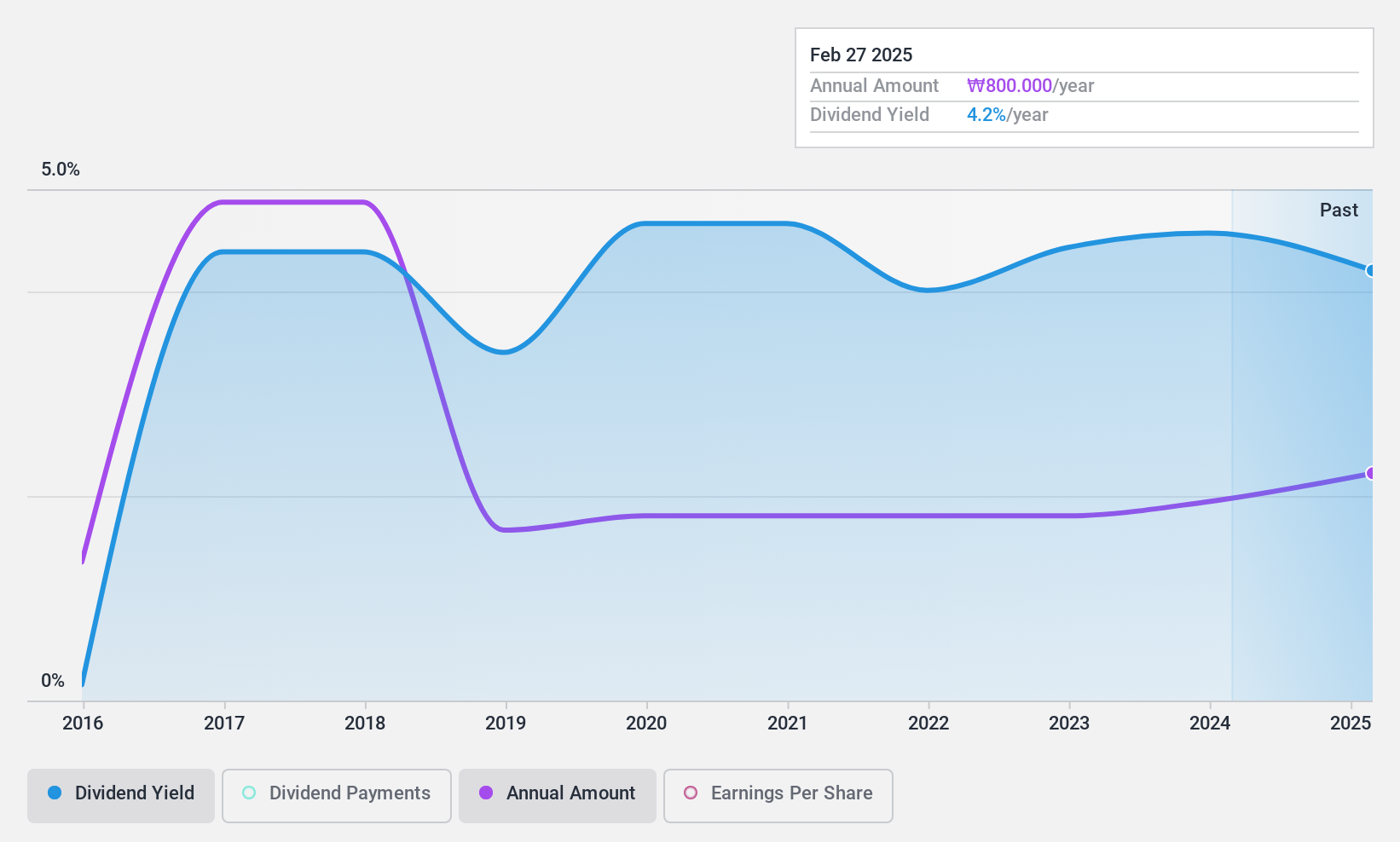

ORION Holdings has shown improved earnings, with second-quarter net income rising to KRW 17.86 billion from KRW 14.78 billion a year ago, and basic earnings per share increasing to KRW 297 from KRW 246. Despite trading at a discount to its estimated fair value and boasting a top-tier dividend yield of 4.82%, the company's dividend history is less reliable due to volatility over the past nine years. However, dividends are well-covered by both earnings (41.2% payout ratio) and cash flows (10.7% cash payout ratio).

- Dive into the specifics of ORION Holdings here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of ORION Holdings shares in the market.

Asia Paper Manufacturing (KOSE:A002310)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Paper Manufacturing Co., Ltd specializes in producing and selling industrial paper in South Korea, with a market cap of ₩327.68 billion.

Operations: Asia Paper Manufacturing Co., Ltd generates its revenue primarily through the production and sale of specialized industrial paper in South Korea.

Dividend Yield: 6.1%

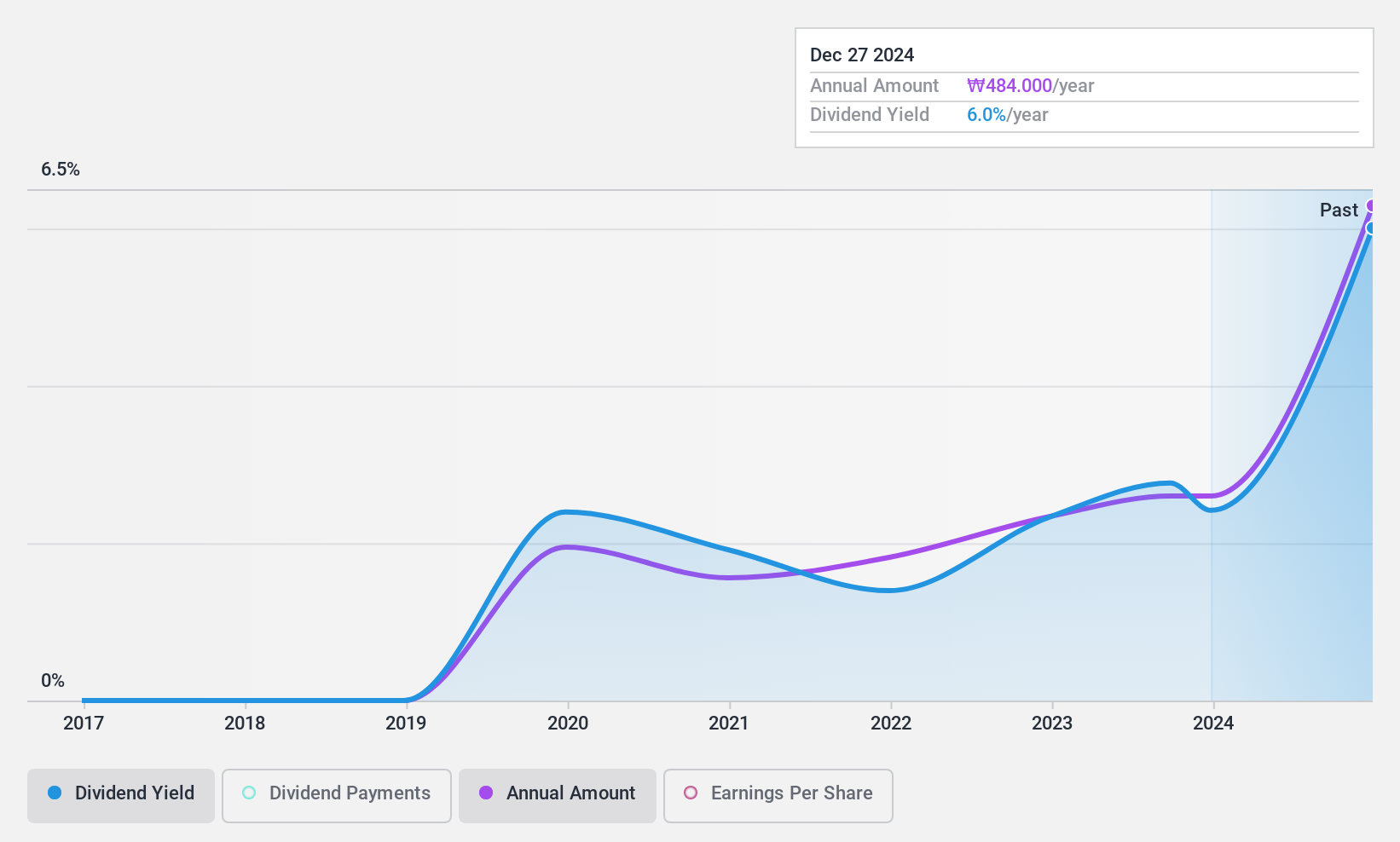

Asia Paper Manufacturing has seen dividend payments increase over the past five years, positioning its 6.14% yield among the top 25% in South Korea. Despite this, dividends have been volatile and less reliable. The payout ratio of 33.6% suggests earnings cover dividends well, but a higher cash payout ratio of 76.1% indicates potential sustainability concerns. Recent earnings showed a decline in net income to KRW 9.82 billion for Q2-2024 from KRW 24.92 billion a year ago, highlighting financial volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of Asia Paper Manufacturing.

- Our valuation report here indicates Asia Paper Manufacturing may be overvalued.

Kangwon Land (KOSE:A035250)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kangwon Land, Inc. operates casinos, tourist hotels, and ski resorts in South Korea with a market cap of ₩3.54 trillion.

Operations: Kangwon Land, Inc.'s revenue primarily comes from its Casinos & Resorts segment, which generated ₩1.41 trillion.

Dividend Yield: 5.3%

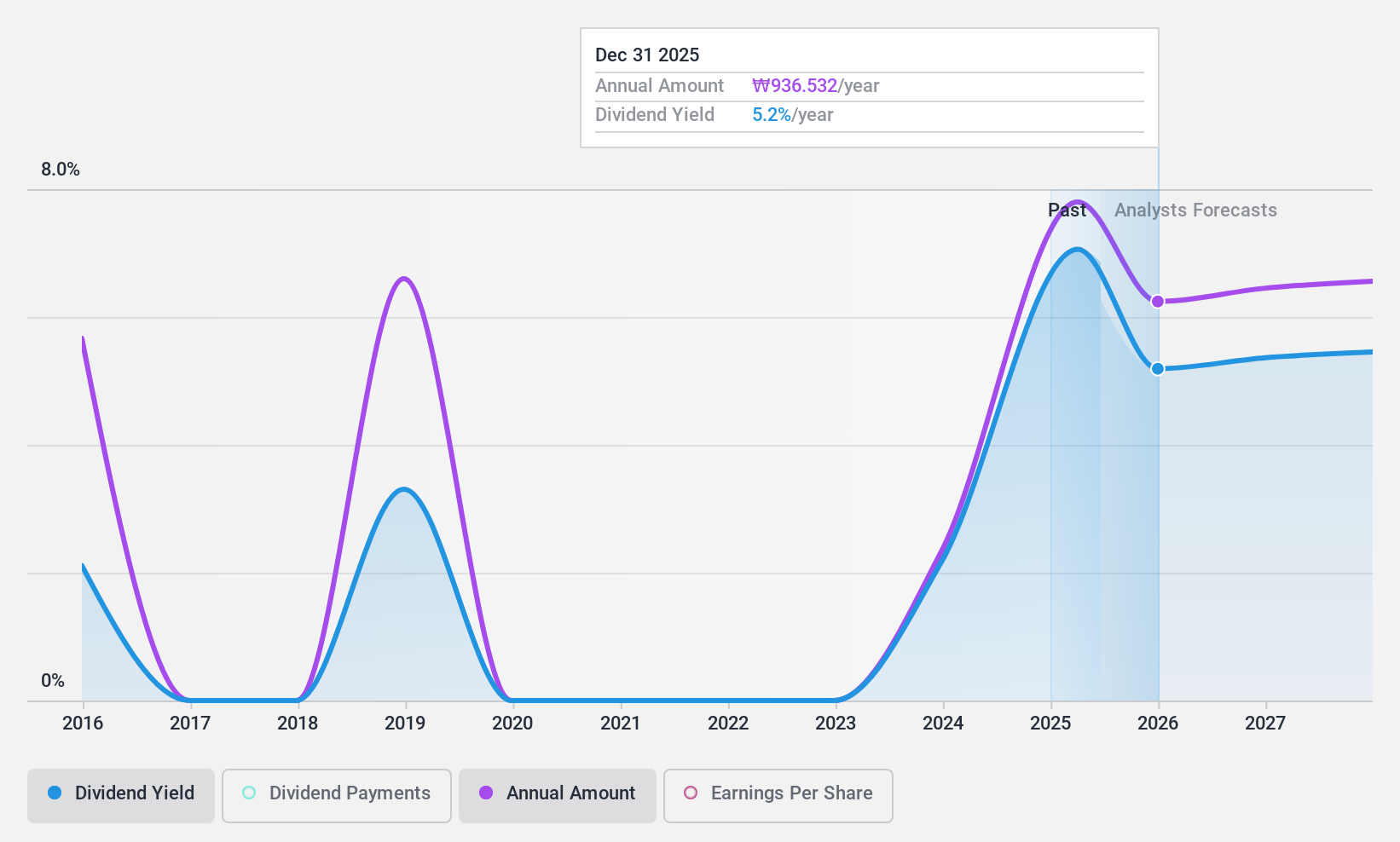

Kangwon Land's dividend yield of 5.32% places it in the top 25% of South Korean dividend payers, with a payout ratio of 46.9%, indicating dividends are well-covered by earnings. However, its dividend history is less reliable, marked by volatility over nine years. Recent Q2-2024 results showed a significant net income increase to KRW 149.80 billion from KRW 91.20 billion a year ago, reflecting robust financial performance despite forecasted earnings decline over the next three years.

- Click here to discover the nuances of Kangwon Land with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kangwon Land shares in the market.

Key Takeaways

- Reveal the 74 hidden gems among our Top KRX Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kangwon Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A035250

Kangwon Land

Engages in the casino, tourist hotel, and ski resorts businesses in South Korea.

Excellent balance sheet established dividend payer.