- South Korea

- /

- Metals and Mining

- /

- KOSE:A001430

SeAH Besteel Holdings' (KRX:001430) Soft Earnings Are Actually Better Than They Appear

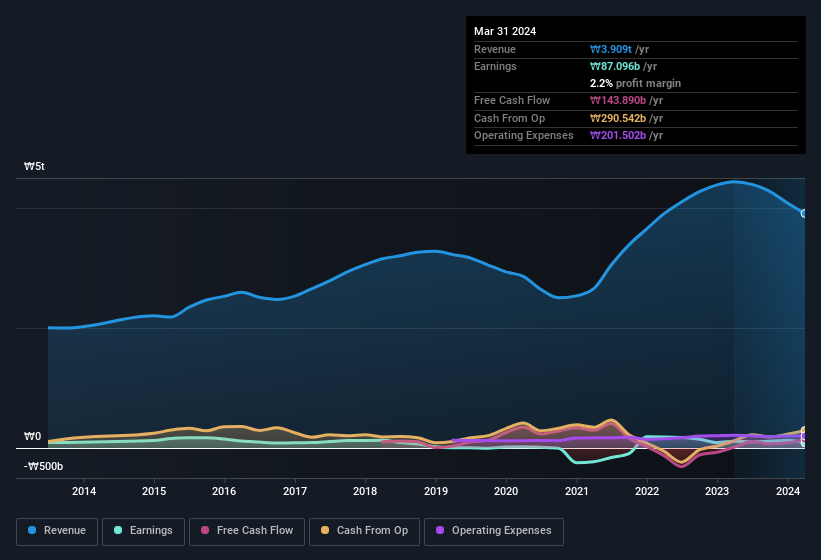

The market was pleased with the recent earnings report from SeAH Besteel Holdings Corporation (KRX:001430), despite the profit numbers being soft. Our analysis suggests that investors may have noticed some promising signs beyond the statutory profit figures.

Check out our latest analysis for SeAH Besteel Holdings

The Impact Of Unusual Items On Profit

Importantly, our data indicates that SeAH Besteel Holdings' profit was reduced by ₩18b, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect SeAH Besteel Holdings to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On SeAH Besteel Holdings' Profit Performance

Unusual items (expenses) detracted from SeAH Besteel Holdings' earnings over the last year, but we might see an improvement next year. Because of this, we think SeAH Besteel Holdings' earnings potential is at least as good as it seems, and maybe even better! Unfortunately, though, its earnings per share actually fell back over the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into SeAH Besteel Holdings, you'd also look into what risks it is currently facing. At Simply Wall St, we found 1 warning sign for SeAH Besteel Holdings and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of SeAH Besteel Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001430

SeAH Besteel Holdings

Engages in the manufacture and sale of special steel, heavy forgings, auto parts, and axles in South Korea.

Undervalued with moderate growth potential.

Market Insights

Community Narratives