- South Korea

- /

- Metals and Mining

- /

- KOSE:A001390

If You Had Bought KG Chemical (KRX:001390) Stock A Year Ago, You Could Pocket A 110% Gain Today

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example KG Chemical Corporation (KRX:001390). Its share price is already up an impressive 110% in the last twelve months. Also pleasing for shareholders was the 18% gain in the last three months. But this could be related to the strong market, which is up 29% in the last three months. In contrast, the longer term returns are negative, since the share price is 3.8% lower than it was three years ago.

View our latest analysis for KG Chemical

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, KG Chemical actually saw its earnings per share drop 91%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We are skeptical of the suggestion that the 1.5% dividend yield would entice buyers to the stock. We think that the revenue growth of 141% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

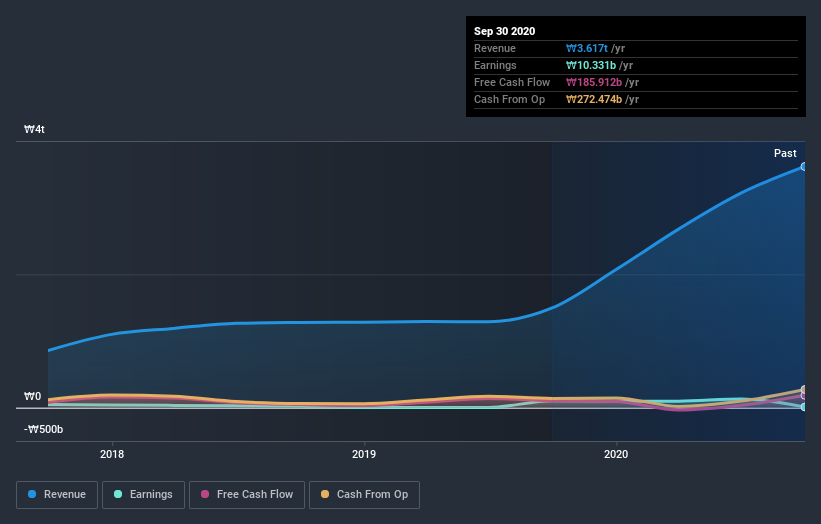

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on KG Chemical's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of KG Chemical, it has a TSR of 113% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that KG Chemical has rewarded shareholders with a total shareholder return of 113% in the last twelve months. Of course, that includes the dividend. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand KG Chemical better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for KG Chemical (of which 1 is a bit unpleasant!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade KG Chemical, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KG Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A001390

KG Chemical

Manufactures and supplies fertilizers and concrete compound ingredients products in South Korea and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives