- China

- /

- Trade Distributors

- /

- SZSE:002962

Three Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by geopolitical tensions, consumer spending concerns, and fluctuating indices, investors are increasingly seeking opportunities in lesser-known small-cap stocks that may offer resilience and growth potential. In this environment, identifying companies with strong fundamentals, innovative business models, or strategic market positions can be crucial for uncovering hidden gems that could thrive despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Jordanian Duty Free Shops | NA | 10.61% | -7.94% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

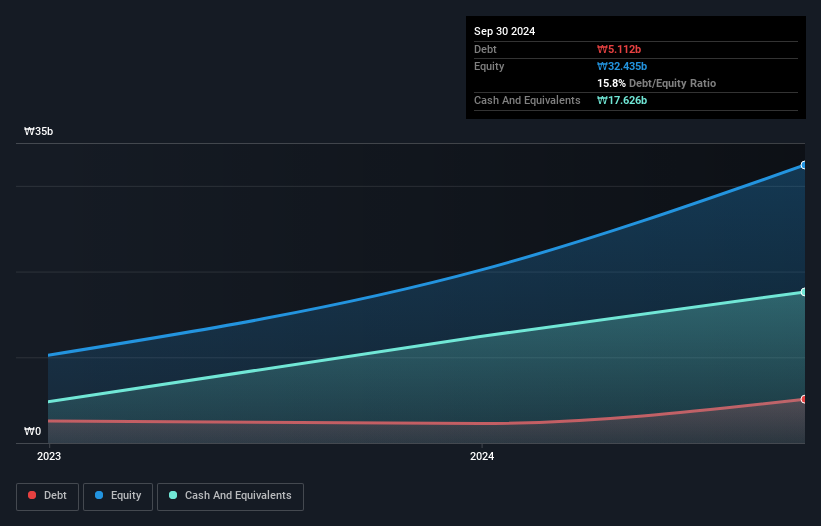

LK CHEM (KOSDAQ:A489500)

Simply Wall St Value Rating: ★★★★★☆

Overview: LK CHEM Co., Ltd. is a technology-oriented company focused on the silicon chemical material business in South Korea, with a market cap of ₩369.15 billion.

Operations: The company generates revenue primarily from its silicon chemical material business. It reported a market cap of ₩369.15 billion, indicating its valuation in the market.

LK CHEM recently completed a KRW 21 billion IPO, offering shares at a discounted price of KRW 21,000. The company boasts impressive earnings growth of 71%, far outpacing the Chemicals industry average of 20.7%. With its interest payments well covered by EBIT at a multiple of 41, it seems financially robust. Despite having more cash than total debt, the shares are highly illiquid and trade at roughly 41% below estimated fair value. The recent IPO may bolster liquidity while maintaining high-quality earnings and positive free cash flow suggests resilience in future operations.

- Click here and access our complete health analysis report to understand the dynamics of LK CHEM.

Assess LK CHEM's past performance with our detailed historical performance reports.

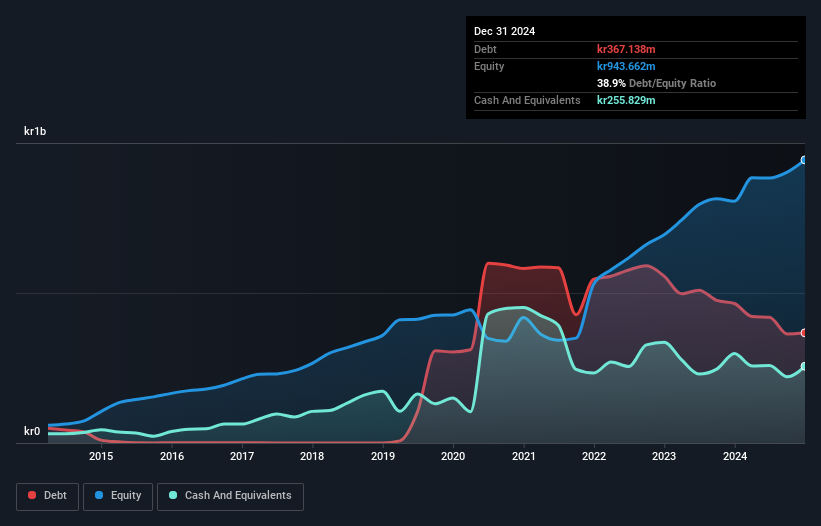

Absolent Air Care Group (OM:ABSO)

Simply Wall St Value Rating: ★★★★★★

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market capitalization of SEK3.06 billion.

Operations: The company generates revenue primarily from its Industrial segment, contributing SEK1.16 billion, and the Commercial Kitchen segment with SEK243.11 million.

Absolent Air Care Group, a promising player in its sector, reported net income of SEK 143.92 million for the full year ending December 2024, an increase from SEK 140.22 million the previous year. Earnings per share rose to SEK 12.71 from SEK 12.39, highlighting consistent performance despite sales slightly dipping to SEK 1,400.2 million from SEK 1,408.46 million. The company has effectively reduced its debt-to-equity ratio over five years from 71% to a more manageable 38%, with interest payments well-covered by EBIT at a robust multiple of 15.6x, indicating solid financial health and potential for future growth under new leadership transitions set for mid-2025.

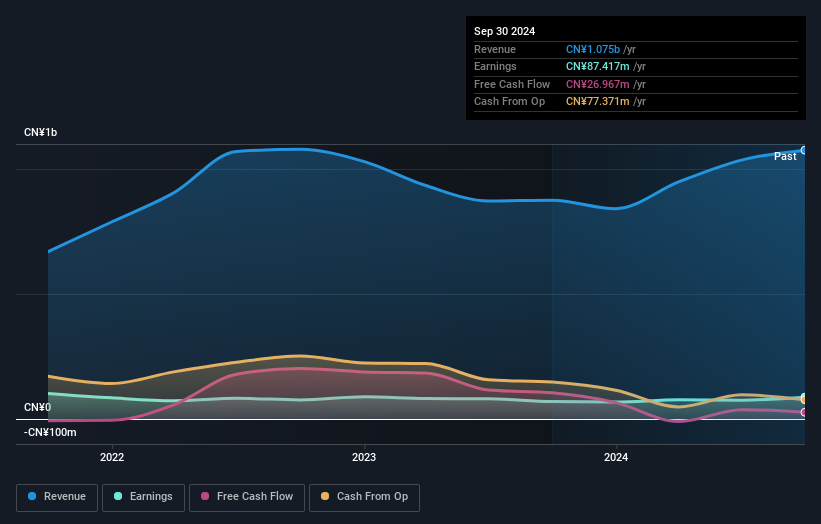

Hubei W-olf Photoelectric Technology (SZSE:002962)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hubei W-olf Photoelectric Technology Co., Ltd. focuses on the development and production of optical and optoelectronic products, with a market capitalization of CN¥4.98 billion.

Operations: With a primary revenue stream of CN¥1.08 billion from the optics and optoelectronics industry, Hubei W-olf Photoelectric Technology Co., Ltd. operates with a market capitalization of CN¥4.98 billion.

Hubei W-olf Photoelectric Technology, a smaller player in its field, has shown robust earnings growth of 25% over the past year, outpacing the broader Trade Distributors industry. Despite this impressive performance, its debt to equity ratio has risen from 0.6 to 3.9 over five years, indicating increased leverage. The company remains profitable with interest coverage not being an issue and more cash than total debt on hand. Although it completed a share buyback program purchasing 450,000 shares for CNY 5.59 million recently, long-term earnings have seen an average annual decline of nearly 19%.

Summing It All Up

- Click this link to deep-dive into the 4749 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubei W-olf Photoelectric Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002962

Hubei W-olf Photoelectric Technology

Hubei W-olf Photoelectric Technology Co., Ltd.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives