- South Korea

- /

- Chemicals

- /

- KOSDAQ:A348370

Enchem Co., Ltd. (KOSDAQ:348370) Shares Slammed 38% But Getting In Cheap Might Be Difficult Regardless

The Enchem Co., Ltd. (KOSDAQ:348370) share price has fared very poorly over the last month, falling by a substantial 38%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

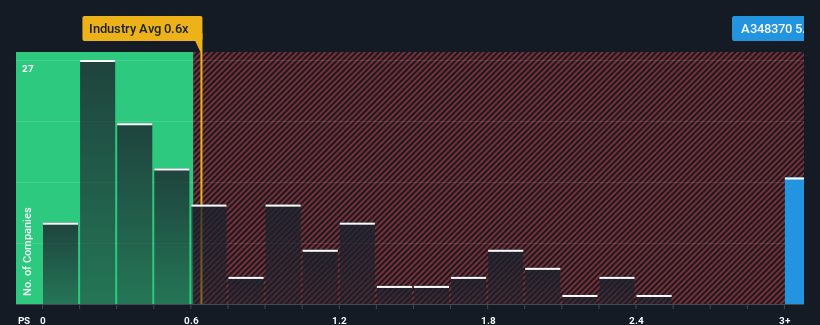

Even after such a large drop in price, given around half the companies in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.6x, you may still consider Enchem as a stock to avoid entirely with its 5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Enchem

How Enchem Has Been Performing

For example, consider that Enchem's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Enchem, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Enchem's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Enchem's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. Even so, admirably revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why Enchem's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

A significant share price dive has done very little to deflate Enchem's very lofty P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Enchem can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Enchem (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Enchem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A348370

Enchem

Manufactures and sells electrolytes and additives for secondary batteries and EDLC.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives