- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A009470

3 Elite Growth Companies With High Insider Ownership On KRX

Reviewed by Simply Wall St

The South Korean market has climbed 1.2% in the last 7 days, although it has remained flat overall over the past year, with earnings forecast to grow by 29% annually. In this context, identifying growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and potential for robust performance.

Top 10 Growth Companies With High Insider Ownership In South Korea

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Bioneer (KOSDAQ:A064550) | 15.8% | 97.6% |

| ALTEOGEN (KOSDAQ:A196170) | 26.6% | 99.5% |

| Oscotec (KOSDAQ:A039200) | 26.3% | 122% |

| Vuno (KOSDAQ:A338220) | 19.5% | 110.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| Park Systems (KOSDAQ:A140860) | 33% | 35.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Techwing (KOSDAQ:A089030) | 18.7% | 83.6% |

Here's a peek at a few of the choices from the screener.

Enchem (KOSDAQ:A348370)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. manufactures and sells electrolytes and additives for secondary batteries and EDLC, with a market cap of ₩4.26 billion.

Operations: Enchem generates revenue primarily from the sale of electronic components and parts, amounting to ₩348.75 million.

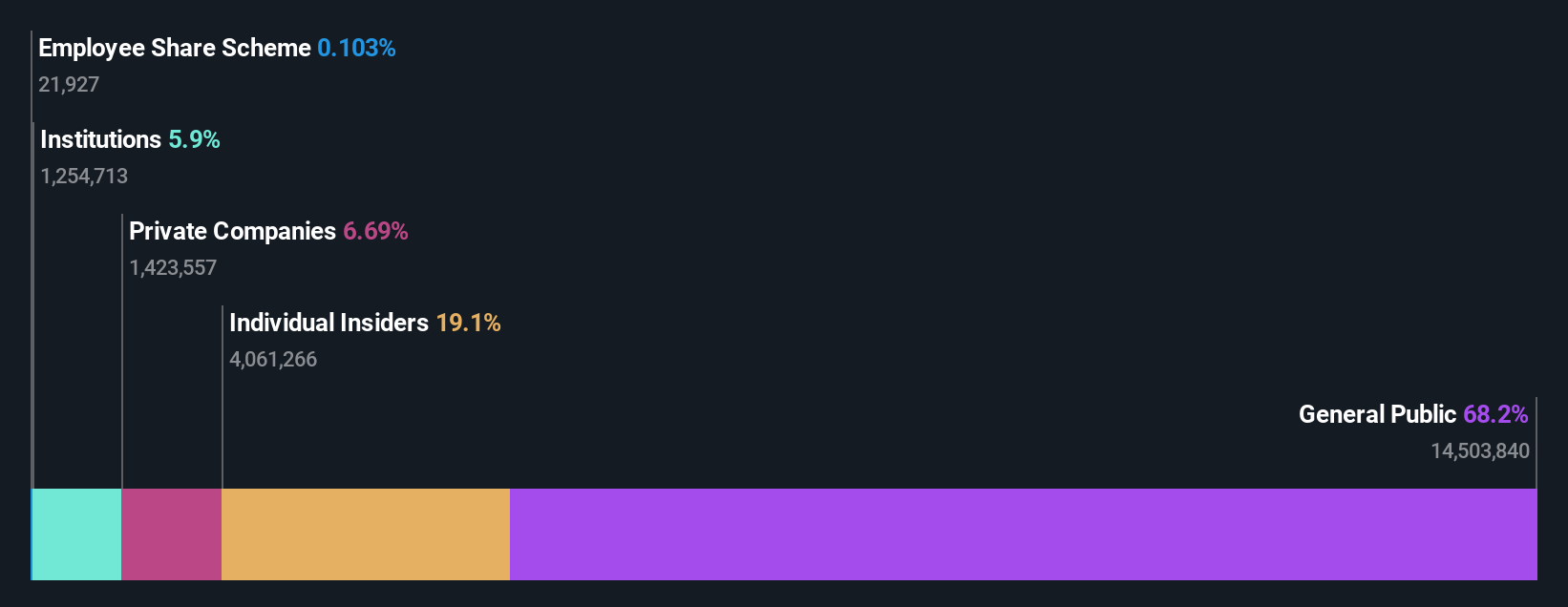

Insider Ownership: 19.4%

Revenue Growth Forecast: 63% p.a.

Enchem, a growth company with high insider ownership in South Korea, is forecast to see its revenue grow at 63% per year, significantly outpacing the market's 10.5% annual growth rate. Despite recent shareholder dilution and highly volatile share prices over the past three months, Enchem is expected to become profitable within three years with earnings projected to grow at an impressive 155.2% annually. However, there has been no substantial insider trading activity reported in the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of Enchem.

- According our valuation report, there's an indication that Enchem's share price might be on the expensive side.

Samwha ElectricLtd (KOSE:A009470)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Samwha Electric Co., Ltd. operates in the electrolytic capacitor industry both in South Korea and internationally, with a market cap of ₩363.10 billion.

Operations: Revenue from electronic components and parts amounts to ₩211.75 billion.

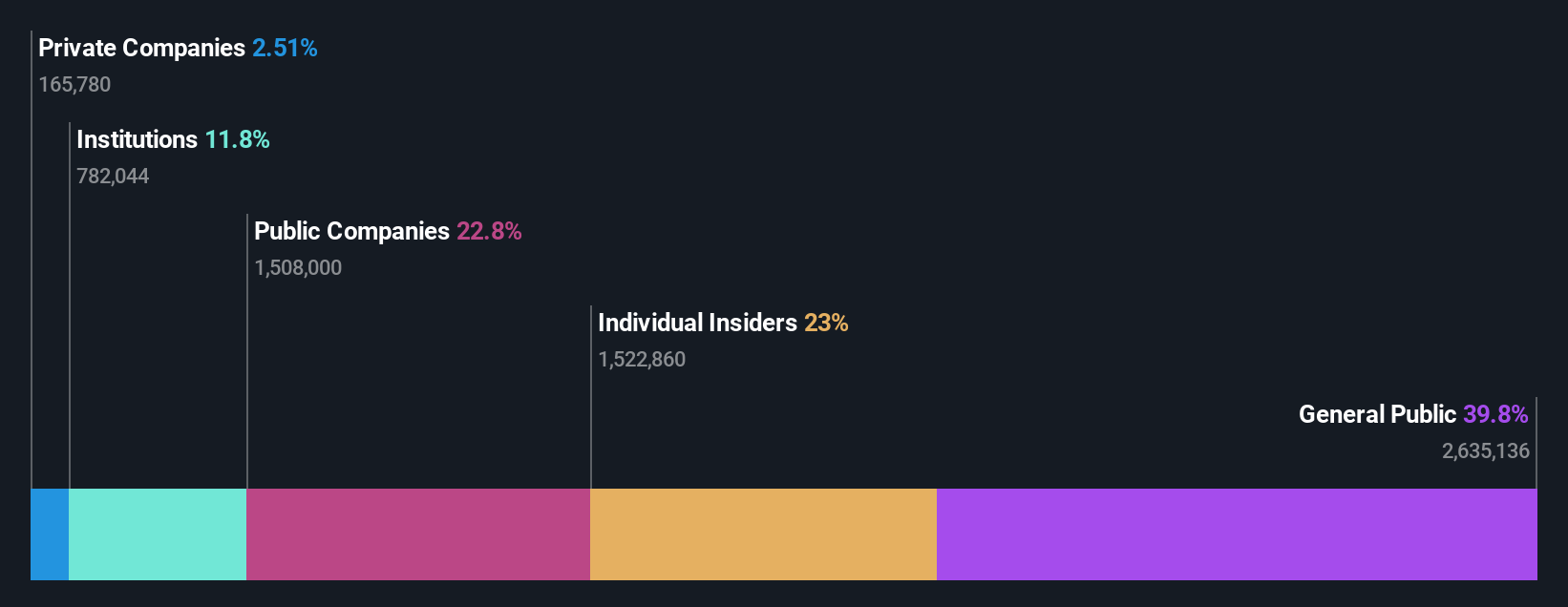

Insider Ownership: 23%

Revenue Growth Forecast: 19.2% p.a.

Samwha Electric Ltd. exhibits strong growth potential with earnings forecasted to grow 43.78% annually, significantly outpacing the South Korean market's 29.3%. Despite highly volatile share prices over the past three months and slower revenue growth at 19.2% per year, its recent inclusion in the S&P Global BMI Index highlights its increasing prominence. The company reported a substantial net income increase to KR₩12.95 billion for H1 2024, reflecting robust profitability improvements from last year’s KR₩5.42 billion.

- Unlock comprehensive insights into our analysis of Samwha ElectricLtd stock in this growth report.

- Our valuation report unveils the possibility Samwha ElectricLtd's shares may be trading at a discount.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩7.08 trillion.

Operations: HYBE Co., Ltd.'s revenue segments include Label (₩1.28 trillion), Platform (₩361.12 million), and Solution (₩1.24 trillion).

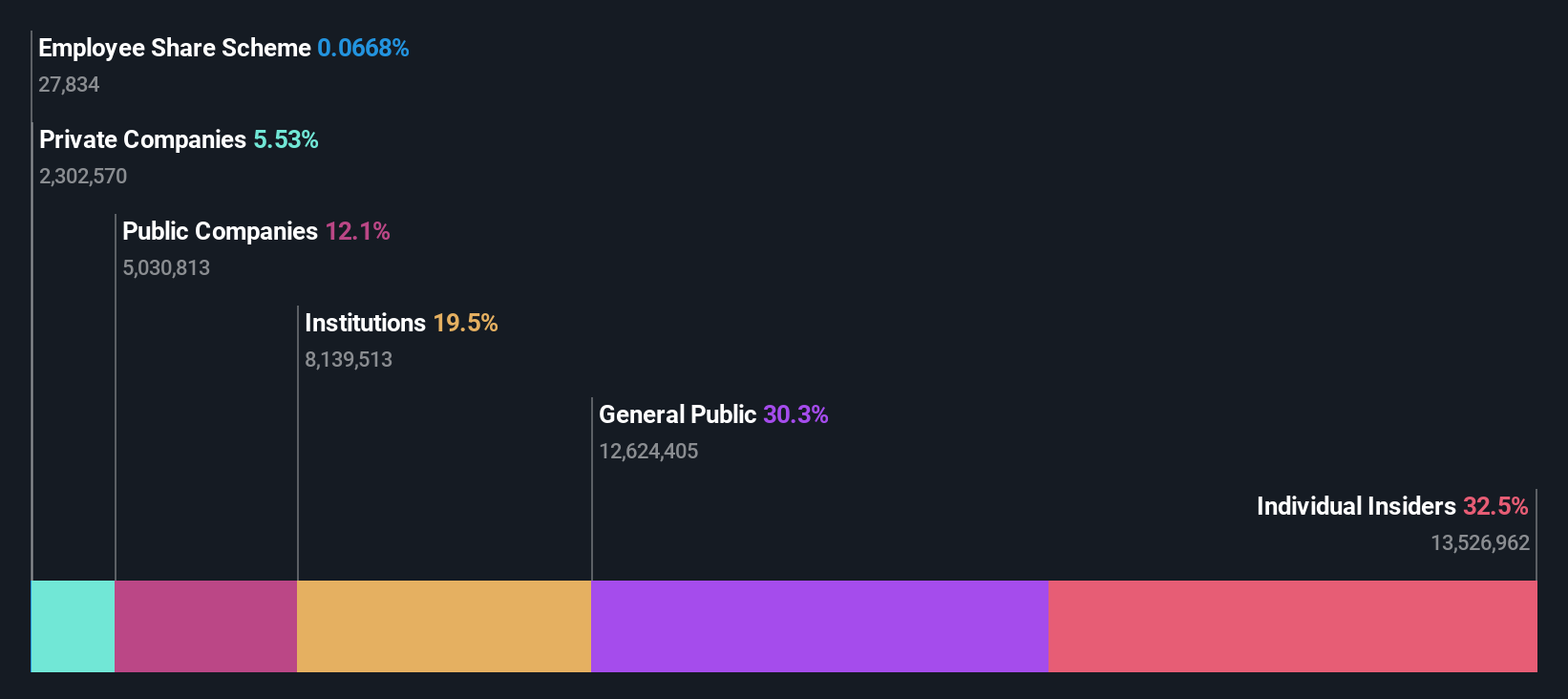

Insider Ownership: 32.5%

Revenue Growth Forecast: 14.0% p.a.

HYBE's earnings are forecast to grow 42.23% annually, outpacing the South Korean market's 29.3%, although revenue growth is slower at 14% per year. The company recently completed a share buyback of 150,000 shares for KR₩26.09 billion to stabilize stock prices. Despite large one-off items impacting financial results and a significant drop in net income from KR₩117.34 billion to KR₩14.59 million YoY, it trades at 26.5% below its estimated fair value with analysts predicting a price rise of 50.9%.

- Click to explore a detailed breakdown of our findings in HYBE's earnings growth report.

- Our expertly prepared valuation report HYBE implies its share price may be lower than expected.

Seize The Opportunity

- Get an in-depth perspective on all 87 Fast Growing KRX Companies With High Insider Ownership by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A009470

Samwha ElectricLtd

Operates in the electrolytic capacitor industry in South Korea and internationally.

Flawless balance sheet with high growth potential.