- South Korea

- /

- Chemicals

- /

- KOSDAQ:A318160

Cell Bio Human Tech Co.,Ltd's (KOSDAQ:318160) 27% Price Boost Is Out Of Tune With Revenues

Despite an already strong run, Cell Bio Human Tech Co.,Ltd (KOSDAQ:318160) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 32%.

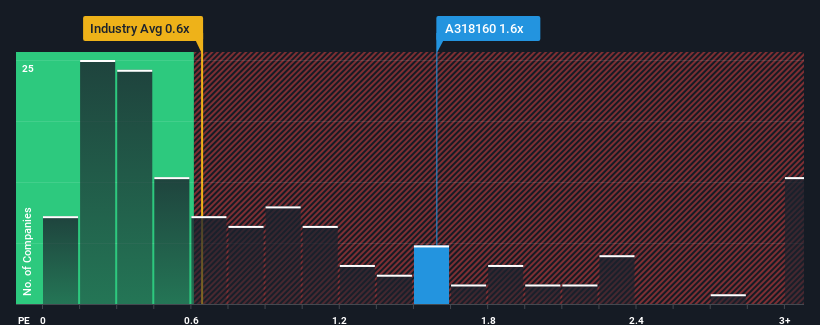

Following the firm bounce in price, given close to half the companies operating in Korea's Chemicals industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Cell Bio Human TechLtd as a stock to potentially avoid with its 1.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cell Bio Human TechLtd

How Cell Bio Human TechLtd Has Been Performing

Cell Bio Human TechLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Cell Bio Human TechLtd will help you shine a light on its historical performance.How Is Cell Bio Human TechLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Cell Bio Human TechLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 4.0% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 19% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Cell Bio Human TechLtd's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Cell Bio Human TechLtd's P/S

Cell Bio Human TechLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cell Bio Human TechLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cell Bio Human TechLtd (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A318160

Cell Bio Human TechLtd

Develops and manufactures cellulose mask pack material by using cellulose reaction technology.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives