- South Korea

- /

- Chemicals

- /

- KOSDAQ:A317870

The ENVIONEERLtd (KOSDAQ:317870) Share Price Has Gained 34% And Shareholders Are Hoping For More

It might be of some concern to shareholders to see the ENVIONEER Co.,Ltd. (KOSDAQ:317870) share price down 12% in the last month. Taking a longer term view we see the stock is up over one year. In that time, it is up 34%, which isn't bad, but is below the market return of 55%.

Check out our latest analysis for ENVIONEERLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year ENVIONEERLtd saw its earnings per share (EPS) drop below zero. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

Unfortunately ENVIONEERLtd's fell 22% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

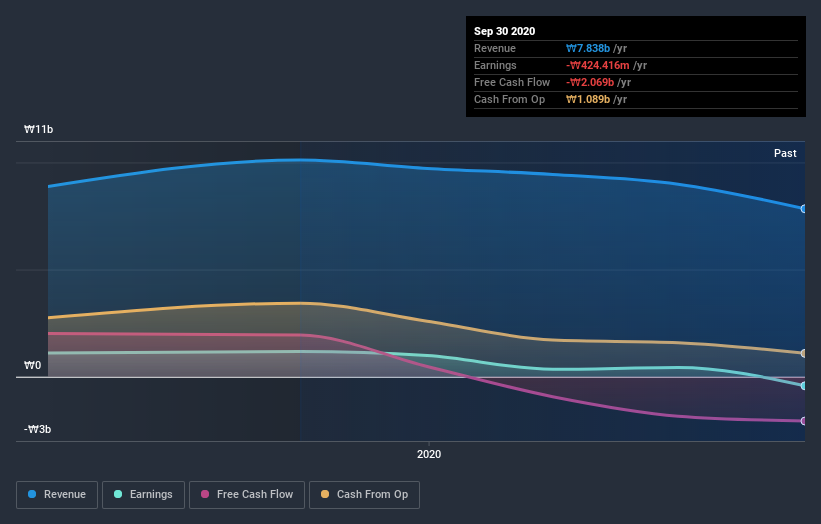

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling ENVIONEERLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

ENVIONEERLtd shareholders have gained 34% for the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 55%. The last three months haven't been great for shareholder returns, since the share price has trailed the market by 3.2% in the last three months. It might be that investors are more concerned about the business lately due to some fundamental change (or else the share price simply got ahead of itself, previously). It's always interesting to track share price performance over the longer term. But to understand ENVIONEERLtd better, we need to consider many other factors. For instance, we've identified 4 warning signs for ENVIONEERLtd (1 is significant) that you should be aware of.

We will like ENVIONEERLtd better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

When trading ENVIONEERLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ENVIONEERLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A317870

ENVIONEERLtd

Offers high-tech composite materials for environmental industry.

Adequate balance sheet with low risk.

Market Insights

Community Narratives