- South Korea

- /

- Basic Materials

- /

- KOSDAQ:A228340

Subdued Growth No Barrier To Tongyang Pile Inc.'s (KOSDAQ:228340) Price

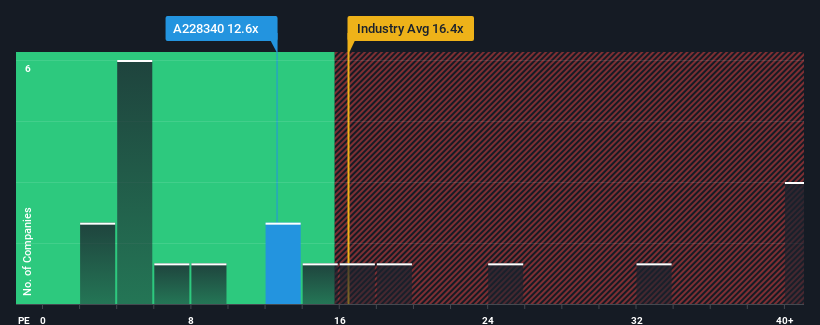

It's not a stretch to say that Tongyang Pile Inc.'s (KOSDAQ:228340) price-to-earnings (or "P/E") ratio of 12.6x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For example, consider that Tongyang Pile's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Tongyang Pile

Is There Some Growth For Tongyang Pile?

The only time you'd be comfortable seeing a P/E like Tongyang Pile's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Tongyang Pile is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Tongyang Pile revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Tongyang Pile that you should be aware of.

If you're unsure about the strength of Tongyang Pile's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tongyang Pile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A228340

Tongyang Pile

Engages in the manufacture and sale of pretensioned spun high strength concrete piles in South Korea.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives