- South Korea

- /

- Metals and Mining

- /

- KOSDAQ:A128660

Is PJ Metal Co., Ltd.'s (KOSDAQ:128660) Recent Stock Performance Influenced By Its Financials In Any Way?

PJ Metal's (KOSDAQ:128660) stock is up by 7.1% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. In this article, we decided to focus on PJ Metal's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for PJ Metal

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for PJ Metal is:

9.5% = ₩3.8b ÷ ₩40b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every ₩1 worth of shareholders' equity, the company generated ₩0.09 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

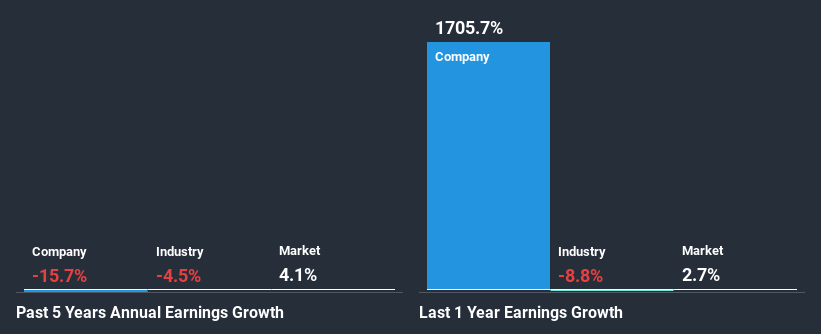

A Side By Side comparison of PJ Metal's Earnings Growth And 9.5% ROE

When you first look at it, PJ Metal's ROE doesn't look that attractive. Although a closer study shows that the company's ROE is higher than the industry average of 3.8% which we definitely can't overlook. However, PJ Metal's five year net income decline rate was 16%. Bear in mind, the company does have a slightly low ROE. It is just that the industry ROE is lower. Therefore, the decline in earnings could also be the result of this.

As a next step, we compared PJ Metal's performance with the industry and found thatPJ Metal's performance is depressing even when compared with the industry, which has shrunk its earnings at a rate of 4.5% in the same period, which is a slower than the company.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is PJ Metal fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is PJ Metal Efficiently Re-investing Its Profits?

PJ Metal doesn't pay any dividend, meaning that potentially all of its profits are being reinvested in the business, which doesn't explain why the company's earnings have shrunk if it is retaining all of its profits. So there could be some other explanations in that regard. For instance, the company's business may be deteriorating.

Conclusion

On the whole, we do feel that PJ Metal has some positive attributes. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. Our risks dashboard would have the 3 risks we have identified for PJ Metal.

When trading PJ Metal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A128660

PJ Metal

Engages in the manufacturing of aluminum deoxidizers and billets in South Korea.

Slight with mediocre balance sheet.

Market Insights

Community Narratives