- South Korea

- /

- Chemicals

- /

- KOSDAQ:A121600

Growth Companies With Insider Ownership Ranging From 13% To 31%

Reviewed by Simply Wall St

In a week marked by U.S. stock indexes climbing toward record highs and growth stocks outperforming value shares, investors are closely watching for opportunities that align with current market conditions. Amid this backdrop, companies with substantial insider ownership can offer unique insights into potential growth trajectories, as insiders often have a vested interest in the long-term success of their businesses.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 111.4% |

We'll examine a selection from our screener results.

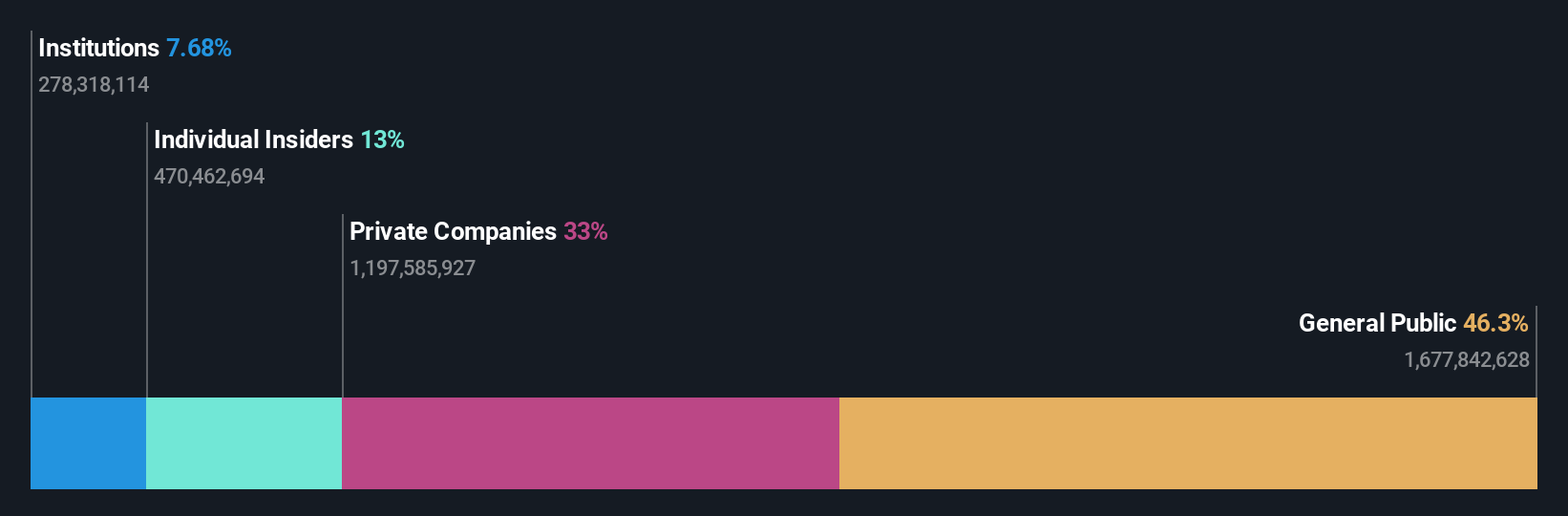

Advanced Nano Products (KOSDAQ:A121600)

Simply Wall St Growth Rating: ★★★★★☆

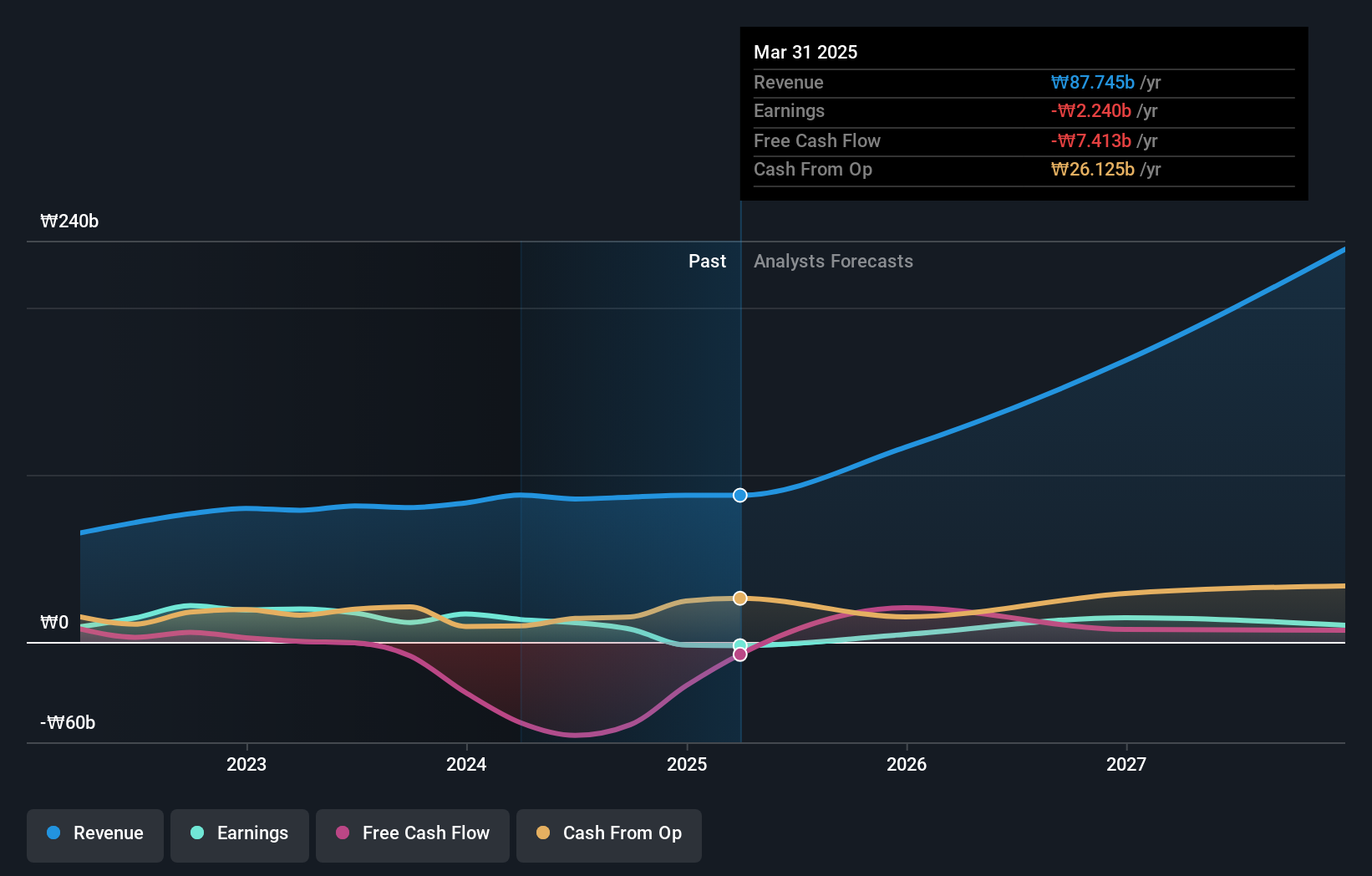

Overview: Advanced Nano Products Co., Ltd. is a company that manufactures and sells high-tech materials including displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally, with a market cap of approximately ₩741.12 billion.

Operations: The company's revenue segment includes Specialty Chemicals, generating approximately ₩86.63 billion.

Insider Ownership: 22.7%

Advanced Nano Products is positioned for significant growth, with earnings projected to increase by 70% annually over the next three years, outpacing the Korean market's 25.8% growth rate. Despite a decline in profit margins from 14.5% to 8.8%, its revenue is expected to grow at an impressive 45% per year, well above market averages. The stock trades slightly below its estimated fair value, though insider trading activity has been limited recently.

- Get an in-depth perspective on Advanced Nano Products' performance by reading our analyst estimates report here.

- The analysis detailed in our Advanced Nano Products valuation report hints at an inflated share price compared to its estimated value.

Beijing Originwater Technology (SZSE:300070)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Originwater Technology Co., Ltd. operates in the water treatment business both in China and internationally, with a market cap of CN¥17.61 billion.

Operations: Beijing Originwater Technology Co., Ltd. generates revenue from its operations in the water treatment sector across domestic and international markets.

Insider Ownership: 13.2%

Beijing Originwater Technology is poised for growth, with earnings expected to rise significantly at 34.71% annually over the next three years, surpassing the Chinese market's 25.1% rate. Despite revenue growth forecasted at 15.4%, below the ambitious 20% benchmark, profit margins have contracted from 12.4% to 3.9%. The company faces challenges with debt coverage and dividend sustainability; however, insider ownership remains stable without recent significant trading activity.

- Navigate through the intricacies of Beijing Originwater Technology with our comprehensive analyst estimates report here.

- Our valuation report here indicates Beijing Originwater Technology may be overvalued.

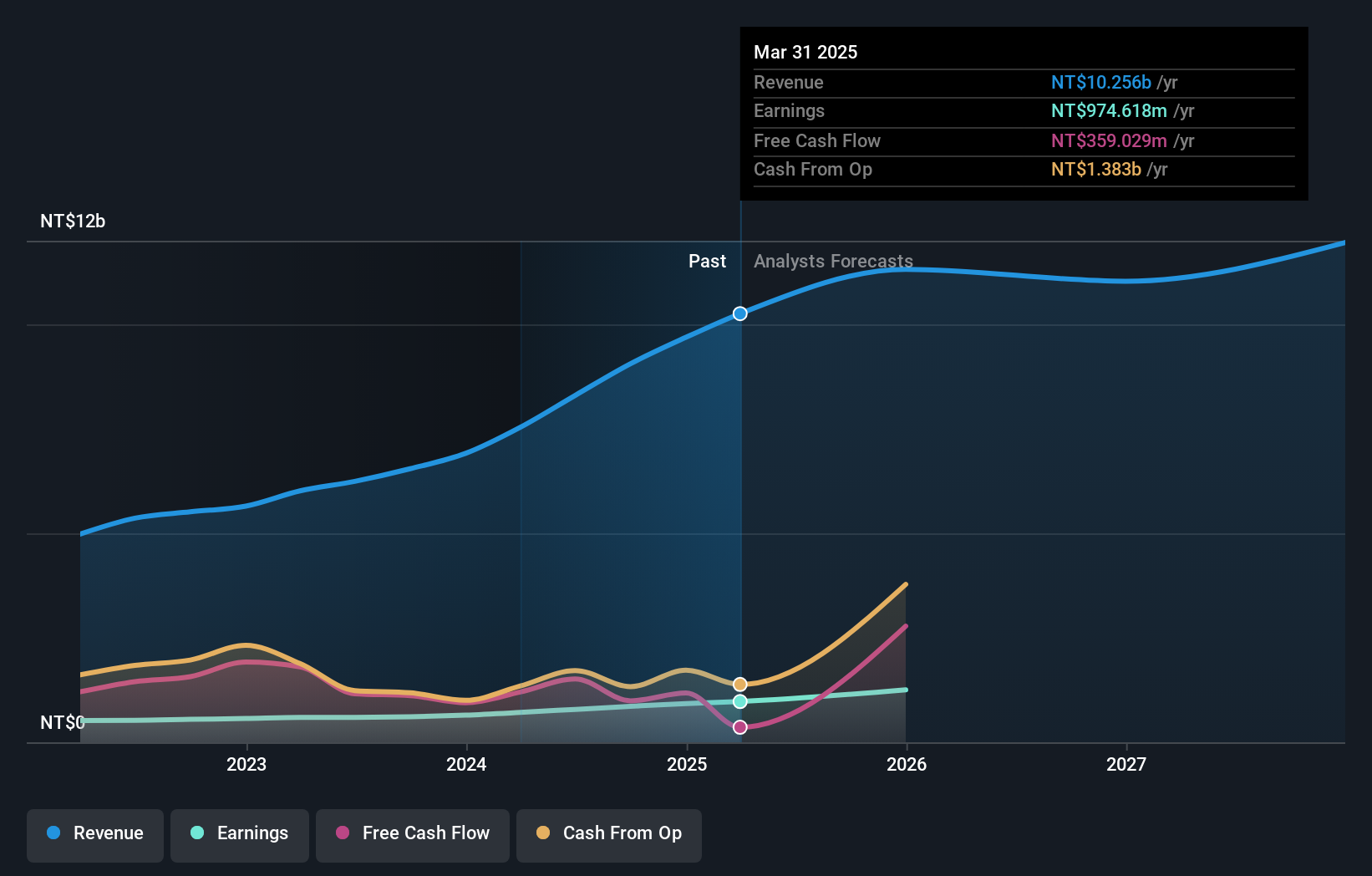

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$28.28 billion.

Operations: The company's revenue is derived from two segments: Brokerage, contributing NT$6.01 billion, and Manufacturing, accounting for NT$3.10 billion.

Insider Ownership: 31.3%

Scientech demonstrates robust growth potential, with earnings projected to increase 50.4% annually, outpacing the TW market's 17.9%. Revenue is also expected to grow significantly at 20.3% per year. The company's return on equity is forecasted to reach a high of 26.9% in three years, indicating efficient profit generation relative to shareholder equity. Recent board discussions on acquiring securities suggest strategic expansion plans, while insider ownership remains consistent without notable trading activity recently.

- Unlock comprehensive insights into our analysis of Scientech stock in this growth report.

- Our comprehensive valuation report raises the possibility that Scientech is priced higher than what may be justified by its financials.

Next Steps

- Dive into all 1463 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121600

Advanced Nano Products

Manufactures and sells high-tech materials, such as displays, semiconductors, secondary batteries, and solar cells in South Korea and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives