- South Korea

- /

- Chemicals

- /

- KOSDAQ:A114630

POLARIS UNO's (KOSDAQ:114630) Weak Earnings May Only Reveal A Part Of The Whole Picture

POLARIS UNO, Inc.'s (KOSDAQ:114630) recent weak earnings report didn't cause a big stock movement. However, we believe that investors should be aware of some underlying factors which may be of concern.

View our latest analysis for POLARIS UNO

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. POLARIS UNO expanded the number of shares on issue by 23% over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out POLARIS UNO's historical EPS growth by clicking on this link.

A Look At The Impact Of POLARIS UNO's Dilution On Its Earnings Per Share (EPS)

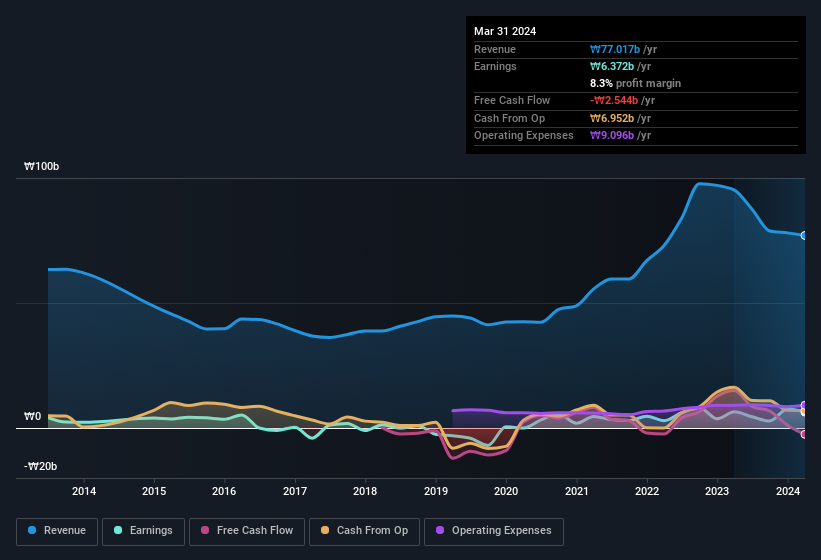

POLARIS UNO has improved its profit over the last three years, with an annualized gain of 38% in that time. In comparison, earnings per share only gained 12% over the same period. Net income was down 2.5% over the last twelve months. But the EPS result was even worse, with the company recording a decline of 16%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, if POLARIS UNO's earnings per share can increase, then the share price should too. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of POLARIS UNO.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that POLARIS UNO's profit was boosted by unusual items worth ₩1.1b in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On POLARIS UNO's Profit Performance

To sum it all up, POLARIS UNO got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue POLARIS UNO's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into POLARIS UNO, you'd also look into what risks it is currently facing. Case in point: We've spotted 2 warning signs for POLARIS UNO you should be aware of.

Our examination of POLARIS UNO has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A114630

POLARIS UNO

Engages in the synthetic fiber and chemical businesses in South Korea, China, Africa, Indonesia, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion