- South Korea

- /

- Chemicals

- /

- KOSDAQ:A104830

WONIK MaterialsLtd (KOSDAQ:104830) Shareholders Booked A 21% Gain In The Last Year

We believe investing is smart because history shows that stock markets go higher in the long term. But if you choose that path, you're going to buy some stocks that fall short of the market. For example, the WONIK Materials Co.,Ltd. (KOSDAQ:104830), share price is up over the last year, but its gain of 21% trails the market return. Unfortunately the longer term returns are not so good, with the stock falling 9.6% in the last three years.

See our latest analysis for WONIK MaterialsLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, WONIK MaterialsLtd actually shrank its EPS by 9.5%.

So we don't think that investors are paying too much attention to EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We doubt the modest 0.5% dividend yield is doing much to support the share price. We think that the revenue growth of 18% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

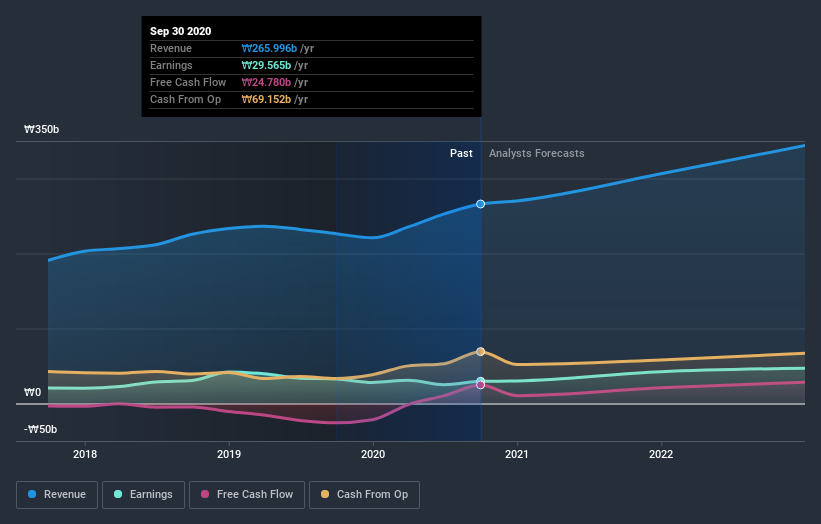

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

WONIK MaterialsLtd provided a TSR of 22% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 1.2% over half a decade This suggests the company might be improving over time. Before forming an opinion on WONIK MaterialsLtd you might want to consider these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you decide to trade WONIK MaterialsLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WONIK MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSDAQ:A104830

WONIK MaterialsLtd

Manufactures and sells specialty gases in South Korea, China, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives