- South Korea

- /

- Chemicals

- /

- KOSDAQ:A104830

WONIK Materials Co.,Ltd. (KOSDAQ:104830) Might Not Be As Mispriced As It Looks

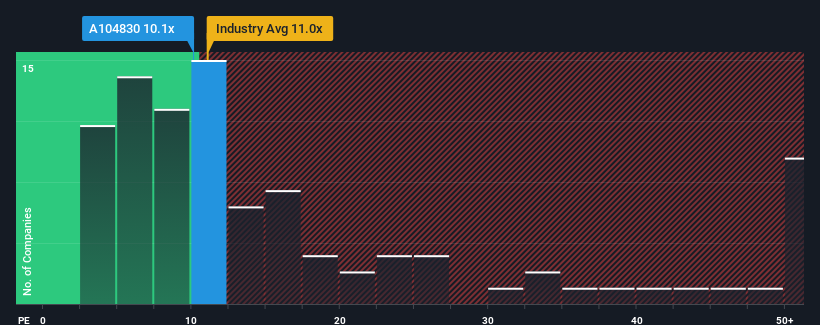

WONIK Materials Co.,Ltd.'s (KOSDAQ:104830) price-to-earnings (or "P/E") ratio of 10.1x might make it look like a buy right now compared to the market in Korea, where around half of the companies have P/E ratios above 13x and even P/E's above 26x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for WONIK MaterialsLtd as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for WONIK MaterialsLtd

Does Growth Match The Low P/E?

In order to justify its P/E ratio, WONIK MaterialsLtd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 48% gain to the company's bottom line. Still, incredibly EPS has fallen 50% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 50% as estimated by the dual analysts watching the company. With the market only predicted to deliver 28%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that WONIK MaterialsLtd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of WONIK MaterialsLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for WONIK MaterialsLtd that we have uncovered.

If you're unsure about the strength of WONIK MaterialsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if WONIK MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A104830

WONIK MaterialsLtd

Manufactures and sells specialty gases in South Korea, China, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives