- South Korea

- /

- Chemicals

- /

- KOSDAQ:A104830

Take Care Before Jumping Onto WONIK Materials Co.,Ltd. (KOSDAQ:104830) Even Though It's 25% Cheaper

To the annoyance of some shareholders, WONIK Materials Co.,Ltd. (KOSDAQ:104830) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 36% in that time.

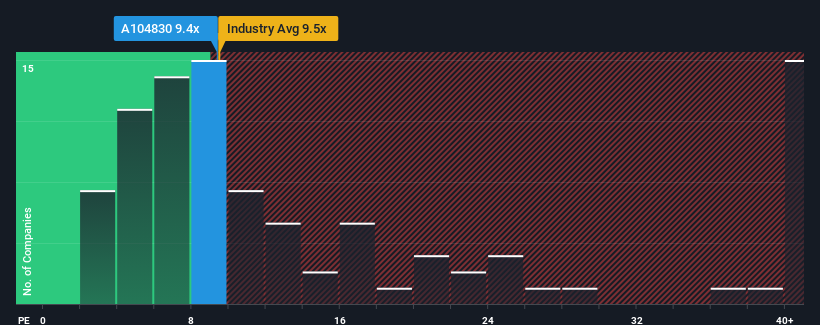

In spite of the heavy fall in price, it's still not a stretch to say that WONIK MaterialsLtd's price-to-earnings (or "P/E") ratio of 9.4x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

WONIK MaterialsLtd hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for WONIK MaterialsLtd

Is There Some Growth For WONIK MaterialsLtd?

The only time you'd be comfortable seeing a P/E like WONIK MaterialsLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 34%. This means it has also seen a slide in earnings over the longer-term as EPS is down 58% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 32% per year during the coming three years according to the three analysts following the company. With the market only predicted to deliver 15% per annum, the company is positioned for a stronger earnings result.

With this information, we find it interesting that WONIK MaterialsLtd is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Following WONIK MaterialsLtd's share price tumble, its P/E is now hanging on to the median market P/E. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that WONIK MaterialsLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - WONIK MaterialsLtd has 1 warning sign we think you should be aware of.

You might be able to find a better investment than WONIK MaterialsLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if WONIK MaterialsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A104830

WONIK MaterialsLtd

Manufactures and sells specialty gases in South Korea, China, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives